Traditionally, the Investment Tax Credit (ITC) for cleantech businesses has operated as a government-backed financial springboard designed to lower the upfront costs of adopting sustainable technologies. It’s a reimbursement program in which businesses receive a direct reduction in their federal tax bills—equivalent to a percentage of their capital investments in qualifying clean energy projects.

For decades, this incentive has targeted specific technologies like solar panels, wind turbines, and geothermal systems, effectively refunding a meaningful percentage of eligible expenditures to accelerate adoption. This targeted approach has been foundational in scaling renewable energy infrastructure.

However, the landscape of clean energy tax incentives is undergoing a significant transformation thanks to the Inflation Reduction Act of 2022. According to the EPA, Starting January 1, 2025, the Inflation Reduction Act replaces the traditional PTC with the Clean Energy Production Tax Credit (§1 3701) and the traditional ITC with the Clean Electricity Investment Tax Credit (§ 13702).

These tax credits are functionally similar to the ITC/PTC but are not technology-specific. The IRA has extended the PTC and ITC, introduced new provisions, and created sections 45Y for PTC and 48E for ITC, including additional provisions for clean energy investments.

In this article, we’ll cover the changes that affect Investment Tax Credits (ITC). Information about the changes to Production Tax Credits can be found in the companion article The Extension and Phase-down of Production Tax Credits for Cleantech

Key Changes and Extensions in the Investment Tax Credit

The following are key changes in the ITC that cleantech businesses need to be aware of, along with actions that companies can take to prepare for the introduction of the new credit:

1. Extension of Transition Processes:

- Notice 2024-84: This notice extends the transition process for claiming statutory exceptions to the elective payment phaseouts for clean energy projects that fail to satisfy domestic content requirements. The deadline for beginning construction has been extended to January 1, 2027, or until further guidance is issued.

- Notice 2024-84: This notice extends the transition process for claiming statutory exceptions to the elective payment phaseouts for clean energy projects that fail to satisfy domestic content requirements. The deadline for beginning construction has been extended to January 1, 2027, or until further guidance is issued.

- Action:

- Submit Attestations: Ensure that attestations regarding the Increased Cost Exception and the Non-Availability Exception are submitted for projects beginning before the new deadline. These attestations must be signed by a person with the legal authority to bind the entity in federal tax matters and attached to the relevant forms (e.g., Form 8835, Renewable Electricity Production Credit; Form 3468, Investment Credit).

2. Beginning of Construction Requirements:

- The Physical Work Test and Five Percent Safe Harbor: To establish the beginning of construction, businesses can either begin physical work of a significant nature or pay/incur 5% or more of the total project cost.

- The Physical Work Test and Five Percent Safe Harbor: To establish the beginning of construction, businesses can either begin physical work of a significant nature or pay/incur 5% or more of the total project cost.

- Action:

- Document Construction Activities: Maintain detailed records, including contracts, physical work certificates, photographic evidence, and engineering reports to substantiate the beginning of construction before the deadline.

- Meet Continuity Requirements: Ensure continuous efforts or progress towards completion once construction has begun. Projects must be placed in service by the end of the year that includes the fourth anniversary of the construction start date.

- Document Construction Activities: Maintain detailed records, including contracts, physical work certificates, photographic evidence, and engineering reports to substantiate the beginning of construction before the deadline.

3. Domestic Content Requirements:

- IRS Notices 2023-38 and 2024-41: These notices provide guidance on the domestic content bonus credit requirements, including classifying project components and calculating domestic cost percentages.

- IRS Notices 2023-38 and 2024-41: These notices provide guidance on the domestic content bonus credit requirements, including classifying project components and calculating domestic cost percentages.

- Action:

- Elect Safe Harbors: Consider using the New Elective Safe Harbor to classify project components and calculate domestic cost percentages. This safe harbor simplifies compliance by providing predefined cost percentages for various components.

- Certify Compliance: Submit a Domestic Content Certification Statement with the relevant tax forms to certify that the project meets the domestic content requirements.

- Elect Safe Harbors: Consider using the New Elective Safe Harbor to classify project components and calculate domestic cost percentages. This safe harbor simplifies compliance by providing predefined cost percentages for various components.

4. Energy Community Bonus Credits

The Inflation Reduction Act allows for increased credit amounts or rates if certain requirements pertaining to energy communities are satisfied. There are three categories of energy communities:

- Brownfield sites

- Certain metropolitan statistical areas and non-metropolitan statistical areas based on unemployment rates (MSA/non-MSA)

- Census tracts where a coal mine closed after 1999 or where a coal-fired electric generating unit was retired after 2009 (and directly adjoining census tracts)

- Action:

- Identify Eligible Locations: If your project is located in an energy community, you might qualify for extra tax credits.

- Document Eligibility: Maintain records to substantiate the project’s location in an energy community, including maps, employment data, and local tax revenue information.

- Identify Eligible Locations: If your project is located in an energy community, you might qualify for extra tax credits.

5. Prevailing Wage and Apprenticeship Requirements

- The prevailing wage requirements of the IRA provide that taxpayers must ensure that all laborers and mechanics employed by the taxpayer (or any contractor or subcontractor) on the construction, alteration, or repair of a qualified facility are paid wages at rates that are not less than the prevailing rates determined by the Department of Labor.

- The apprenticeship requirements of the IRA include three components — a labor hours requirement, a ratio requirement, and a participation requirement. Under the labor hours requirement, the taxpayer must ensure that a minimum percentage of the total labor hours performed on the construction, alteration, or repair of a facility are performed by qualified apprentices from a registered apprenticeship program.

- The prevailing wage requirements of the IRA provide that taxpayers must ensure that all laborers and mechanics employed by the taxpayer (or any contractor or subcontractor) on the construction, alteration, or repair of a qualified facility are paid wages at rates that are not less than the prevailing rates determined by the Department of Labor.

- Action:

- Ensure Compliance with Wage Rates: Verify that laborers and mechanics are paid wages at rates not less than the prevailing rates for construction, alteration, or repair in the locality as determined by the Secretary of Labor.

- Meet Apprenticeship Requirements: Ensure that a specified percentage of total labor hours are performed by qualified apprentices and that the project complies with apprentice-to-journey worker ratios.

- Maintain Records: Keep detailed records of wage payments and apprenticeship participation to demonstrate compliance with these requirements .

- Ensure Compliance with Wage Rates: Verify that laborers and mechanics are paid wages at rates not less than the prevailing rates for construction, alteration, or repair in the locality as determined by the Secretary of Labor.

6. Direct Pay and Transferability

- As part of the IRA’s overhaul, direct pay is now available for tax-exempt entities, such as state and local governments, rural electric cooperatives, and tribal communities. This allows these entities to claim ITC without needing to pay taxes. Additionally, businesses can transfer their credits to other taxpayers (e.g., investors), improving liquidity and financing options.

ITC Transitions to Zero-emission Provisions

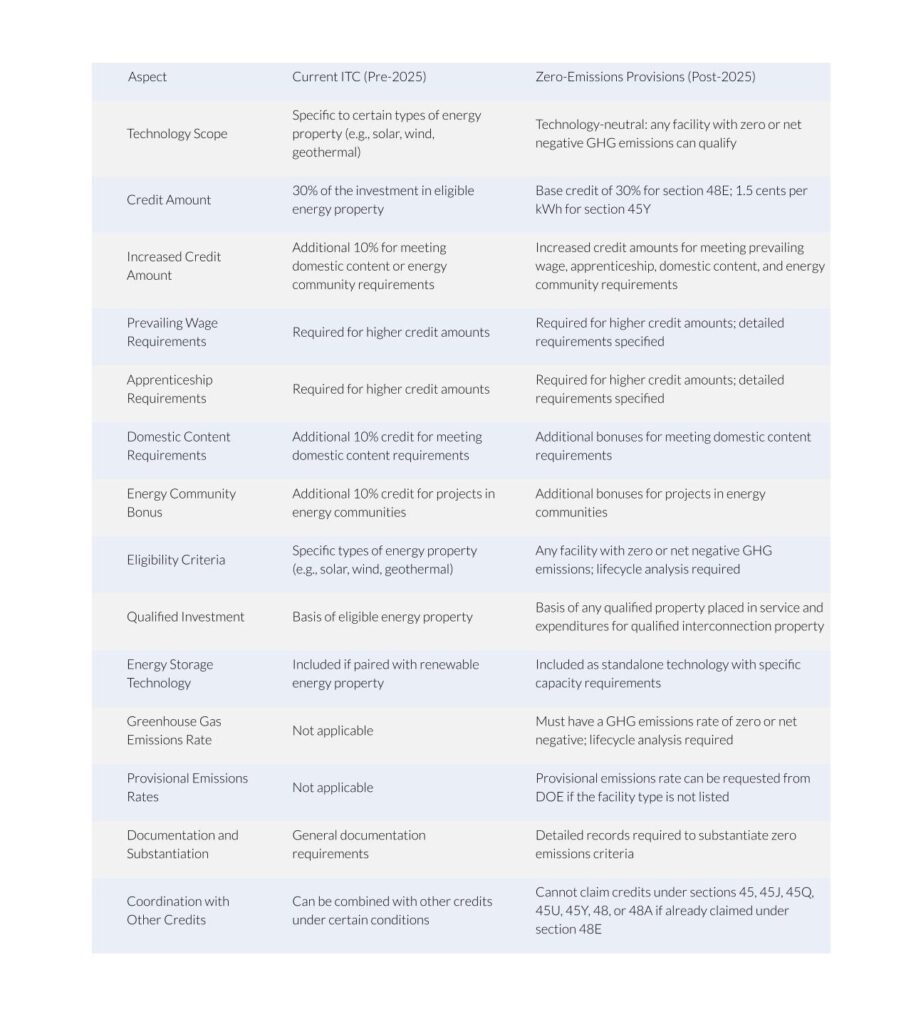

The introduction of zero-emission provisions in 2025 will significantly change how ITC operates compared to the current system. Here are the key differences:

Technology-Neutral Framework

Starting in 2025, the system will transition to a technology-neutral model. This new framework focuses on zero-emission facilities rather than specific technologies. Projects must demonstrate zero greenhouse gas emissions to qualify, with special provisions for facilities using combustion or gasification technologies.

Impact Across Sectors

The changes to the ITC will affect different industries in different ways. Some of the expected impacts include:

- Energy Production

- Eligibility for Credits: Energy production businesses must ensure their facilities have a greenhouse gas (GHG) emissions rate of zero to qualify for the clean electricity investment credit. This includes facilities that generate electricity through combustion or gasification, which must account for lifecycle GHG emissions as described in the Clean Air Act.

- Expansion and Incremental Production: Businesses can expand existing facilities or add new capacity to qualify for the credits.

- Credit Phaseout: The credit phaseout begins in the later of either 2032 or the year in which the Secretary determines that annual GHG emissions from electricity production in the U.S. are equal to or less than 25% of the 2022 levels.

- Eligibility for Credits: Energy production businesses must ensure their facilities have a greenhouse gas (GHG) emissions rate of zero to qualify for the clean electricity investment credit. This includes facilities that generate electricity through combustion or gasification, which must account for lifecycle GHG emissions as described in the Clean Air Act.

- Waste Management

- Carbon Capture and Sequestration: Waste management businesses involved in energy production through waste-to-energy processes must ensure that any GHG emissions are captured and sequestered to meet the zero-emissions requirement. Section 45Y(b)(2)(D) specifies that GHG emissions do not include any qualified carbon dioxide that is captured and disposed of in secure geological storage or utilized in a manner described in section 45Q.

- Lifecycle Emissions: For facilities producing electricity through combustion or gasification, the GHG emissions rate must account for lifecycle emissions, which include emissions from feedstock generation or extraction through the point of production.

- Carbon Capture and Sequestration: Waste management businesses involved in energy production through waste-to-energy processes must ensure that any GHG emissions are captured and sequestered to meet the zero-emissions requirement. Section 45Y(b)(2)(D) specifies that GHG emissions do not include any qualified carbon dioxide that is captured and disposed of in secure geological storage or utilized in a manner described in section 45Q.

- Electric Vehicle (EV) Manufacturing

- Supply Chain and Critical Minerals: EV manufacturers are impacted by the requirements for critical minerals in battery production. Section 45X(c)(6) outlines the need for critical minerals to meet certain purity levels, and manufacturers must ensure that these minerals are sourced and processed in compliance with the statutory requirements.

- Consumer Education and Market Impact: The transition to new credits under sections 45Y and 48E may require consumer education to help buyers understand how these credits affect their purchase decisions. This is particularly relevant for EV manufacturers who need to communicate the benefits of the credits to potential customers.

- Supply Chain and Critical Minerals: EV manufacturers are impacted by the requirements for critical minerals in battery production. Section 45X(c)(6) outlines the need for critical minerals to meet certain purity levels, and manufacturers must ensure that these minerals are sourced and processed in compliance with the statutory requirements.

Opportunities for Cleantech Companies

The new production and investment credits significantly enhance project valuations and financial viability. The ability to transfer credits or receive direct payments provides additional flexibility for project financing.

- Increased Investment in Clean Technologies: The broad applicability of the credits to various clean technologies can drive increased investment and innovation in the sector, providing opportunities for businesses to develop and deploy new clean energy solutions.

- Expansion and Retrofitting of Existing Facilities: The credits allow for expanding and retrofitting existing facilities to increase electricity production, which can be a cost-effective way for businesses to enhance their clean energy output.

- Leveraging Bonus Credits: Projects located in energy communities, low-income communities, or on tribal land and those meeting domestic content requirements can benefit from additional credit amounts, making these projects more financially attractive.: Projects located in energy communities, low-income communities, or on tribal land and those meeting domestic content requirements can benefit from additional credit amounts, making these projects more financially attractive.

Looking Ahead

The phaseout of these credits is scheduled for 2032 or when U.S. electricity sector emissions fall by 75% from 2022 levels, whichever occurs later. Companies should plan their project timelines accordingly to maximize available benefits.

The transformation of clean energy tax credits represents a significant shift toward technology-neutral, emissions-based incentives. Success in this new framework requires careful planning, thorough documentation, and strategic positioning of clean energy projects.

How Scrubbed Can Help

This article outlines the changes and potential opportunities brought about by the new framework, but it isn’t comprehensive, and each business will have to evaluate its own eligibility for the revised credit. At Scrubbed, we have deep experience in the cleantech and renewable energy industries, as well as offering specialized biotech accounting services and fractional CFO services, and have helped clients establish a firm financial foundation and maximize credits and incentives.

Contact us to discuss how we can help your cleantech business prepare for the changes to the ITC with our SaaS accounting expertise.

Key Takeaways

Investment Tax Credits (ITC) are Changing: Starting January 1, 2025, the traditional ITC will be replaced by the Clean Electricity Investment Tax Credit (§13702) and the Clean Energy Production Tax Credit (§13701). These new credits are technology-neutral and include additional provisions for clean energy investments.

- Significant Changes and Extensions:

- Extension of Transition Processes: The transition process for claiming statutory exceptions to the elective payment phaseouts for projects that fail to satisfy domestic content requirements has been extended. The deadline for beginning construction has been extended to January 1, 2027, or until further guidance is issued

- Beginning of Construction Requirements: To establish the beginning of construction, businesses can either begin physical work of a significant nature or pay/incur 5% or more of the total project cost.

- Domestic Content Requirements: New elective safe harbors simplify compliance by providing predefined cost percentages for various components.

- Energy Community Bonus Credits: Increased credit amounts are available for projects in energy communities.

- Prevailing Wage and Apprenticeship Requirements: Compliance with wage rates and apprenticeship participation is necessary for higher credit amounts.

- Extension of Transition Processes: The transition process for claiming statutory exceptions to the elective payment phaseouts for projects that fail to satisfy domestic content requirements has been extended. The deadline for beginning construction has been extended to January 1, 2027, or until further guidance is issued

- Direct Pay and Transferability: Tax-exempt entities can now claim ITC without needing to pay taxes, and businesses can transfer their credits to other taxpayers, improving liquidity and financing options.

- ITC Transitions to Zero-emission Provisions: Introducing zero-emission provisions in 2025 will significantly change how ITC operates compared to the current system across multiple aspects.

- Technology-Neutral Framework: Starting in 2025, the system will transition to a technology-neutral model, focusing on zero-emission facilities rather than specific technologies.

- Opportunities for Cleantech Companies:

- Increased Investment in Clean Technologies: The broad applicability of the credits can drive increased investment and innovation in the sector.

- Expansion and Retrofitting of Existing Facilities: The credits allow for expanding and retrofitting existing facilities to increase electricity production.

- Leveraging Bonus Credits: Projects in energy communities, low-income communities, or on tribal land can benefit from additional credit amounts.

- Increased Investment in Clean Technologies: The broad applicability of the credits can drive increased investment and innovation in the sector.

- Looking Ahead: The phaseout of these credits is scheduled for 2032 or when U.S. electricity sector emissions fall by 75% from 2022 levels, whichever occurs later.

Further Guidance and Updates

Detailed Regulations and Guidance: The IRS and Treasury are expected to issue further detailed regulations and guidance on various aspects of sections 45Y and 48E, including the calculation of emissions rates, the specifics of the direct pay and transfer options, and the procedures for petitioning for provisional emissions rates.

Public Comments and Hearings: The IRS has requested public comments on the implementation of these credits and has scheduled public hearings to gather input from stakeholders. This ongoing dialogue may result in further refinement to the regulations.

Annual Updates to Emissions Rates: The annual publication of emissions rates for different facility types will be a critical component of the ongoing implementation of these credits, providing taxpayers with the necessary information to determine their eligibility

Sources:

IRS Guidance on Inflation Reduction Act

U.S. Treasury IRA Resource Hub

IRS Domestic Content Bonus Guidelines