Maximizing Impact, Minimizing Costs: A Guide to Fractional Finance for Nonprofits

Introduction: Is Your Nonprofit Struggling to Balance Financial Management with Your Mission?

Nonprofits face unique financial challenges—tight budgets, complex compliance requirements, and the constant need to balance mission-driven work with sound financial management. Hiring a full-time CFO or in-house finance team can be costly and, for many organizations, an inefficient use of resources.

The fractional accounting model offers a compelling alternative, providing nonprofits with expert financial leadership at a fraction of the cost of a full-time hire. But how does it work in practice?

In a recent Nonprofit Quarterly (NPQ) webinar, financial experts Laurence Ruelo, Director of Finance Professional Business Services and Nonprofit at Scrubbed, Amy Omand, Founder of 7 Seat Consulting, and Tom Low, the owner of Pivot Consulting, shared valuable insights on how fractional finance models can transform nonprofit financial management. Drawing from real-world experience, they discussed:

- The hidden costs of understaffed finance teams including compliance risks, financial mismanagement, and lost funding opportunities.

- Why traditional CFO models often fall short for nonprofits, particularly when it comes to cost and scalability.

- How fractional CFOs provide specialized expertise, strategic guidance, and cost-effective solutions tailored to nonprofit needs.

- Common concerns around outsourcing financial management and how to address them.

For many nonprofits, staying on top of financial operations can consume valuable time and energy that could be better spent furthering their mission. Outsourcing accounting services can help streamline financial processes, ensure compliance, and strengthen donor confidence, all while freeing up staff to focus on what matters most—making a difference.

In this guide, we’ll highlight the key takeaways from the NPQ webinar and explore how a fractional finance model could work for your nonprofit.

In This Guide...

Introduction

Section I:

How the Traditional Approach is Failing Nonprofits

Nonprofit organizations are often managed by lean teams, with people wearing different hats to deliver on the mission. From over-reliance on a single staff member to missed opportunities for cash flow optimization, nonprofits face numerous risks when their finance teams are stretched too thin or don’t have the right expertise.

Some of the most common financial pitfalls nonprofits face include single points of failure, inefficient cash management, outdated financial reporting, and technology challenges. In this section, we’ll examine these issues and why the traditional CFO model often fails to address them, leaving organizations struggling to balance financial management with mission-driven work.

The Hidden Costs of Understaffed Finance Teams

“Nonprofits often underestimate the impact of weak financial leadership, which can result in costly mistakes and missed opportunities. From inaccurate financial reporting to delayed decision-making. These challenges can hinder organizational growth and sustainability.” – Laurence Ruelo, Director of Finance Professional Business Services and Nonprofit, Scrubbed

Single Points of Failure:

Fraud Risks:

Inefficient Cash Management

Organizations often miss out on opportunities to maximize cash flow and generate additional income when they don’t have expert support in place. Amy recalls a client who didn’t understand how to maximize cash flow and held their organization’s money in a checking account. When Amy helped them create a sweep fund into an interest-bearing account, “they were thrilled every month when we closed the book because, wow, I have an additional $10,000 a month that’s unrestricted, and I can spend anywhere.”

On a similar note, Tom recounts the story of two clients who were unaware of the employee retention tax credit. When he helped them to claim the credit, the organizations received several hundred thousand dollars in unrestricted funds.The lack of knowledge that held both organizations back reflects how time for training and education is often another consequence of having an understaffed financial team.

Technology and Integration Challenges:

“Integration plays a crucial role in making sure you have reliable data,” says Laurence. “It ensures fewer hands on your input data, and therefore fewer errors.”However, nonprofits often lack people with the necessary technical skills to implement and optimize financial software, leading to inefficiencies and compliance issues. Laurence highlighted one client story where the firm was on its second attempt to implement a new ERP system. “When you’re implementing an ERP, you’re hiring consultants, you’re paying for the subscription,” he says. “And you can imagine the toll that takes on your internal resources, where they’re trying to manage the migration of the data, trying to configure the system, and at the same time still dealing with their day-to-day responsibilities.”

