As the world’s fourth-largest economy, California has taken proactive steps to combat climate change by mandating firms within its jurisdiction to report greenhouse gas emissions and climate-related financial risks starting in 2025.

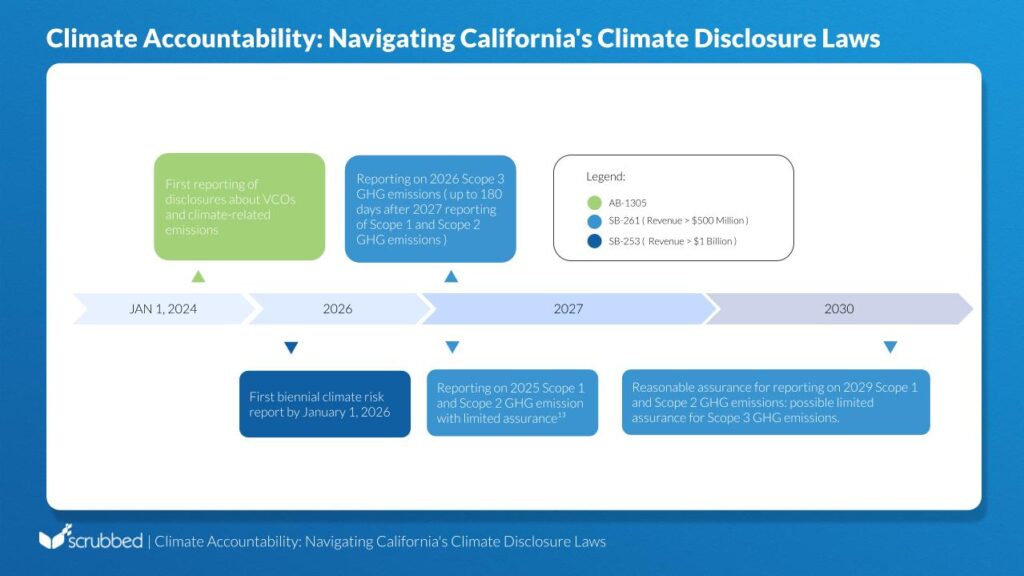

On October 7, 2023, Governor Gavin Newsom signed a groundbreaking climate disclosure law package including three key acts:

- California Corporate Data Accountability Act (SB 253)

- Climate-Related Financial Risk Act (SB 261)

- Voluntary Carbon Market Disclosures (AB 1305)

