Attracting new customers sets the pace for expansion, but retaining them keeps the ball rolling. With growing competition in the retail market , building customer loyalty is one way for retail companies to stay top of mind for consumers. Hence, the need for Customer Loyalty Programs (CLPs).

As CLPs progressed, numerous strategic variations arose to meet and fit customer preferences including Points-based, Tiered, Value-based, Gaming, and Cash-back Programs. Some well-known examples are:

1. Starbucks Rewards Program

This rewards program is an example of a Gaming CLP. For every dollar spent, the customers earn “stars,” which, when accumulated, can, be redeemed for an extra cup of coffee, a slice of cake, or even exclusive coffee merch.

2. The North Face XPLR Pass

Formerly known as the VIPeak, this program is an example of the Point-based CLP, which grants customers 1 point for every $1 spent online or in-store. For every 100 points accumulated, the customer gets a $10 reward to use on the gear they love.

CLPs are not stand-alone, they are complementary to sales, which is why they also affect how we account for revenues following the 5-step revenue recognition model required under ASC 606.

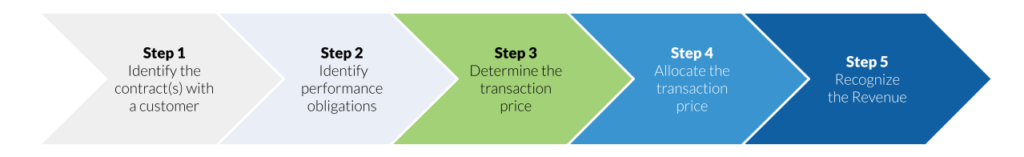

The Revenue 5-step Model of ASC 606

The core principle of ASC 606 is that revenue recognition must depict the transfer of the promised goods or services to the customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. To address this core principle, ASC 606 requires companies to follow the five (5) steps model shown in the diagram below:

Implementation of CLPs significantly affects a company’s revenue recognition process, particularly steps 2, 4, and 5 above.

Step 2: Identify The Performance Obligations

Performance obligations are promises to transfer distinct goods and services to the customers. Under ASC 606-10-25-19, goods and services are distinct only if: (1) They are capable of being distinct, the benefit from them can either be on their own or together with other readily available resources; and (2) the goods or services within the context of the contract, are distinct, which means the company’s promise to transfer these to the customers is separately identifiable from other promises in the contract.

Establishing CLPs means granting customers the right to acquire free or discounted goods or services in the future, giving rise to two obligations (1) The delivery of the goods or services promised; and (2) The future fulfillment of the rights granted.. In the case of CLPs, ASC 606 requires that for this right to give rise to a performance obligation, the CLP should provide a material right to the customer, and the customer would not have received such right without entering into that contract. If the rights granted qualify, considerations received for these sales must be allocated to these obligations,

The standard does not specify the qualifications or the definition of material rights. However, ASC 606-10-55-43 specifies that if the customers’ rights to acquire future goods or services would be at a price equivalent to the stand-alone selling price of those goods or services, then these rights do not provide the customers with a material right, even if these rights can be exercised only by entering into that contract.

Step 4: Allocate the transaction price

ASC 606 requires companies to allocate the transaction price to all the identified performance obligations in the contract, including the customers’ rights for additional goods or services under CLPs, provided these rights have passed the “material right” assessment under Step 2. Moreover, the standard requires that the transaction price be allocated based on the stand-alone selling prices of the goods or services provided to the customers.

As defined, a stand-alone selling price is the price at which a company sells a promised good or service separately to a customer. In the case of CLPs, should the stand-alone selling price not be observable, ASC 606-10-55-44 requires companies to make sound estimations and adjust such estimates for both of the following:

- Discounts that customers could receive without exercising the right

- The likelihood that the right will be exercised.

Step 5: Recognize the revenue

The amount of transaction price allocated to the rights under CLPs is, in effect, an advance payment from customers for their future purchase of goods or services. Therefore, the price allocated to these rights is initially recognized as a contract liability and will later be recognized as revenue when the performance obligation to deliver additional goods or services underlying the rights is fulfilled.