Delayed or Inaccurate Reporting:

Incomplete or outdated financial reports make it difficult for leadership to make informed decisions and attract donors. If your nonprofit can’t create accurate financial reports, especially once you hit reporting or compliance requirements, it can also lead to audit problems. In some cases, that can even mean paying the auditors to put together the necessary financial reports, which can be extremely expensive.

Why Traditional Models Fall Short

Budget Constraints

Limited Career Growth

Specialized Knowledge Gaps

Section II:

How Outsourcing Provides Better Options for Nonprofits

Given the challenges of understaffed financial teams, lack of expert leadership, and the budget constraints that make hiring a full-time CFO unrealistic, it’s no surprise that many nonprofits are looking around for alternatives. In the webinar, our expert panel presented several compelling reasons for nonprofits to consider outsourcing some or all of their financial and accounting requirements.

The Power of a Fractional CFO

A fractional CFO is an experienced financial executive who works on a part-time, retainer, or contractual basis, scaling their services in response to the organization’s needs. Typically, a fractional CFO will be working with more than one organization at a time. This model allows companies to access the benefits of having an experienced CFO-level resource, such as financial planning and analysis, risk management, and cash flow forecasting, at a fraction of the cost of a full-time CFO.

Cost-Effective Expertise:

Transactional Level Support

Flexibility

Fractional CFOs can work on specific short-term projects, provide ongoing direction and oversight to an in-house team, or overhaul the entire financial strategy at your nonprofit. Since they usually have a network of fractional or outsourced accounting professionals, they can call on additional expertise as needed and offer flexible engagement models, allowing nonprofits to scale services up or down as needed.

For instance, one of Tom’s clients was audited by the IRS. “We were a very small team, and we needed to expand greatly and be flexible and timely. We called on an outsourced firm, and they were able to handle that for us.”

Amy has had similar experiences: “As an in-house CFO, we had a special project that we outsourced. It wasn’t an ongoing need, but we were able to take that chunk of work and outsource it rather than staffing up with FTEs.”

Scrubbed client Common Sense Growth saw first-hand how flexibility and scalability can work for nonprofits. The organization was juggling multiple financial needs. They needed to generate accurate and timely investor reports to maintain trust and attract new investments.

Additionally, the board required clear financial insights to make informed strategic decisions.

Anticipating significant funding increases, Common Sense Growth knew their current system wouldn’t be able to handle the additional financial complexity. Building a dedicated accounting team wasn’t an option due to cost constraints, so they reached out to Scrubbed. “I have my go-to point of contact, and that’s for all the basic needs like expenses and reporting,” says Ben Kornell, managing partner of Common Sense Growth. “And then we also have a leadership contact who’s really thinking about everything across our financial portfolio.”

Managing Turnover

Turnover can be disruptive, especially in a small team. Working with a fractional CFO and an outsourced team means your organization has access to a deeper bench of people who can step in. It avoids the single point of failure issue and often leads to better documentation of processes. “At Scrubbed, that is one of our value propositions,” says Laurence. “Our clients don’t have to think about staff turnover because we have all the backups in place, and the first thing we do when we onboard clients is document all of their processes so that there is always a good record, and your processes don’t change with the people.”

Fresh Perspectives and Better Training

Because they often work with various clients across different sectors, fractional CFOs can offer fresh perspectives and innovative solutions. A fractional CFO can also provide training for a company’s finance team by sharing their expertise and experience, providing hands-on training, improving processes, adopting new technologies, mentoring, and fostering team collaboration.

Focus on Your Mission

Many day-to-day accounting tasks can be time-consuming and take the staff and leadership away from core activities like fundraising, program development, and community impact. Bringing in a fractional CFO frees leaders and executives to focus more on their core competencies and the nonprofit’s mission.