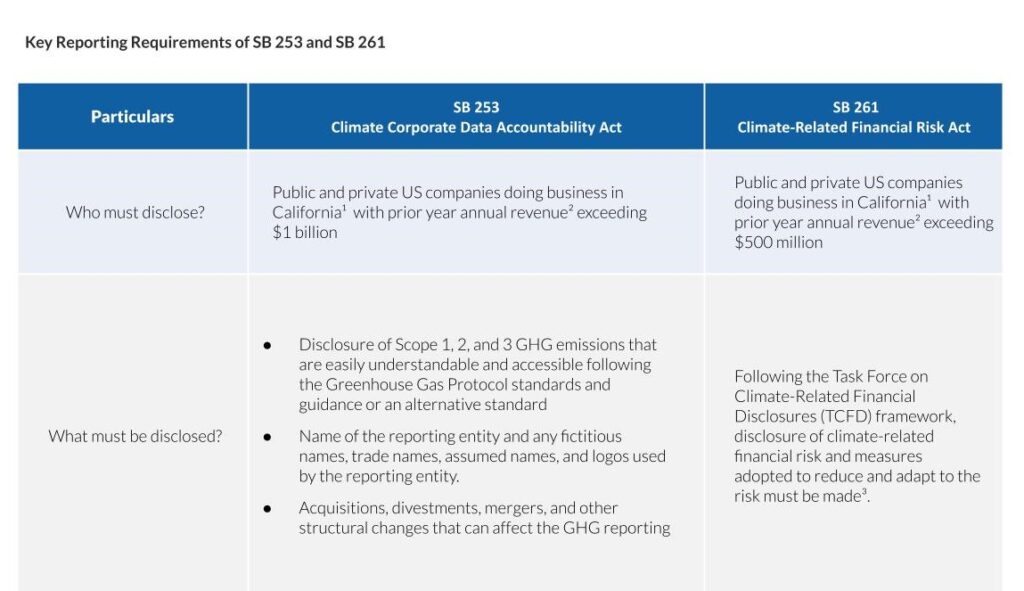

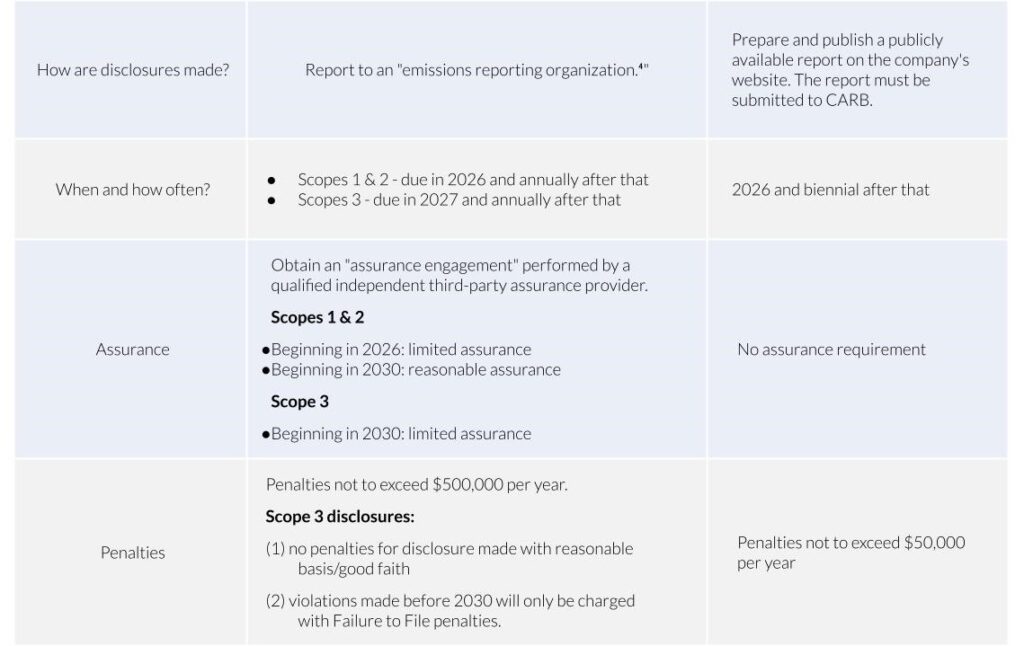

SB 253 and SB 261 are the first general regulations in the US requiring companies to report their greenhouse gas emissions and climate risks, while AB 1305 aims to prevent misleading claims about emissions, known as greenwashing. These laws mark a significant shift towards mandatory climate-related disclosure for companies operating in California.

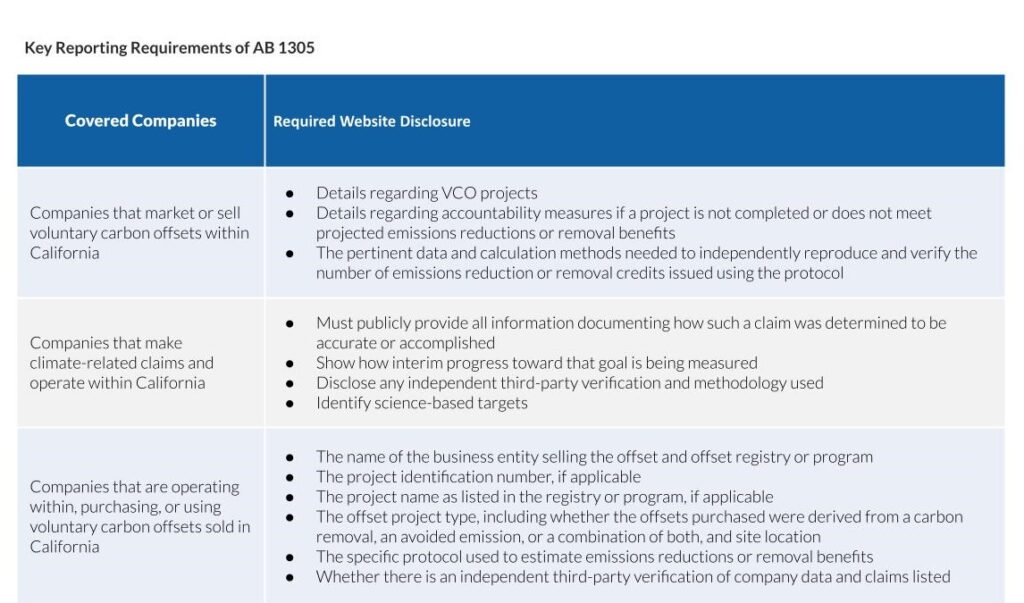

AB 1305 applies to all public and private firms, irrespective of revenue. Moreover, the disclosure mandated by AB 1305 must be prominently displayed on the company’s website and updated at least annually. Failure to do so may result in civil penalties of up to $2,500 per day per violation, not exceeding $500,000.

