The global landscape of income tax has become increasingly complex, with multinational corporations facing a growing web of tax regulations across different jurisdictions. For investors, this complexity translates into a need for more transparency, making it difficult to assess a company’s tax risks and exposures. The need for more detailed income tax disclosures has become critical, prompting regulatory bodies to take action.

In response to these challenges, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2023-09 on December 14, 2023. This update aims to enhance the clarity and usefulness of income tax disclosures, ensuring that investors have the information necessary to make informed decisions. The key changes introduced include more rigorous requirements for effective tax rate reconciliation, disclosure of income taxes paid across various jurisdictions, replacing Public Entities with Public Business Entities (PBEs) throughout the ASU, and the removal of certain disclosure requirements.

Complying with these new disclosure requirements is essential to ensure transparent financial reporting and avoid potential penalties from regulatory bodies or auditors for inadequate or misleading disclosures. Adhering to ASU 2023-09 helps maintain compliance and minimizes the risk of legal or financial challenges due to insufficient disclosure.

What are the key changes to income tax disclosures?

The new income tax disclosure requirements affect the presentation and disclosure of a financial statement’s income tax information. These include changes in the effective rate reconciliation in the notes, accompanied by certain additional disclosure requirements, and an entity’s income taxes paid information

Effective Rate Reconciliation

Under ASU 2023-09, PBEs are now required to provide a more comprehensive reconciliation of the effective tax rate. This includes:

- Detailed Reconciliation: Entities must provide a tabular reconciliation of the effective tax rate, requiring the presentation of reconciling items in both amounts and percentages. Reconciling items must be separately presented and disclosed if they equal or exceed 5% of the product of pre-tax income (loss) from continuing operations and the statutory tax rate.

- Categories of Reconciliation: The reconciliation must be broken down into specific categories, such as state and local income tax effects, foreign tax effects, tax credits, and changes in tax laws or rates. Each category must be detailed by nature and, in the case of foreign tax effects, by jurisdiction.

Comparison with Existing Disclosure:

- Before ASU 2023-09: Previously, entities were required to disclose reconciling items either in amounts or percentages, with a general guideline to disclose items affecting the effective tax rate. The disclosure was less detailed, and there was no specific guidance on disaggregation thresholds or categories.

- After ASU 2023-09: The new requirements mandate a more granular approach. For instance, entities must now:

- Include a tabular presentation of reconciling items in both percentages and amounts.

- Disclose reconciling items impacting the rate by 1.05% or more (assuming a statutory tax rate of 21%) with detailed categories and disaggregation.

Reconciling items means equal to or more than 5% of the amount computed by multiplying the pre-tax income by the statutory tax rate.

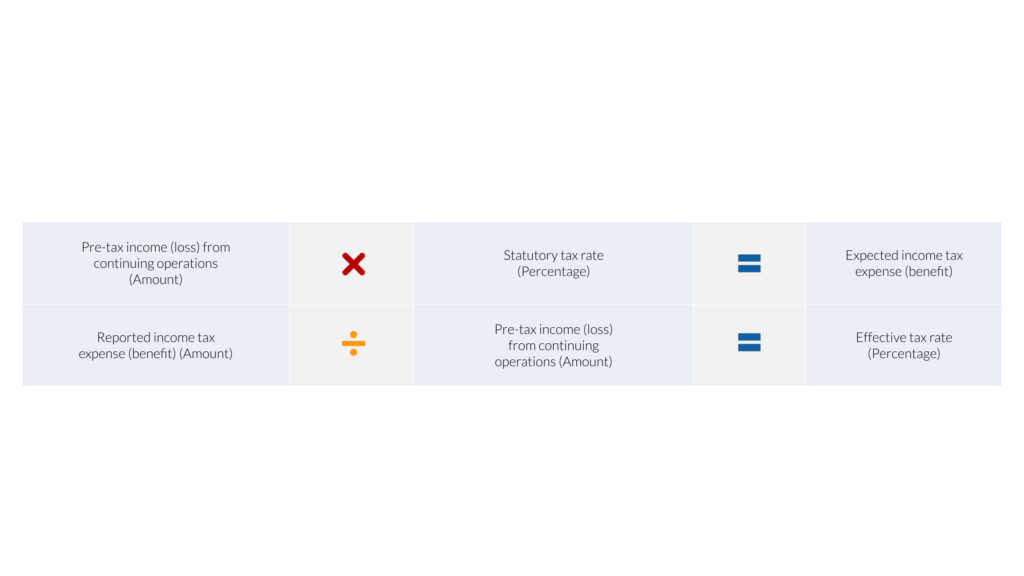

A tabular reconciliation must be between the following amounts and related rates for each annual reporting period.

