Post-employment benefits play a significant role in the overall compensation package offered by employers to their workforce. These benefits extend beyond an employee’s active service period and are designed to provide financial security and support during retirement or after leaving employment. The importance of post-employment benefits is multi-faceted and has implications for both employees and employers. Accounting Standards Codification (ASC) 715, Compensation – Retirement Benefits, provides guidelines for the accounting and financial reporting of these employee benefit plans.

WHAT ARE BENEFITS PLANS?

A benefit plan is an arrangement that is a mutual understanding between an employer and its employees, whereby the employer undertakes to provide employees with benefits after they retire in exchange for the employees’ services over a specified period, upon attaining a specified age while in service, or both. Benefits can either start immediately after the termination of service or be delayed until retired employees reach a designated age.

It follows from that basic view that the benefits are not gratuitous gestures but integral components of an employee’s overall compensation. As the remuneration is postponed, the benefit plan can be categorized as a deferred compensation. Additionally, the employer assumes the obligation for this compensation when the services are provided.

There are two types of post-employment benefits plan:

1. Defined Benefit Plans: A defined benefit plan promises a specified benefit payout to employees upon retirement, typically determined by factors like salary history and years of service. The employer assumes the investment risk and is tasked with ensuring there are sufficient funds to fulfill future benefit obligations. A plan’s net assets represent the available resources through which it can deliver benefits. Consequently, understanding net asset information is crucial for evaluating a plan’s capability to fulfill benefit payments promptly.

2. Defined Contribution Plans: A defined contribution plan specifies the contributions that employers and, often, employees make to the plan but does not promise a specific benefit amount upon retirement. Contributions, investment returns, and other factors determine the individual account balances. The employees typically bear the investment risk, as the employer’s responsibility is limited to making contributions. The plan’s net assets allocated for benefit payments are equivalent to the total of participants’ individual account balances. Consequently, the plan’s capacity to meet due benefits is tied to the current value of assets that individual participants can access.

COMMON ACCOUNTING CONSIDERATIONS

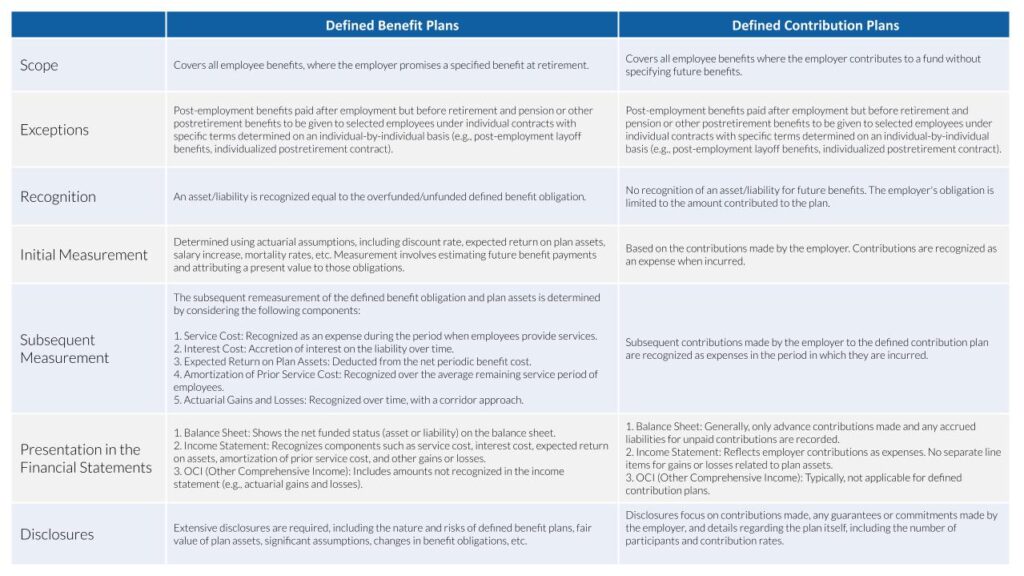

Let’s outline the scope, exceptions, recognition, initial and subsequent measurement, and presentation and disclosure requirements for defined benefit and defined contribution plans based on ASC 715.

This is a general overview of the specific requirements of ASC, and specific details may vary based on the circumstances of individual plans. It is advisable to refer to the relevant ASC sections and consult with a qualified professional for accurate information.