While AB 1305 is set to take effect on January 1, 2024, Mr. Jesse Gabriel, the bill’s author, has clarified the timing of disclosures. In a letter addressed to the Chief Clerk of the Assembly, Mr. Gabriel indicated that while the bill does not explicitly outline the timeline for initial disclosures, he intends for the first annual disclosure to be published no later than January 1, 2025.

1The term “doing business in California” is unclear in either bill. Further clarification regarding the definition of the term is expected in the future. However, it is defined by the State here.

2Revenues are not required to be earned exclusively in California.

3Note that a subsidiary is not required to prepare a separate climate-related financial risk report if consolidated reports are prepared. Furthermore, if a covered entity does not complete a report consistent with all required disclosures, the covered entity shall provide the recommended disclosures to the best of its ability, provide a detailed explanation for any reporting gaps, and describe steps the covered entity will take to prepare complete disclosures.

4A nonprofit emissions reporting organization contracted by the California Air Resources Board (CARB) to develop a reporting program to receive and make publicly available disclosures that has experience with GHG emissions disclosure.

Following the Greenhouse Gas Protocol standards, companies must start working on identifying their GHG emissions sources, selecting an appropriate calculation approach, collecting data and determining emission factors, investing in calculation tools, and rolling up the data to corporate and reporting levels.

SB 261 requires disclosures following the Task Force on Climate-related Financial Disclosures (TCFD) guidelines, which requires the disclosures of the following key matters:

• Governance

TCFD requires companies to describe their board’s oversight of climate-related risk and opportunities, including (a) the process and frequency the board is informed about climate-related issues, (b) whether climate-related issues are considered on board strategies and other business decisions, and (c) how the board monitors and oversees the process against goals and targets for addressing climate-related issues. Companies should also describe management’s role in assessing and managing climate-related risks and opportunities.

• Strategy

Disclosures should include information about a company’s climate-related risks and opportunities over the short, medium, and long term, describe its impact on the company’s businesses, strategy, and financial planning, and describe the resilience of the company’s strategy, considering different climate-related scenarios.

• Risk management

Companies should disclose their processes for identifying, assessing, and managing climate-related risks. This includes information on how the organization identifies and prioritizes climate-related risks, measures to mitigate them, and any associated financial implications.

• Metrics and targets

TCFD requires companies to disclose specific metrics and targets related to climate-related risks and opportunities. This may include GHG emissions, energy consumption, water usage, and other relevant indicators. Companies should also disclose any targets they have set to address these issues and their progress towards achieving them.

Preparing for New Disclosures

All firms operating in California must start incorporating climate considerations into governance, risk management, and strategy. Establishing a cross-functional task force can ease the burden of organizing the company around the extensive impacts of the laws, which includes comprehensive data collection from both internal and external sources.

Key initial steps to take include:

• Assessing and refining materiality determination: Once companies identify which law applies to them and review the required data, they need to shift their focus to relevant ESG topics, considering the needs of their internal and external stakeholders. Additionally, companies should evaluate their existing climate-specific or industry-specific disclosures, prepared under established standards and frameworks such as the GHG Protocol or TCFD, adapting them as necessary.

• Identifying gaps: Companies must review the new regulatory requirements and timelines to determine the necessary changes and evaluate existing preparedness. This information facilitates coordinated data requirements with relevant internal stakeholders and process owners, including the board and C-suite leaders.

• Evaluating processes, controls, and readiness: Entities can scrutinize their current internal control and data governance systems to assign roles and responsibilities for data ownership. Boards can develop oversight and top-down accountability mechanisms to support a controlled environment, enabling leaders to efficiently address climate, GHG disclosure, and control gaps. These measures can expedite ESG reporting within the Form 10-K filing timeline.

• Investing in education, upskilling, and action: Providing training and other learning opportunities for the board and executive levels enhances the organizational capabilities necessary for assurance preparedness. Networking with relevant stakeholders, such as financial reporting and sustainability teams, can aid in drafting and finalizing disclosures related to climate and ESG emissions.

How Scrubbed Can Help

Given the comprehensive scope and timing considerations of the bills, planning for ESG regulation compliance now is a must. Establishing a multidisciplinary team comprising seasoned experts proficient in ESG accounting and regulatory nuances is necessary to help your company speed up aggregating, structuring, and formulating the required reporting protocols. Reach out to Scrubbed today to harness the specialized expertise of our ESG professionals. Let us streamline your organization’s compliance journey and propel it toward seamless adherence to regulatory mandates.

Disclaimer: The information contained herein is general and is not intended to address the circumstances of any particular individual or entity. It is not intended to be relied upon as accounting, tax, or other professional services. Please refer to your advisors for specific advice. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation.

*Disclaimer: Services being offered do not require a state license.

**Special thanks to Sharole Gay Hael for her valuable contribution to this article.