Overview:

Staying up to date with the latest accounting standards is crucial to maintaining the trust of investors, stakeholders, and regulators. The recent update by the Financial Accounting Standard Board (FASB), Accounting Standards Update (ASU) 2023-05—Joint Venture Formations (Subtopic 805-60): Recognition and Initial Measurement, is a significant step toward bringing more clarity and specificity to the appropriate accounting for contributions made to a joint venture. The new ASU ensures that joint ventures measure their assets and liabilities at fair value on their formation date and provides specific disclosure requirements that enhance the credibility and reliability of financial reports.

Background and Scope

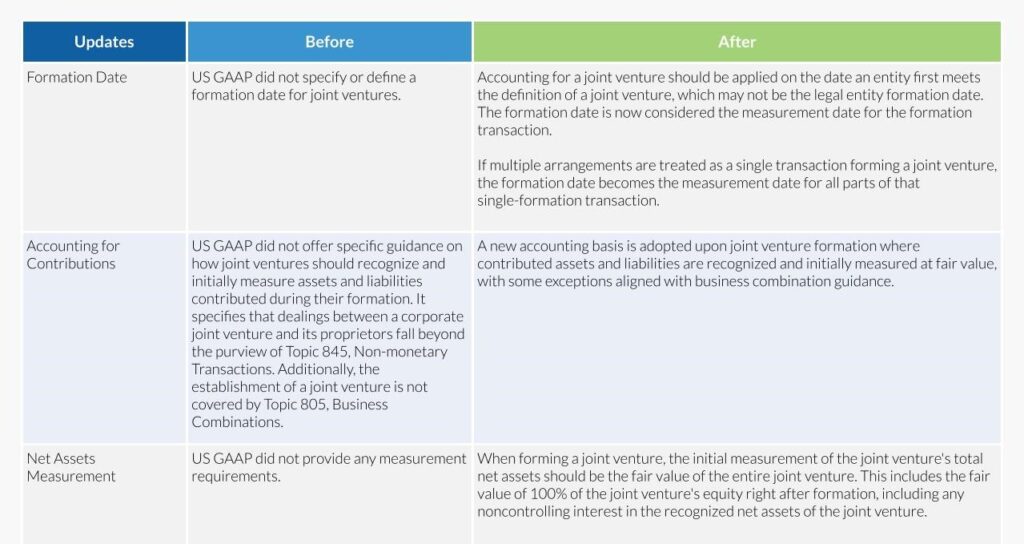

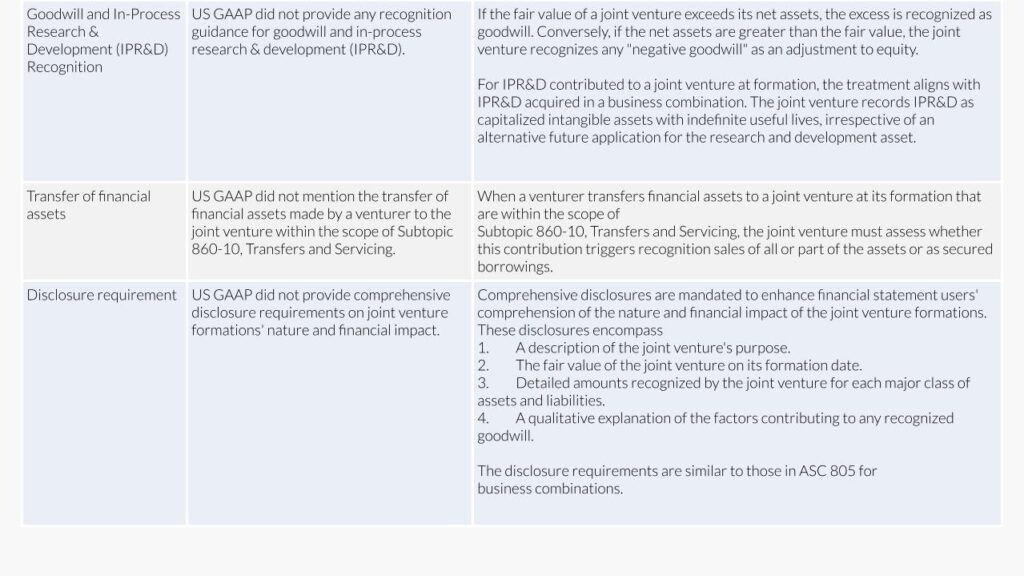

Before the issuance of ASU 2023-05, no authoritative guidance in US GAAP addressed how a joint venture should recognize contributions received at the formation date. This resulted in diversity in practice, with some joint ventures accounting for contributions received on a carryover basis and others at fair value. ASU 2023-05 aims to minimize variations in financial reporting practices and furnish users of joint venture financial statements with information that enhances decision-making.