KEY DIFFERENCES BETWEEN IFRS AND US GAAP

International Financial Reporting Standards (IFRS) and ASC are widely recognized frameworks that shape financial reporting practices globally. While both systems aim for transparency and consistency, differences still exist, particularly when accounting for employee benefit plans. The section below explores the key distinctions between IFRS and ASC in accounting for Defined Benefit and Defined Contribution plans, insights that are especially relevant for organizations focused on nonprofit financial reporting, where compliance and clarity are critical to maintaining donor trust and meeting regulatory obligations.

Income from plan assets limit: According to IFRS, the net interest expense encompasses interest income from plan assets, interest cost related to the defined benefit obligation, and interest associated with any asset ceiling impact. This net interest expense is determined using the discount rate of the benefit obligation. Discrepancies between net interest and actual returns are incorporated into remeasurement gains and losses, acknowledged in OCI, and are not recycled into net income in subsequent periods. However, they may be transferred within equity.

Conversely, according to US GAAP, the anticipated return on plan assets is determined by either the fair market value of those assets or a computed value. Variances between expected and actual returns are immediately recognized in net income or initially in OCI and subsequently amortized into net income.

Net interest expense and service cost presentation: Under IFRS, there is no specific requirement regarding the presentation or separation of net interest expense and service cost. Entities have the flexibility to choose an approach for presentation, and this chosen method should be consistently applied. In practice, net interest expense is commonly presented within net finance expense.

In contrast, with the adoption of ASU 2017-07 under US GAAP, all elements of net periodic benefit cost, excluding current service cost, are now presented outside any subtotal of operating results. This applies if such a line item is separately presented according to US GAAP standards.

Actuarial gains and losses recognition: In accordance with IFRS, actuarial gains and losses are acknowledged in OCI and are not subsequently reclassified to the net income in subsequent periods. However, they may be transferred within equity, such as from OCI to retained earnings.

Conversely, under US GAAP, entities have the option to initially recognize actuarial gains and losses in OCI or net income. Following this, gains or losses recognized in OCI are gradually transferred to net income through a ‘corridor’ approach. The corridor is computed as 10% of the higher of the defined benefit obligation or the market value of plan assets. Any cumulative actuarial gains and losses beyond this corridor are amortized on a straight-line basis into net income over the anticipated average remaining working lives of plan participants.

How Scrubbed Can Help You

The Scrubbed Technical Accounting Group can assist you in evaluating specific scenarios related to post-employment benefits and ASC 715. We can help you with complex accounting transactions, prepare related accounting memos, and ensure your disclosures and reporting meet the requirements under the specific guidance.

Contact Scrubbed to learn how our Technical Accounting Group and Tax experts can help your business navigate accounting complexities, manage risk and SOX compliance, and tax concerns related to post-employment benefits.

Disclaimer: The information provided here is general and not intended to cater to the circumstances of any specific individual or entity. It should not be relied upon as accounting, tax, or other professional services. For precise advice, please consult with your advisors. While we strive to offer accurate and timely information, there is no assurance of its accuracy at the time of receipt or its continuous accuracy in the future. No one should make decisions based on this information without seeking appropriate professional advice and thoroughly examining the specific situation.

**Special thanks to Kyle Hermoso for his valuable contribution to this article.

*Disclaimer: Services being offered do not require a state license.

References: https://viewpoint.pwc.com/dt/us/en/pwc/accounting_guides/financial_statement_/financial_statement___18_US/chapter_13_pensions__US/133_defined_benefit__US.html#pwc-topic.dita_1420041512158262 / https://www.iasplus.com/en/standards/ias/ias19 / https://www.bdo.com/insights/assurance/fasb-amends-the-disclosure-requirements-for-defined-benefit-plans / https://dart.deloitte.com/USDART/home/publications/archive/deloitte-publications/heads-up/2018/fasb-amends-guidance-disclosures-related-defined / https://www.fasb.org/Page/ShowPdf?path=ASU+2018-14.pdf&title=&acceptedDisclaimer=true&Submit= / https://www.dol.gov/general/topic/retirement/typesofplans / https://www.fasb.org/page/PageContent?pageId=/standards/accounting-standards-updates-issued.html#2022 / https://asc.fasb.org/715/showallinonepage / https://kpmg.com/us/en/articles/2023/defined-benefit-plans.html