Recent decades have brought about a significant shift in the global economy. We’ve moved away from the factories and smokestacks of the past and towards an economy fueled by ideas. Where physical resources and manufacturing prowess were once the primary drivers of economic growth, today, knowledge, creativity, and innovation reign supreme.

Innovation has emerged as the cornerstone of economic competitiveness, driving advancements in technology, science, and business practices. At the heart of this transformation is the recognition that intellectual capital, rather than physical assets, holds the key to sustainable growth and prosperity in the modern world.

The modern economy revolves around two key concepts: innovation and intellectual property (“IP”). Innovation fuels progress by continually introducing new products, services, and technologies that respond to consumers’ dynamic needs. Intellectual property provides the essential legal framework to safeguard and incentivize this innovation. Innovation and IP form the bedrock of today’s thriving and dynamic economy.

What’s shaping today’s intellectual property landscape?

The emergence of a knowledge-based economy has reshaped how companies approach IP. With the rise of innovative technologies and the growing emphasis on automation and digitalization, businesses increasingly invest in developing valuable IP assets in-house. This encompasses creating proprietary software solutions tailored to automate processes, catering to the evolving needs of consumers and businesses.

These in-house innovations represent a significant departure from traditional IP acquisition models. The shift poses unique challenges in accounting, particularly in reconciling differences between accounting for acquired IP and internally generated IP.

Intellectual property in the accounting domain

The significant distinction between the accounting treatments for acquired and internally generated intellectual property (IP) lies in their initial recognition and measurement. While acquired IP is generally recognized at cost, internally generated IP is typically expensed unless specific criteria are met. However, once recognized, the subsequent accounting implications for both types of IP are generally similar, including amortization, impairment testing, and disclosure requirements.