Illustrative Examples of Income Tax Reconciliation Disclosure:

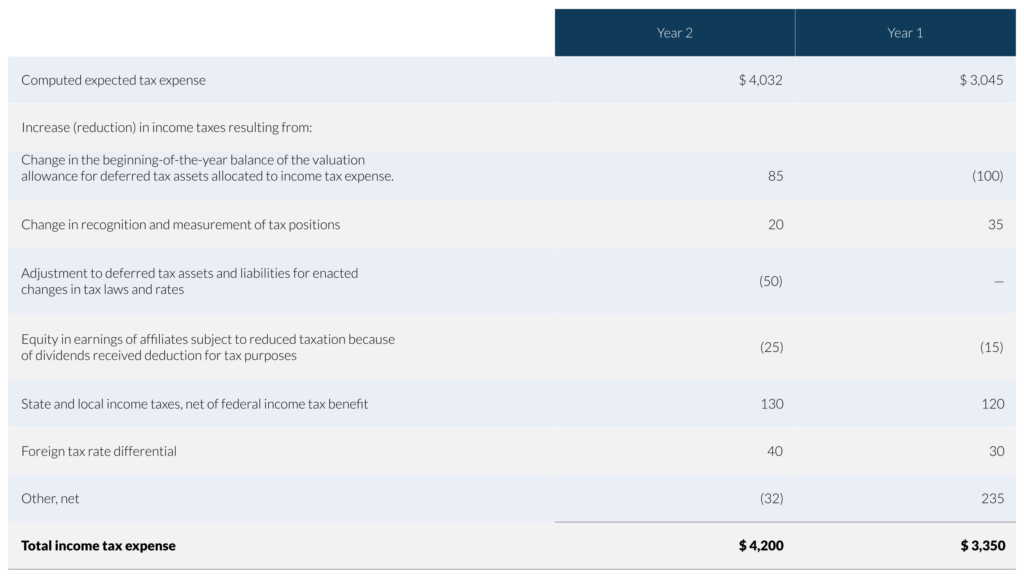

Before ASU 2023-09:

Income tax expense attributable to income from continuing operations was $4,200 and $3,350 for the years ended December 31, 2024 and 2023, respectively. It differed from the amounts computed by applying the statutory U.S. federal income tax rate of 21% to pre-tax income from continuing operations as a result of the following:

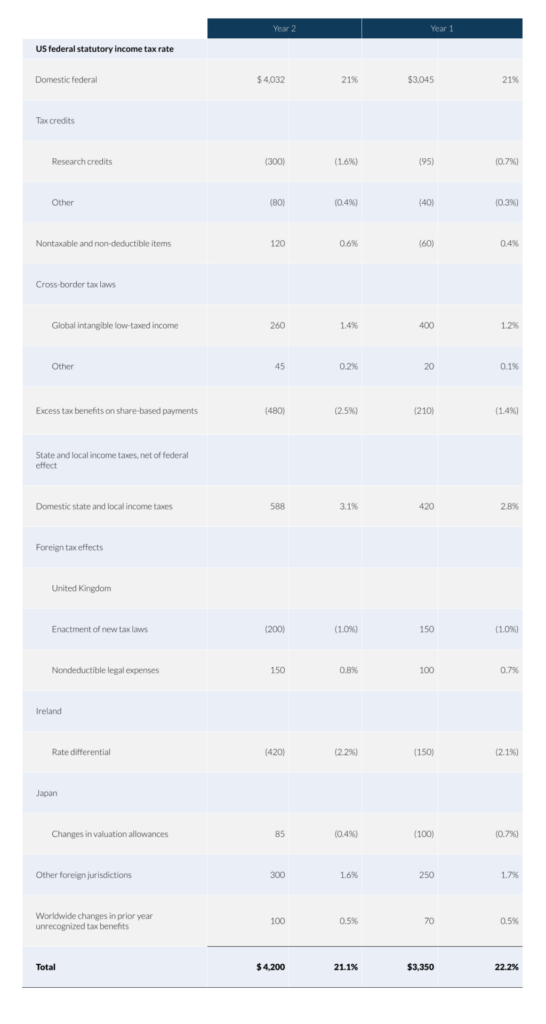

After ASU 2023-09:

Income tax expense attributable to income from continuing operations was $4,200 and $3,350 for the years ended December 31, 2024 and 2023, respectively. It differed from the amounts computed by applying the statutory U.S. federal income tax rate of 21% to pre-tax income from continuing operations as a result of the following:

Disclosure Requirements

- Required Categories:

-

-

The tabular rate reconciliation must include both percentages and amounts in the applicable reporting currency for the following categories:

-

A. State and local income tax, net of federal (national) income tax effect.

B. Foreign tax effects.

C. Effect of changes in tax laws or rates enacted during the period.

D. Effect of cross-border tax laws.

E. Tax credits.

F. Changes in valuation allowances.

G. Nontaxable or non-deductible items.

H. Changes in unrecognized tax benefits.

2. Disaggregation of Reconciling Items:

- Reconciling items affecting the rate by 5% or more of the amount computed by multiplying pre-tax income (loss) from continuing operations by the statutory rate must be disclosed separately.

A. Disaggregation by nature is required for items within categories such as cross-border tax laws, tax credits, or nontaxable/non-deductible items.

B. For foreign tax effects, disaggregation by jurisdiction (country) and by nature is required, except for changes in unrecognized tax benefits.

C. Disaggregation by nature is required for items not falling into the above categories.

3. Categorization Guidelines:

- State and local income tax should reflect taxes imposed at the state or local level within the domicile jurisdiction.

- Foreign tax effects should reflect taxes imposed by foreign jurisdictions.

- Other categories should reflect federal (national) taxes imposed by the domicile jurisdiction.

4. Presentation of Reconciling Items:

- Reconciling items must generally be presented on a gross basis. However, unrecognized tax benefits and certain cross-border tax law effects, including related tax credits, may be presented on a net basis.

- Changes in unrecognized tax benefits may be disclosed on an aggregated basis across all jurisdictions.

Additional Requirements:

- For the state and local category, a PBE must provide a qualitative description of the states and local jurisdictions that constitute the majority (greater than 50 percent) of the effect.

For Non-PBEs, a qualitative disclosure is required for specific categories of reconciling items and individual jurisdictions that lead to significant differences between the statutory and effective tax rates.

Removed Disclosures:

1. The nature and estimate of the range of reasonably possible increases or decreases in the unrecognized tax benefits balance in the next 12 months, or to make a statement that an estimate of the range cannot be made

- Removal of this disclosure was based on feedback on the earlier exposure drafts that the amount is difficult to reliably predict and therefore may not provide meaningful information to investors.

2. The cumulative amount of each type of temporary difference when a deferred tax liability is not recognized because of the exceptions to comprehensive recognition of deferred taxes related to undistributed earnings of subsidiaries and corporate joint ventures.

- Removal of this disclosure was based on feedback on the earlier exposure drafts that the disclosure is costly to prepare and significantly less relevant after considering the effects of the Tax Cuts and Jobs Act.

