Often, sustainability initiatives are viewed as sunk-cost projects, and earning a “Sustainable Business” badge is viewed as just an ornament or proof of compliance. But what if there’s a sustainability initiative that can help you protect your energy costs from fluctuating prices and also generate incentives on the side? Sounds enticing? Are you willing to give it a try? Great, then hear me out!

Ever heard of the Power Purchase Agreement (PPA) and Virtual Power Purchase Agreement (VPPA)? In the simplest terms, these Renewable Energy (RE) agreements allow a business to fix the price (“RE Price”) of their energy consumption and earn Renewable Energy Credits (RECs) as they finance and support renewable energy projects.

How it works?

Under both PPA and VPPA, a Company enters into an agreement with a Renewable Energy Project Contractor to purchase renewable energy at a fixed price (often lower than the market price of traditional sources) over a long period of time. Put simply, the Contractor provides the Company with the energy it needs, and the Company pays the Contractor a fixed amount per unit of consumption.

Under a PPA, the on-site Renewable Energy Project (REP) directly supplies the Company with renewable energy. If the agreement covers the Company’s entire energy needs, then the Company no longer needs to purchase energy from the traditional grid.

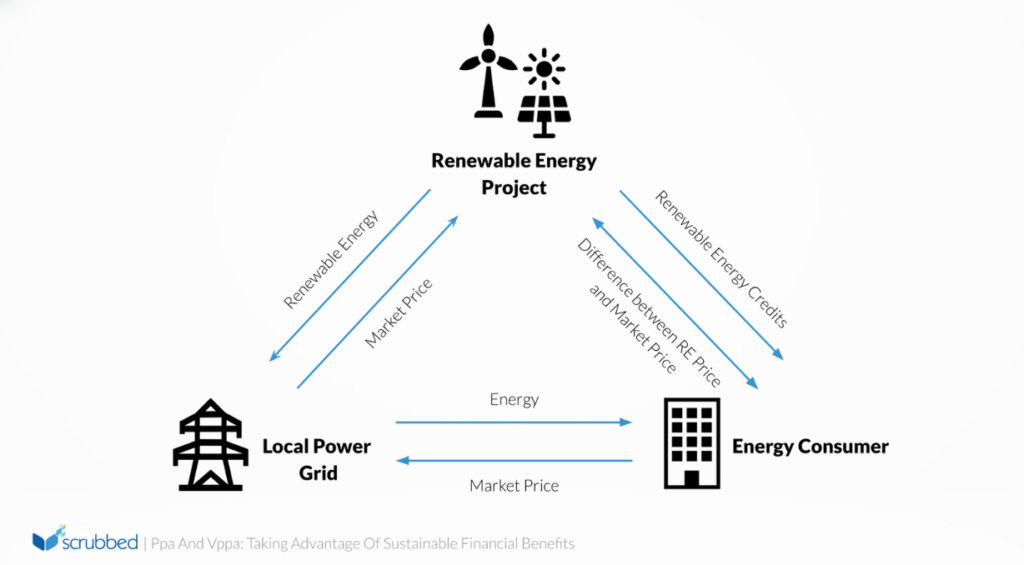

In contrast, under a VPPA, the REP is located elsewhere and supplies the energy to the Grid. The Grid pays the REP Contractor at the market price. The Company continues to source its energy from the Grid and pays the Grid the market price. If the market price is lower than the RE Price, the Company pays the REP Contractor the difference. If the RE Price is lower than the market price, the REP Contractor pays the Company the difference. Additionally, this arrangement entitles the Company RECs supplied by the REP Contractor.

The Company can use these RECs to offset its carbon emissions and meet goals or regulatory requirements. Any excess RECs can also be sold to third parties or returned to the REP Contractor.

Circling back on the benefits!

Again, let’s recap the benefits that can be gained from these agreements:

- Improved Cash Flows – the fixed price set by these agreements allows for better cash management and protection against fluctuating energy prices.

- Avoid Penalties – for industries subject to carbon emissions regulations, the RECs provided for under these agreements ensure compliance resulting in financial savings. Integrating these measures into your broader risk and SOX compliance strategy can further strengthen your organization’s ability to meet regulatory requirements while minimizing potential exposure to financial or reputational risks.

- Other income – Excess RECs can be sold for additional cash after meeting regulatory requirement

- Get that Sustainable Business Badge – meet your sustainable goals, improve your brand reputation, support your local communities, and ultimately, protect the environment.

Take a moment and consider these matters!

I know you are excited to take advantage of the benefits, but you might be concerned about operational and technical considerations. Well, I get you, so let me give you some matters to consider.

- How reliable is your local grid? Check their energy source, current price, and market price forecast. Some grids are already struggling to manage their supply and their customers’ demand which will be a concern for you in the long run.

- Are you located in an area rich in renewable energy sources? This is a big factor in determining whether a PPA or a VPPA suits your case.

- Setting the fixed RE Price. Determining the proper RE price suited to your market and your needs is very crucial to maximizing financial savings.

- Check your emissions. You must first determine your emissions to determine the total RECs you need to generate from the agreements.

- Financial and Accounting Considerations. As usual, any business transaction requires a proper understanding of how it will impact your financial reports and how each component of your agreement will affect your bottom line.

Nevertheless, don’t fret!

While there’s a list of matters to consider, the benefits of PPAs or VPPAs still outweigh their cost. The number of PPAs and VPPAs has been growing rapidly in recent years.

You just need the right partner to help you navigate these matters and further your sustainability goals.

How Scrubbed Can Help

At Scrubbed, our professionals are well-equipped with the sustainability expertise you need.

- PPA and VPPA Management and Accounting—Our Clean Technology Accounting Professionals are ready to help you determine the complexities of PPAs and VPPAs.

- Emissions Accounting and Regulations Assessment—Our ESG Team is well-equipped Carbon Accountants and is on top of sustainability regulatory changes.

- Financial analysis and scenario planning—Our Corporate Finance Advisory team can help you build scenario analysis to help you determine the best PPA or VPPA suited for your business.

- Sustainability Tax Assessments—Our tax professionals can help you maximize tax incentives and ensure penalties are avoided.

We are ready to help you with your sustainability programs. If you’re ready to get started, contact us.

Disclaimer

The information provided here is general and not intended to cater to the circumstances of any specific individual or entity. It should not be relied upon as accounting, tax, or other professional services. For precise advice, please consult with your advisors. While we strive to offer accurate and timely information, there is no assurance of its accuracy at the time of receipt or its continuous accuracy in the future. No one should make decisions based on this information without seeking appropriate professional advice and thoroughly examining the specific situation.

*Special thanks to Khryst Celine Vizon for her valuable contribution to this article.