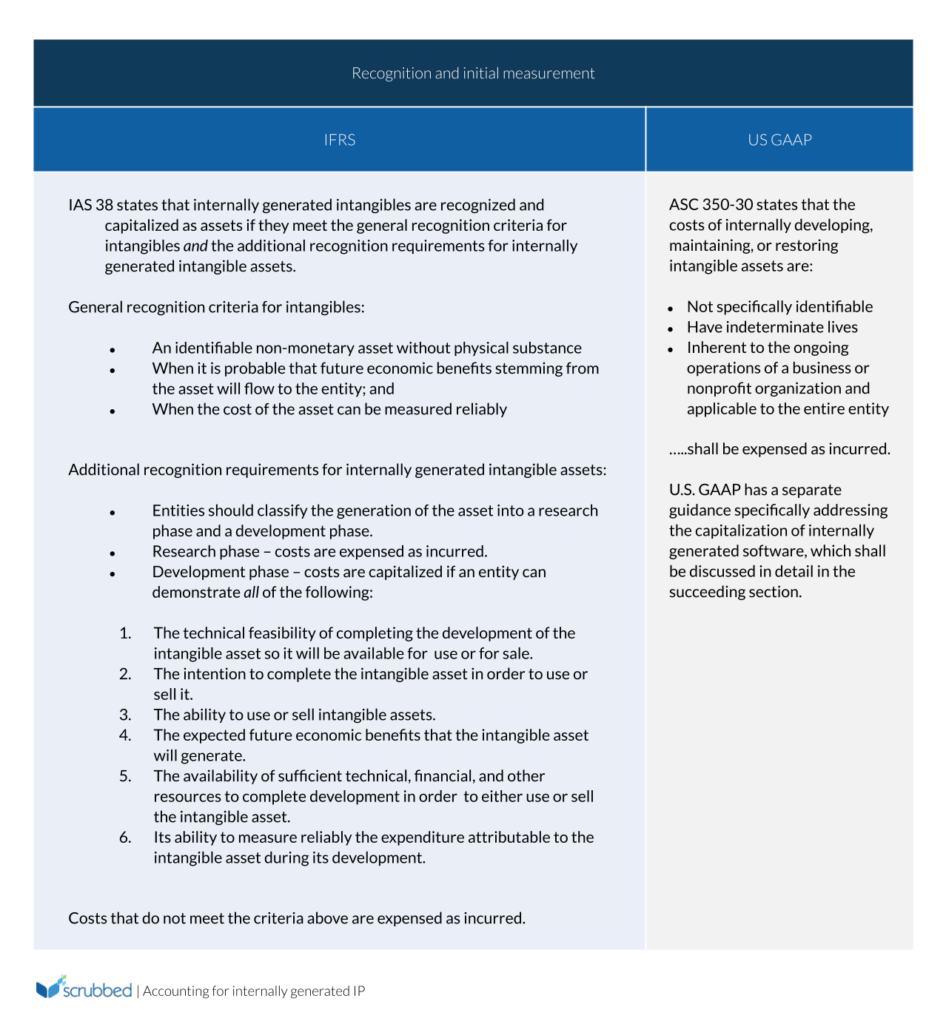

Adherence to accounting standards like IAS 38 under the International Financial Reporting Standards (“IFRS”) and ASC 350 under U.S. Generally Accepted Accounting Principles (“US GAAP”) necessitates a thorough understanding of these nuances. While these standards often apply to for-profit entities, nonprofit financial reporting also demands clarity when recognizing and measuring internally generated intellectual property (IP), especially in research-driven organizations. This article aims to provide guidance on the proper recognition and initial measurement of internally generated IP, offering insights to appropriately account for their intellectual property assets in today’s era of innovation and knowledge-based economy.

The next section outlines the recognition criteria for internally generated intangibles under IFRS and U.S. GAAP.

Accounting for internally generated IP

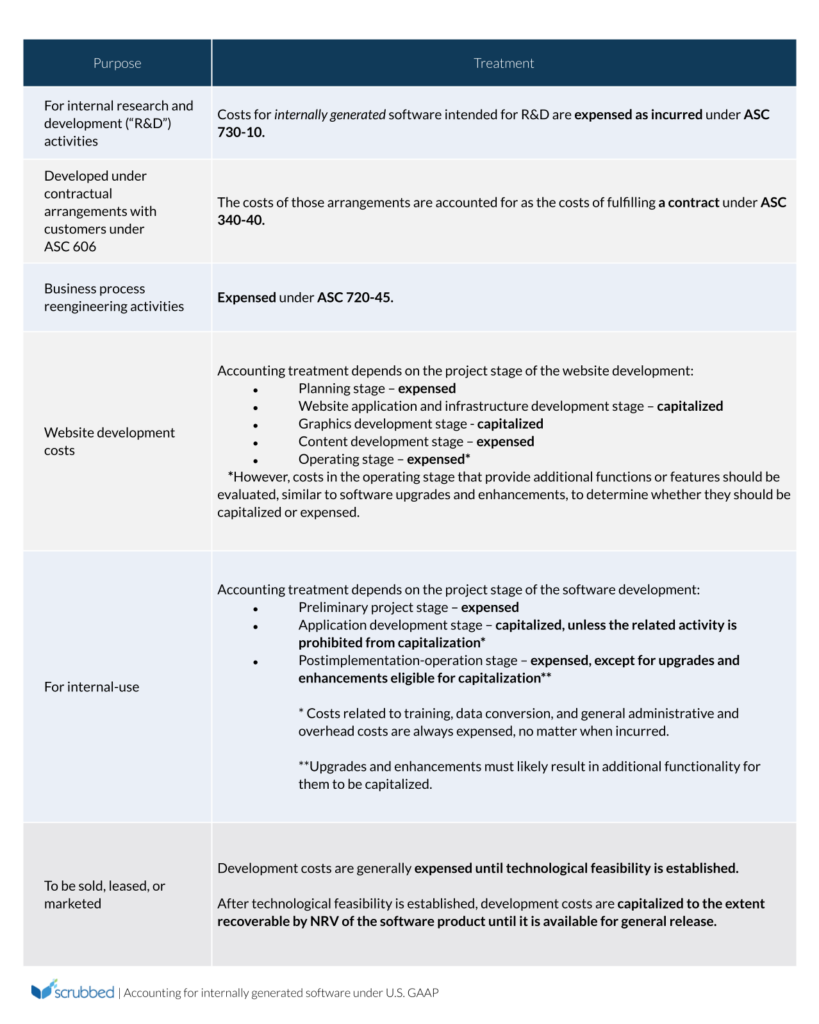

Accounting for internally generated software under U.S. GAAP

The accounting treatment for software development costs can differ depending on the software’s intended purpose. This section specifically applies only to US GAAP.

New tax treatment of R&D expenses under the Tax Cuts and Jobs Act

The Tax Cuts and Jobs Act (TCJA) has significantly changed the tax treatment of research and development (R&D) expenses. Prior to the TCJA, businesses could generally deduct these expenses in the year they were incurred. However, for tax years beginning on or after January 1, 2022, the TCJA mandates that these costs, for tax purposes, be capitalized and amortized—spread out over five (5) years for domestic research or fifteen (15) years for international research. This guidance can be found under Section 174 of the Internal Revenue Code.

Another notable change under the TCJA is including software development costs within the definition of R&D expenses. This means software development costs are subject to the same capitalization and amortization requirements. It’s essential to note that this change impacts tax reporting only. The financial statement treatment of R&D expenses remains governed by accounting standards like Generally Accepted Accounting Principles (GAAP). While the tax rules have changed, companies must continue to follow their standard accounting practices for financial reporting purposes.

These changes can significantly impact companies with substantial R&D expenses. Even if a company reports a financial loss on its books, the new rules could still lead to taxable income due to the capitalization of R&D costs, potentially increasing the company’s tax burden.

How Scrubbed can help

The diverse nature of intellectual property today can pose challenges in pinpointing the necessary and appropriate accounting guidance to apply, a task that is both crucial and complex. The Scrubbed Technical Accounting Group can assist you in evaluating specific scenarios related to intellectual property and intangibles (IAS 38 and ASC 350). Whether it’s analyzing complex accounting transactions, crafting comprehensive memos, and ensuring adherence to presentation and disclosure requirements under specific guidance, risk and SOX compliance, and regulatory mandates, our team is equipped to guide you.

Get in touch with Scrubbed to discover how our Technical Accounting Group can assist your business in navigating accounting complexities associated with intellectual property.

Disclaimer

The information provided here is general and not intended to cater to the circumstances of any specific individual or entity. It should not be relied upon as accounting, tax, or other professional services. For precise advice, please consult with your advisors. While we strive to offer accurate and timely information, there is no assurance of its accuracy at the time of receipt or its continuous accuracy in the future. No one should make decisions based on this information without seeking appropriate professional advice and thoroughly examining the specific situation.

*Disclaimer: Services offered do not necessitate a state license.

References:

https://www.accountingresearchmanager.com/#/index/view/csh-da-filter!WKUS-TAL-DOCS-PHC-%7B6bd64f21-b74d-46e7-8a46-91852de44c4d%7D–WKUS_TAL_10949%23combined_BA10F573AAF3B1438625756D0062AB48TOC_bdfd99b13f603785821163e96daf0382!BA10F573AAF3B1438625756D0062AB48!Doc

https://www.sec.gov/spotlight/globalaccountingstandards/ifrs-work-plan-paper-111611-gaap.pdf

https://dart.deloitte.com/USDART/home/codification/broad-transactions/asc805-10/roadmap-business-combinations/chapter-4-recognizing-measuring-identifiable-assets/4-10-intangible-assets

https://www.grantthornton.com/content/dam/grantthornton/website/assets/content-page-files/audit/pdfs/2020/accounting-software-costs/accounting-software-costs.pdf

https://rsmus.com/insights/services/business-tax/faq-capitalization-and-amortization-of-r-d-costs-under-new-section-174-rules.html#legislative

https://www.grantthornton.com/insights/alerts/tax/2023/flash/irs-guidance-clarifies-amortization-under-section#:~:text=The%20TCJA%20amended%20Section%20174,amortize%20SRE%20expenditures%20over%20a