Income Taxes Paid

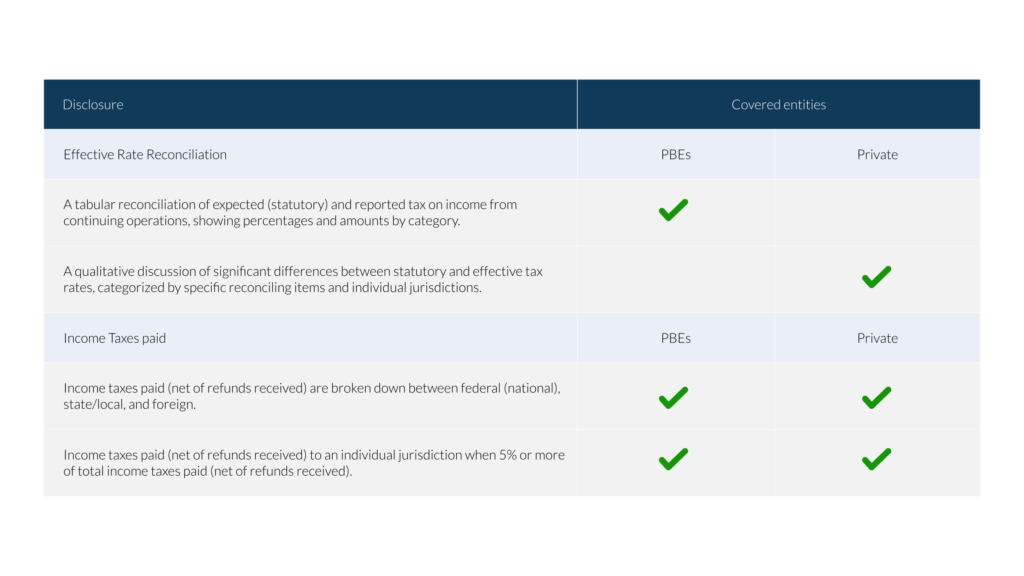

The ASU requires that all entities disclose on an annual basis the following information about income taxes paid:

- The income taxes paid (net of refunds received) are disaggregated by federal (national), state, and foreign taxes.

- The amount of income taxes paid (net of refunds received) disaggregated by individual jurisdictions in which income taxes paid (net of refunds received) is equal to or greater than 5% of total income taxes paid (net of refunds received).

The 5% threshold is evaluated using the absolute value of the net refund or net payment in each jurisdiction compared to the total income taxes paid (net of refunds received).

Who must comply with the New Income Tax Disclosures?

The amendments introduced in ASU 2023-09 apply to all entities subject to income taxes, with some mandated disclosures applicable only to PBEs. ASU 2023-09 was made to follow the definition introduced in 2013-12 regarding Public Business Entities and Public Entity.

Public Business Entity

A public business entity is a business entity meeting any one of the criteria below. Neither a not-for-profit entity nor an employee benefit plan is a business entity.

A. It is required by the U.S. Securities and Exchange Commission (SEC) to file or furnish financial statements, or does file or furnish financial statements (including voluntary filers), with the SEC (including other entities whose financial statements or financial information are required to be or are included in a filing).

B. It is required by the Securities Exchange Act of 1934 (the Act), as amended, or rules or regulations promulgated under the Act, to file or furnish financial statements with a regulatory agency other than the SEC.

C. It is required to file or furnish financial statements with a foreign or domestic regulatory agency in preparation for the sale of or for purposes of issuing securities that are not subject to contractual restrictions on transfer.

E. It has issued, or is a conduit bond obligor for, securities that are traded, listed, or quoted on an exchange or an over-the-counter market.

F. It has one or more securities that are not subject to contractual restrictions on transfer, and it is required by law, contract, or regulation to prepare U.S. GAAP financial statements (including footnotes) and make them publicly available on a periodic basis (for example, interim or annual periods). An entity must meet both of these conditions to meet this criterion.

An entity may meet the definition of a public business entity solely because its financial statements or financial information is included in another entity’s filing with the SEC. In that case, the entity is only a public business entity for purposes of financial statements that are filed or furnished with the SEC.