When a joint venture is formed, ASU 2023-05 mandates the application of a new basis of accounting. Under the new guidance, none of the assets or businesses contributed to the joint venture are treated as independent entities; instead, they are viewed as transfers of net assets to a newly created entity that assumes control over them. The accounting approach involves applying elements of the acquisition method for business combinations tailored to the unique characteristics of joint ventures. ASU 2023-05 applies to all joint ventures, irrespective of whether they are formed by two or more parties or controlled by a single party. Additionally, it extends its application to all monetary and non-monetary contributions made to a joint venture at its formation date.

There were no changes in the definition of a joint venture as provided in the ASC master glossary. While the new update applies its accounting updates to all joint ventures, it does come with a few exceptions. Keep in mind that the update is not applicable in certain scenarios, such as:

1. Transactions between a joint venture and its owners other than the formation of a joint venture

2. Formations of entities determined to be not-for-profit entities

3. Combinations between entities, businesses, or nonprofit activities under common control

4. Entities in the construction or extractive industries that may be proportionately consolidated by any of their investor-venturers

5. Collaborative arrangements within the scope of Topic 808, except for any part of the arrangement conducted in a separate legal entity that meets the definition of a joint venture

ASU 2023-05 is effective for fiscal years beginning after December 15, 2024. These changes apply prospectively to joint ventures formed on or after January 1, 2025. Joint ventures established before January 1, 2025 can retroactively apply the amendments if they possess adequate information. Early adoption is allowed in any interim or annual period before the issuance of financial statements, either prospectively or retrospectively.

Implementation Considerations

Implementing the new accounting updates may significantly affect the financial statements of companies that form joint ventures. Thus, companies that form joint ventures should carefully consider the following implementation considerations:

● Developing new accounting policies and procedures: Companies may have to formulate new accounting policies and procedures to adhere to the stipulations outlined in ASU 2023-05. These policies and procedures should address the measurement of fair value, the allocation of fair value to individual assets and liabilities, and the disclosure requirements.

● Updating accounting systems: Companies may need to update their systems to comply with the standardized requirements. This may involve adding new data to existing documents or developing new reports.

● Training staff: Companies may also need to train their personnel to be adept at applying the provisions of the new accounting guidance.

Private companies forming joint ventures have the option to apply the accounting alternative for the recognition of identifiable intangible assets described in ASC 805-20-25. Under this method, customer-related intangible assets and non-competition agreements are not recognized separately from goodwill unless they can be independently sold or licensed. This approach also excludes contract assets and leases from being considered customer-related intangible assets. Additionally, if a joint venture chooses this simplified method, it must adopt the accounting alternative approach for amortizing goodwill outlined in ASC 350-20.

How Scrubbed can help

When it comes to navigating the complexities of a joint venture, having the right partner by your side can make all the difference. At Scrubbed, we understand the challenges of changing accounting standards, and we’re committed to providing you with the specialized expertise you need. Our team of professionals has the knowledge and experience to guide you seamlessly through the ASU 2023-05 updates.

We can provide the following assistance:

1. Expertise in Joint Ventures: Our seasoned professionals are well-versed in the latest accounting changes and updates.

2. Tailored Solutions: Each business and its accounting needs are unique. Scrubbed provides customized solutions to ensure that your joint venture accounting aligns with your business goals. Whether you’re managing complex partnerships or require real estate accounting solutions to support joint venture property investments, we deliver strategies designed to fit your operations.

3. Smooth Transition: We’ll guide you step-by-step, ensuring compliance without headaches.

4. Enhanced Transparency: Scrubbed helps you present your financial information in a clear, concise manner, seamlessly meeting the disclosure requirements. As part of our corporate finance advisory services, we ensure your reporting aligns with industry standards and provides stakeholders with the transparency they expect.

5. Efficiency and Timeliness: We value your time. Our efficient processes ensure that your joint venture accounting is accurate and delivered promptly, keeping you ahead of deadlines.

Contact Scrubbed Today!

Our Technical Accounting Group is ready to assist you in providing transparent and up-to-date financial reports. Our Corporate Finance Team provides expert guidance in valuing your assets at Fair Value, allowing you to make informed decisions. Together, we empower you to make strategic financial decisions and achieve your long-term goals. For a comprehensive assessment tailored to your specific needs, reach out to [email protected] . At Scrubbed, we go beyond consultancy; we’re your partner on the path to financial success.Disclaimer: The information contained herein is general and is not intended to address the circumstances of any particular individual or entity. It is not intended to be relied upon as accounting, tax, or other professional services. Please refer to your advisors for specific advice. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or will continue to be accurate. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation.