The complexities of goodwill impairment often present a challenge for companies. During a business combination, the excess of the amount of consideration paid by an acquirer and the net asset’s fair value of the acquiree is known as goodwill. When the value of the net asset of a reporting unit declines, goodwill impairment may have occurred.

Further exacerbated by macroeconomic facts such as inflation, employment levels, national income, and international trade, which affects the valuation and health of both publicly listed and private companies, valuing the fair value of companies presents a challenge, especially the determination if there are impairment of a company’s value.

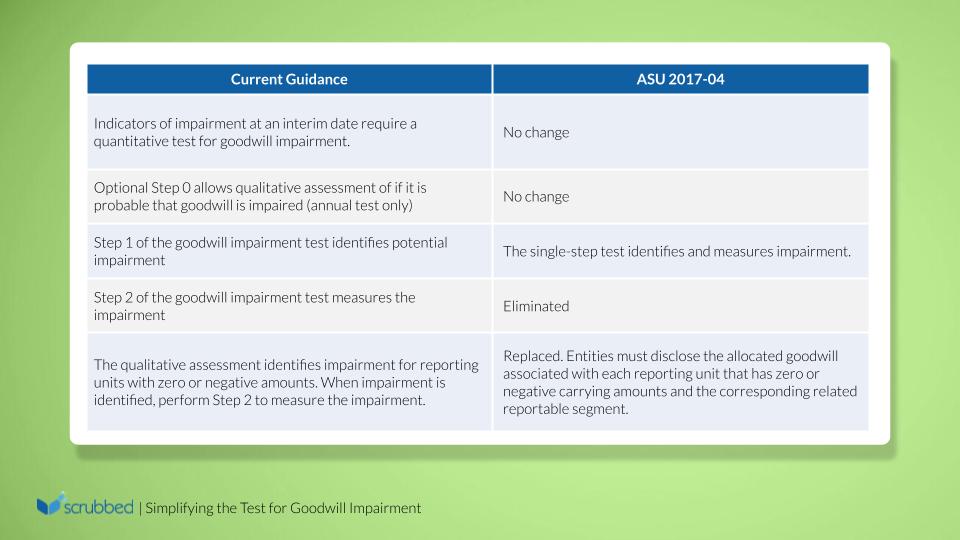

The current guidance in ASC 350, Intangibles—Goodwill and Other, requires a two-step assessment to determine whether goodwill is impaired.

The first step is to compare each entity’s reporting unit’s carrying value, including goodwill and implied fair value. The second step must be performed if the implied fair value is less than the carrying amount. The second step is to compare the goodwill’s carrying value to its implied fair value and record an impairment charge for any excess carrying value over the implied fair value.

Accounting Standards Update 2017-04 (ASU 2017-04) provides a simpler goodwill impairment test by eliminating the second step to simplify the goodwill impairment test and provide cost savings for all entities.

Impact of ASU 2017-04 on Goodwill Impairment Test at a Glance:

Key Discussion

Goodwill is an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognized. The goodwill’s unit of accounting is at the reporting unit level. A reporting unit is an operating segment or one level below an operating segment (a component). A component of an operating segment is deemed a reporting unit if it meets the definition of a business in ASC 805, Business Combinations for which discrete financial information is available and whose operating results are regularly reviewed by segment management.

Operating segments or components with similar economic characteristics should be aggregated into one or more reporting units. However, components that are part of different operating segments may not be combined into a single reporting unit. Reportable segments are irrelevant in the determination of reporting units. Goodwill is assigned to specific reporting units for purposes of the annual or interim impairment assessment and, therefore, identification of an entity’s reporting units is the cornerstone of goodwill impairment testing.

Under the current guidance in ASC 350, goodwill impairment exists when the implied fair value of goodwill is less than its carrying amount. Determining the implied fair value of goodwill follows the same approach as calculating goodwill recognized in a business combination. This measurement process is currently referred to as Step 2 of the goodwill impairment test. To perform step 2, an entity must assign a reporting unit’s fair value to all of that unit’s assets and liabilities (including any unrecognized intangible assets) as if the reporting unit had been acquired in a business combination.

The amendment in ASU 2017-04 changes the concept of impairment from a condition that exists when the carrying amount of goodwill exceeds its implied fair value to a condition that exists when the carrying amount of a reporting unit exceeds its fair value. Accordingly, step 2 of the goodwill impairment test is now eliminated. A goodwill impairment loss is measured as the excess of the carrying amount of a reporting unit, including goodwill, over its fair value, which is limited to the allocated total amount of goodwill to that reporting unit. The related income tax effect from any tax-deductible goodwill on the carrying amount of the reporting unit should be considered when measuring the goodwill impairment loss.

Goodwill Impairment Testing Sequence

A: Optional Qualitative Assessment

ASU 2017-04 did not introduce any changes to the optional qualitative assessment. An entity may choose to perform a qualitative assessment in which qualitative factors such as macroeconomic conditions, industry and market considerations, cost factors, overall financial performance, and other entity-specific events and circumstances are assessed to determine whether it is more likely than not that the fair value of a reporting unit is less than it’s carrying amount, including goodwill. The process of qualitative assessment for any reporting unit in any period may be bypassed. Thus, an entity may perform the quantitative goodwill impairment test directly.

B: Quantitative Goodwill Impairment Test

1. If the reporting unit’s carrying amount is less than its fair value, then its goodwill is considered not impaired.

2. If the carrying amount of a reporting unit exceeds its fair value, an impairment loss should be recognized in the amount of the excess and limited to the total amount of goodwill allocated to that reporting unit. Additionally, an entity should consider the income tax effect from any tax-deductible goodwill on the reporting unit’s carrying amount, if applicable, when measuring the goodwill impairment loss.

3. Once a goodwill impairment loss is recognized, the adjusted carrying amount of goodwill will become its new accounting basis.

4. Subsequent reversal of a previously recognized goodwill impairment loss is prohibited once the measurement of that loss is recognized.

Tax Deductible Goodwill

In certain jurisdictions, goodwill is deductible for tax purposes for some business combinations. In such jurisdictions, when a business acquisition takes place, a deferred tax asset or deferred tax liability is recorded based on the variance between the tax basis and the book basis of goodwill. Therefore, the impairment of goodwill would create a cycle of impairment when a reporting unit’s goodwill is tax deductible. This is because the decrease in the book value of goodwill will increase the deferred tax asset (or decreases the deferred tax liability). As a result, the reporting unit’s carrying amount will also increase. However, there is no corresponding increase in the reporting unit’s fair value, which could trigger another impairment test since the carrying amount will again be higher than the fair value because of the effect on the deferred tax asset or liability.

To address this issue, the guidance now requires an entity to calculate the impairment charge and the deferred tax effect using a simultaneous equations method comparable to the approach used for measuring goodwill and related deferred tax assets during a business combination. This means that when there is tax-deductible goodwill, further goodwill reduction must be recognized during impairment to offset the increase in deferred tax asset or decrease in deferred tax liability. This will result in the reporting unit’s carrying value equal to its fair value.

Reporting Units with Zero or Negative Carrying Amounts

Before ASU 2017-04, under US GAAP, a qualitative assessment was required to determine whether there was a likelihood of impairment of goodwill associated with having a net asset carrying amount of zero or negative. If the qualitative analysis indicated goodwill impairment, Step 2 would be performed to determine the existence and amount of impairment for that reporting unit.

However, with the implementation of ASU 2017-04, the requirement for conducting a qualitative assessment for reporting units with zero or negative carrying amounts has been eliminated. The same impairment assessment thus applies to all reporting units. In addition, entities that have one or more reporting units with zero or negative carrying amounts of net assets should disclose the reporting units with allocated goodwill, including the amount of goodwill allocated to each and in which reportable segment the reporting unit is included.

Transition Requirements and Effective Date

ASU 2017-04 should be applied prospectively. Public Business Entities that are SEC filers have already adopted the ASU last 2020 reporting. For all other entities, the ASU will be effective beginning the calendar year-end 2023 and thereafter.

How Can Scrubbed Help?

We can assist you by evaluating specific scenarios related depending on your industry related to the changes in ASU 2017-04. In addition, we provide technical consultation on complicated accounting transactions, prepare accounting memos, and provide audit support. Our team can help you ease the burden and complexities of ongoing reporting requirements such as nonprofit financial reporting, risk and SOX compliance, and the application of complex accounting matters.