The following is a checklist on which disclosure applies to covered entities:

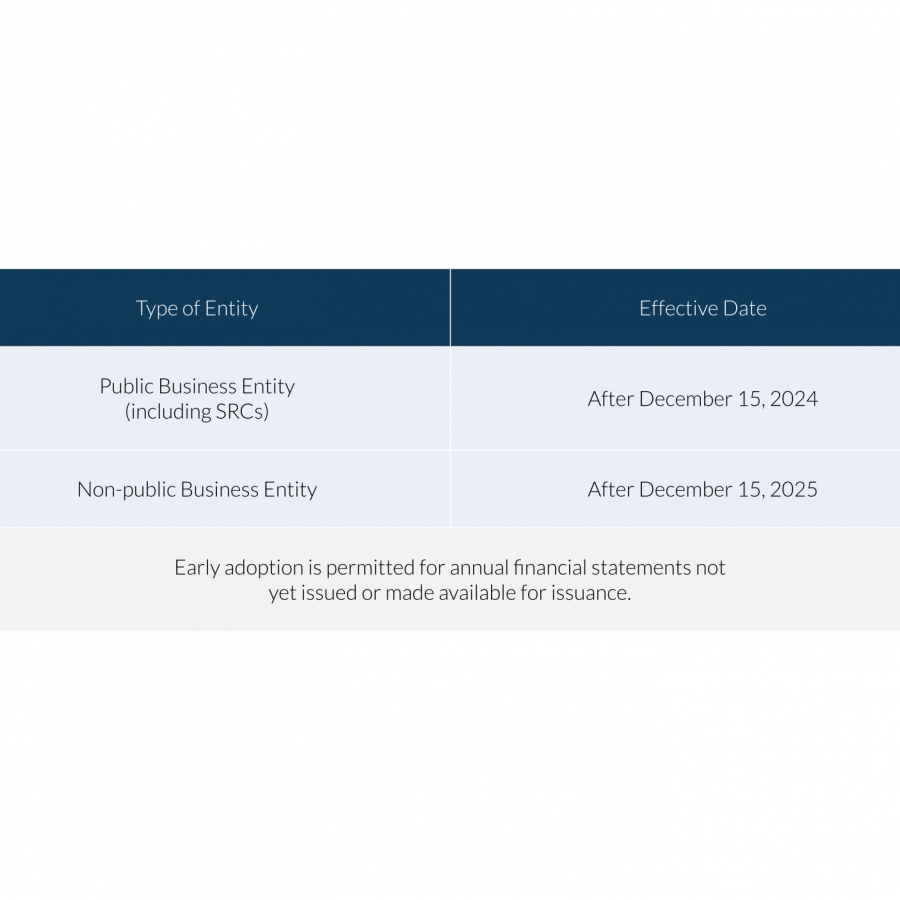

When Must Reporting Companies Start Complying with the New Income Tax Disclosures?

Why is Compliance with ASU 2023-09 Essential?

ASU 2023-09 introduces key updates to income tax disclosures driven by the need for enhanced transparency and regulatory alignment. The detailed reconciliation of effective tax rates and disclosure of income taxes paid is crucial for investors to accurately assess tax risks and exposures. Compliance with these requirements aligns with updated regulatory standards and provides stakeholders with a clearer view of the company’s tax position. By adhering to ASU 2023-09, companies can avoid regulatory penalties, improve financial reporting quality, and support better comparability across entities.

How Scrubbed can help?

When navigating the complexities of income tax disclosures, having the right partner by your side can make all the difference. At Scrubbed, we understand the challenges of adapting to the dynamic world of accounting standards. Our team is committed to providing the specialized technical accounting support you need to succeed, particularly in collaboration with our dedicated tax team. Together, we ensure a seamless transition through the ASU 2023-09 updates, providing you with the support and resources needed to make informed, compliant decisions.

Beyond corporate disclosures, we also help organizations strengthen areas such as nonprofit financial reporting, ensuring transparency, compliance, and accountability across all reporting requirements.

Contact Scrubbed Today!

Our Technical Accounting Group is ready to assist you in providing transparent and up-to-date financial reports. We empower you to make strategic financial decisions and achieve your long-term goals. For a comprehensive consultancy assessment tailored to your specific needs, contact [email protected].

At Scrubbed, we go beyond consultancy; we’re your partner on the path to financial success.

Disclaimer: The information contained herein is general and is not intended to address the circumstances of any particular individual or entity. It is not intended to be relied upon as accounting, tax, or other professional services. Please refer to your advisors for specific advice. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or will continue to be accurate. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation.

Contact us for a free consultation today.