For Common Sense Growth that was one of the key benefits of working with outsourced accounting talent. “At the end of the day, I would say the team that we have in-house is far more focused on the things that really move the needle for our business because we have the leverage of the Scrubbed team on the financial reporting,” says Ben. “So, while it might seem like an investment in finance, it’s actually an investment in your team and helping them focus on what’s most important for your organization.”

Enhanced Donor Confidence

Why Traditional Models Fall Short

Budget Constraints

Limited Career Growth

Specialized Knowledge Gaps

Section III:

Busting the Myths About Outsourcing

Given all the advantages of a fractional model for nonprofit accounting that we’ve laid out above, some leaders still hesitate to move away from the traditional model. During the webinar, our panel discussed some common concerns they hear and how fractional accounting firms address those challenges.

Cost Considerations

Fractional CFOs offer cost savings compared to a full-time salary and benefits package. However, the initial investment might seem daunting for smaller nonprofits.

Tom recommends considering the whole lifecycle and relationship and the added value that a fractional CFO or team brings to the nonprofit in terms of additional expertise and the strengthening of donor confidence and reputation.

Control and Confidentiality Concerns

Some businesses are hesitant to share sensitive financial data with an external party, feeling that having an in-house CFO is safer.

For Tom, this is an issue of trust. “As professionals, it’s something we have to address, and it’s part of our professional standards,” he explains. “It’s about trusting your partner and understanding where they’re coming from, what their parameters are. You can use legal documents to secure the systems, and so on, but it comes down to trust and knowing who you’re working with.”

Perceived Lack of Expertise or Experience

Some nonprofit leaders worry that fractional CFOs lack the depth of experience or industry knowledge compared to a full-time CFO. For the panel, the truth is that while they may not have in-depth knowledge of your organization yet, a fractional CFO will have a breadth of experience that your nonprofit can use. “When you hire folks like Scrubbed or Amy or myself, you’re bringing in a depth of experience that you may not have from others,” says Tom. “Both Amy and I, for example, have multi-industry experience in different venues for profit, nonprofit, and across different industries. We have a breadth of knowledge and expertise that we can use to the organization’s benefit.”

Communication and Integration Concerns

Concerns about integrating a fractional CFO into the existing team or communicating with a team in a different country or time zone are common.

“Again, this comes back to the team dynamics and trusting your partners,” says Tom. “In today’s virtual office world, it’s harder to establish those professional and personal relationships, but we endeavor to get to know people whether they’re here or offshore.”

For example, despite the physical distance between Common Sense Growth in San Francisco, CA, and Scrubbed’s team in the Philippines, clear communication was never a hurdle. “I actually find that the time difference works in our favor a lot of the time,” says Ben.” I will submit a question or request in the day, and I wake up the next morning and it’s been totally completed. It’s been really, really successful.”

Temporary solution, not a long-term strategy

The perception that fractional CFOs are just for short-term projects and not for ongoing financial guidance is often raised, but Tom and Amy agree that a fractional CFO engagement can work in either situation. “You may have an urgent need to handle something, and I’ve been brought into a number of crisis situations,” says Tom. “I’ve also sat in the chair for a couple of years or even longer as a fractional or interim CFO.”

Amy is often engaged by clients who are smaller today but on a strong growth trajectory. “It’s going to be a happy news story when they grow out of me,” she says. “I might recommend to them that they’re ready for a full-time CFO now because they’ve been successful in their fundraising, or they’re replicating across cities, which means there’s a lot more complexity that needs to be handled.”

How each firm structures its engagements can vary across the industry and also with time. For instance, what started with a short-term project for Scrubbed’s client Playworks to address their Accounts Receivable and collection issues blossomed into a long-term partnership that revolutionized Playworks’ financial management. Playworks CFO Satoshi Steinmetz recognized during that initial engagement that his Scrubbed partners had “outstanding” expertise in the nonprofit sector and were comfortable with challenging issues such as when to recognize revenue from a fundraising campaign, how to manage restricted grants, and how to develop the various types of financial statements that are unique to nonprofits. “In fact, I think I learned more from them than they learned from me!” he says.

Real-World Success: Common Sense Growth's Story

Accurate and timely financial reporting for investors and board members.