To sum up, revenue from the rights shall be recognized when the customers exercise these rights and the Company delivers the goods or services. However, there may be instances when customers do not exercise all the rights granted. Thus, the concept of “Breakage” comes in.

Breakage

Breakage refers to unexercised rights that have lapsed or expired. ASC 606-10-55-48 states that if a company expects to be entitled to a breakage in a contract liability, the company should recognize the expected breakage amount as revenue based on a historical pattern of rights exercised by customers. In the case of CLPs, a company’s estimated breakage is considered as early as Step 4. As you may recall, ASC 606-10-55-44 requires entities to adjust their stand-alone selling price estimate considering the likelihood that the right will be exercised. For example, suppose a company expects that 80% of the points granted will be redeemed. In that case, the remaining 20% will be the initially estimated breakage and will be recognized as part of revenue. Revenue recognition for the breakage follows the pattern of the rights exercised or redeemed by the customers.

Companies are required to reassess their breakage estimate every reporting period. Say, if as a result of the reassessment there is an increase from the initial assessed probability of exercise, this increase in estimate shall be accounted for as an additional liability. It should be noted that any changes in the estimate should be accounted for prospectively, and the original stand-alone selling price allocated to the rights should not be adjusted.

Moreover, ASC 606-10-55-44 also states that if a company does not expect to be entitled to a breakage, the company should recognize the expected breakage amount as revenue only when the likelihood of exercising the remaining rights becomes remote. To determine whether the company expects to be entitled to a breakage amount, the company should consider the guidance on constraining estimates of variable consideration.

Constraining Estimates of Variable Consideration

The transaction price shall include some or all of an amount of variable consideration estimated using either of the methods mentioned in ASC 606-10-32-8: expected value or most likely amount. However, the inclusion shall only be to the extent that it is probable that a significant reversal in the cumulative amount of recognized revenue will not occur when the uncertainty associated with the variable consideration is subsequently resolved. In assessing this probability, the reversal’s likelihood and magnitude shall be considered.

Presentation in the Statement of Financial Position

It is noteworthy that although the standard uses the term ‘contract liability’, ASC 606 does not prohibit companies from using alternative descriptions in the statement of financial position (i.e., Loyalty program liability). However, for discussion purposes, the term ‘contract liability’ is used in this article.

At the end of each reporting period, the company should assess and identify the amount of customer rights that will be presented as current and noncurrent contract liability in the Statement of Financial Position. The current portion of the contract liability should represent the estimated amount of customer rights that company expects to recognize as revenue in the next 12 months. The amount of customer rights expected to be recognized as revenue in the periods thereafter should be presented as part of the noncurrent contract liability.

How Scrubbed can help

Establishing an effective Customer Loyalty Program (CLP) does not end with building customer loyalty and driving increased revenue. It requires diligent application of accounting considerations to ensure that you get both financial success and accurate reporting.. Failure to properly account for and consider all aspects of CLPs can result in inaccurate financial records, which may influence stakeholder decision-making. Scrubbed is here to help you put your mind at ease as we assist you in the following matters: (a) Qualification of CLP rights as performance obligations based on the principle of material rights (b) Proper allocation of the transaction price to CLP rights (c) Timing of the revenue recognition (d) Accounting for breakage and estimates (e) Accounting for subsequent measurement of contact liability (f) Proper financial presentation of CLP rights Contact Scrubbed to learn how our Technical Accounting experts can help your company account for your Customer Loyalty Programs the right way.Disclaimer: The information contained herein is general and is not intended to address the circumstances of any particular individual or entity. It is not intended to be relied upon as accounting, tax, or other professional services. Please refer to your advisors for specific advice. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation.

*Disclaimer: Services being offered do not require a state license.

*Special thanks to Gonna Mae Bacla-an for her valuable contributions to this article.