Today, the stakes for M&A are higher than ever, and so is the amount of data involved in every deal. In the past, due diligence often meant combing through financial reports and working with spreadsheets by hand. But with the amount and complexity of business data today, that approach is no longer enough.

This is where data analytics plays a critical role. It gives deal teams the ability to move faster, uncover risks and opportunities, and make more informed decisions. In fact, Deloitte reports that around 97% of corporate and private equity leaders are now using advanced analytics or AI to strengthen their approach to due diligence and M&A decision-making.

With that in mind, let’s explore how data analytics is reshaping M&A due diligence and why it’s becoming a necessity for companies that want to gain an edge in a competitive market.

The Role Due Diligence Plays in M&A

Due diligence is the foundation of every M&A deal. It provides buyers with the insights they need to make sound decisions and helps reduce the chances of costly surprises after the transaction closes. At its core, due diligence assesses the financial health, operational performance, legal risks, and market position of the company being acquired.

What’s changing is how this work gets done. Instead of relying solely on manual data gathering and spreadsheet analysis, deal teams are now turning to advanced analytics to dig deeper and cover more ground in less time. For dealmakers, analytics is no longer a “nice to have” but has become an essential part of the process.

This shift is happening for a good reason. EY’s 2024 Technology Corporate Development Survey found that almost two thirds of acquisitions don’t meet most of their pre-deal KPI goals. This reinforces the need for stronger, data-driven diligence that can flag risks earlier and help buyers set more realistic expectations about the value they can capture from a deal.

Data Analytics and Due Diligence

Data analytics can enhance due diligence through its use of advanced tools and techniques making analyses much faster and more efficient.

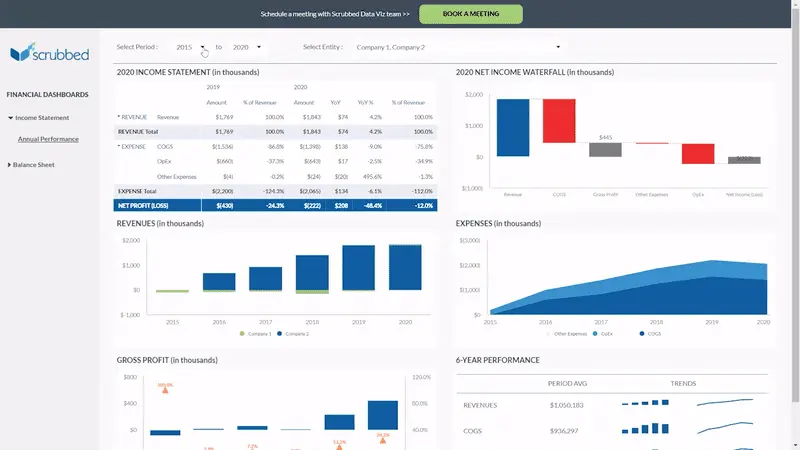

- Data Visualization – Through the use of dynamic dashboards, it can present the data in various charts and graphs e.g. trend analysis to help uncover irregularities in revenue streams, expenses, or detect potential areas of financial risk. It can also calculate metrics much faster such as those related to profitability at a customer level or product level, allowing decision makers to gain a clearer picture of the target company’s performance drivers.

For instance, a dashboard might show revenue by customer segment in a line chart, while a heat map can highlight expense categories with unusual spikes to make anomalies more visible.

- Automation – Due diligence usually has tight deadlines and volumes of data can come from disparate sources. Data analytics tools can definitely make the data cleansing, aggregation, and reconciliation much faster and more accurate.

Leverage Scrubbed’s Data & Analytics Services

This is where Scrubbed can make a meaningful difference. We help deal teams unlock the full potential of data analytics while ensuring every insight is grounded in accounting and financial expertise.

Here’s how we support M&A and due diligence:

- Data preparation and optimization to make sure information is accurate, complete, and ready for analysis.

- Advanced financial analysis that uncovers irregularities, highlights risks, and identifies opportunities for value creation.

- Custom dashboards and reporting that make it easy to track key metrics, synergies, and trends throughout the deal.

- Sales, marketing, and inventory analytics to give a clearer picture of business performance and growth potential.

- Human resources analytics to assess workforce efficiency, cost structures, and potential integration challenges.

- Automated reporting to streamline recurring reports and free up teams for higher-level decision-making.

- Post-merger integration support, including aligning financial systems, reporting processes, and compliance requirements.

By combining advanced analytics tools with CPA expertise, Scrubbed helps companies move faster, minimize risks, and make smarter decisions at every stage of the deal lifecycle.

Conclusion

For companies pursuing M&A now, relying only on traditional due diligence methods isn’t enough. The amount and complexity of data involved require a more advanced approach. Data analytics can give deal teams the speed and insight needed to uncover risks, spot opportunities, and make better decisions that increase the chances of long-term success.

But data analytics alone is not the answer. Its real value comes from combining analytics with the experience and judgment needed to interpret them and turn them into action. That’s why more companies are turning to trusted partners like Scrubbed.

If your company is planning an acquisition or preparing for a transaction, this is the time to strengthen your due diligence process with data-driven insights. Connect with Scrubbed today to explore how we can help you navigate M&A with confidence and clarity.