Scrubbed’s recent virtual conference, “The Future is Fractional”, brought together top finance executives, fractional leaders, and AI experts to discuss one pressing question: “How can businesses scale smarter in an age of talent scarcity and rapid change?”

This discussion has never been more urgent. Since 2020, the fractional workforce has exploded by 57%, while 83% of enterprises have turned to AI to bridge talent gaps. The old models of hiring simply aren’t keeping up.

Held last October 30, 2025, this virtual conference provided a powerful roadmap for the future of finance. From real-world case studies in scalable growth to a practical framework for AI adoption, here are the most important takeaways from the event:

From Fractional Staff to Integrated Partner

The conversation around “outsourcing” has fundamentally changed. As Ivan Kwan, VP of Corporate Finance at Adapture Renewables, shared in his session, the old model of failed temp hires and disjointed contractors is dead. The new model is about deep, strategic integration.

Kwan, who scaled his finance team from just himself and a CFO to a robust, compliance-driven department, attributed his success to a mindset shift. “I looked at the fractional staff as our staff, just housed elsewhere,” he explained.

This sentiment was echoed by Ismaila Sougoufara, CAO of Jaguar Health, a public company navigating complex SEC and SOX compliance. He explained that building trust with auditors and the board was possible for one reason: “Quality speaks for itself.”

The key takeaways were:

Treat partners like team members: True integration, including face-to-face visits and inclusion in company culture, is non-negotiable. Ismaila noted, “Scrubbed is not seen as fractional. We refer to Scrubbed as our company in the Philippines. It’s an integral part of Jaguar.”

Start with incremental trust: Both leaders advised starting with core tasks like bookkeeping and AP to build confidence before expanding to more complex areas like technical accounting and FP&A.

Unlock unexpected value: For Adapture Renewables, the partnership drove an unintended, highly positive consequence: it forced early adoption of cloud-based tech (like Zoom and Asana), making them fully resilient when the pandemic hit.

Designing Your "Dream Team"

Once the foundation is set, how do you scale leadership? The panels on fractional executive performance provided a clear blueprint.

Chris Cook of FLG Partners framed the value proposition perfectly: “One of the biggest misconceptions about fractional work is that it’s primarily a cost-saving move… The real value is strategic leverage.” Companies get access to a “full stack” of expertise: payroll, compliance, inventory, on a part-time basis, precisely when they hit key “inflection points,” as Nicole Tall of Tall Tax noted.

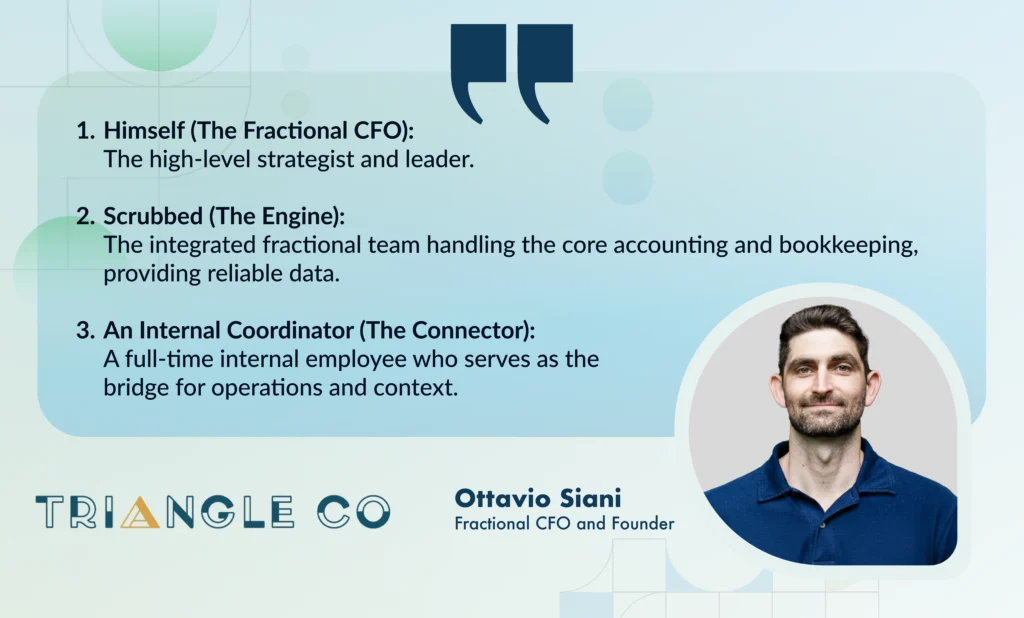

But how do you structure this? Ottavio Siani, fractional CFO and owner of Triangle Coffee, offered his “Dream Team” model:

This “Dream Team” model has a clear endgame: building a self-sustaining system. Ottavio’s goal is to create durable processes and train the internal team, ensuring the company “owns” the finance function long after his day-to-day involvement ends.

This approach is designed to deliver what Nicole called the ultimate metric for fractional leadership. It moves beyond just a clean audit to build lasting “founder confidence”, giving leaders the trust and visibility they need to make better, faster decisions.

The Future-Ready Edge: Your AI Roadmap

The final and most forward-looking session tackled the biggest topic in business today: Artificial Intelligence. Led by Scrubbed CTO Vince De Leon, the panel featuring experts from SADA, Marketri, and Altiora Advisory laid out a simple “Start, Build, Scale” framework.

Brady Lewis of Marketri advised against tackling core accounting immediately. Instead, start with high-visibility, low-risk, “annoying” tasks.

START: Start Where It Won't Hurt

Quick Wins: Use AI for meeting intelligence (using tools like Fathom or Otter), proposal generation, and drafting internal documentation.

The 80/20 Rule: Follow a simple “80/20” model: Use AI for the drafts; use your human experts for the decisions, the polish, and the strategy.

Measure Success: Forget complex ROI. Track “time saved” and team “adoption rate.”

BUILD: Customize and Integrate

Then, Michael Williams of SADA explained that the next step is moving beyond off-the-shelf tools when those once-annoying tasks become genuine blockers to growth.

Build vs. Buy: “Building” doesn’t mean creating your own LLM. It means customizing and integrating a powerful, secure AI model with your company’s proprietary data.

Grounded AI: The key trend is “grounded AI,” which cites its sources. This allows the AI to move from guessing to knowing, confidently telling you it found a specific number “on page 5 of the Q3 board deck.”

Agentic AI: The next wave is AI that completes a task, not just answers a question, like receiving a vendor invoice, performing a three-way match against the PO, and drafting an email to flag a discrepancy for human approval.

SCALE: Embrace Change or Become Irrelevant

Finally, Felix Dela Rea, formerly of Meta and Google, provided a powerful lesson on scaling AI and culture, centered on the idea that “if you want to go far, build together.” At Meta, this meant creating a “Finance Academy” to upskill everyone and celebrate small wins to get company-wide buy-in.

He closed with the powerful story of Meta’s headquarters, which famously features the old, rusting sign of the building’s previous tenant, Sun Microsystems, on its back. It serves as a constant, powerful reminder of what happens to industry giants who fail to embrace change. The lesson for every finance leader is clear: embrace technology and new models of working, or risk becoming a relic.

Don't Miss Out: Watch the Full Conference On-Demand

If these insights resonate with you, the full experience is now available. Get access to all five session recordings to hear the detailed strategies and advice directly from the speakers.