Stronger compliance and audit readiness with clear financial trails.

Seamless integration with external partners and systems.

Cost savings compared to hiring an in-house team.

“Scrubbed’s flexibility and agility have been mind-blowing. Our fund grew from $5 million to $40 million, and our fractional finance team scaled with us—at a fraction of the cost of running it ourselves.”

– Ben Kornell, Managing Partner, Common Sense Growth

Case Study: Greater visibility and improved financial processes at Playworks

Playwork’s most pressing challenge was effectively managing their Accounts Receivable collections. CFO Satoshi Steinmetz stated, “We had no visibility into our cash flow, our collection efforts were inadequate, and we were constantly having to write off invoices.”

Acknowledging the situation’s urgency, Steinmetz explained, “Our organization was in desperate need of reliable accounting services at an affordable cost.” After working with Scrubbed, Playworks is seeing:

Significant improvement in collections

Greater visibility into expenditures and receipts

A rolling weekly forecast that is used to inform the board

More time for the in-house CFO to focus on strategic matters

– Satoshi Steinmetz, CFO Playworks

Section IV:

How to move forward

Bringing in a fractional CFO or outsourced accounting team can feel daunting. Our panel outlined some questions that can help nonprofits understand what kind of partnership they’re looking for and how to assess different potential providers.

1. Define Your Needs

- Start by assessing your current situation. Who do you have on staff? Are you trying to solve a specific problem or looking to evolve your services in the light of anticipated growth or a new grant?

What specific tasks do you want to outsource? Are you looking for someone to help with bookkeeping and transactional tasks, or do you need a more executive, forward-looking skillset to help develop strategy?

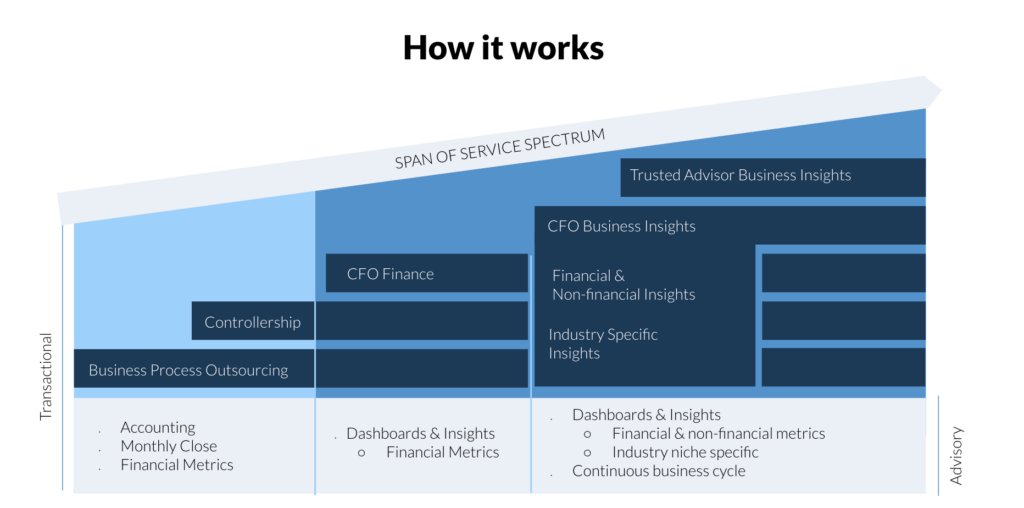

Amy recommends considering the services you need on a sliding scale, as shown in the graphic below. It’s a spectrum that starts with transactional services like bookkeeping, accounts payable, and reconciliation. It moves through more forward-looking, strategic CFO work of translating information into business insights or building financial models for different scenarios.

- What level of experience and expertise do you need? Is familiarity with your industry or knowledge of a specific software vital to your organization?

2. Evaluate the Service Provider

Amy recommends approaching different providers as you would the hiring of an FTE- ” You want to go into it asking for references of past and current clients, really get a sense of their communication style, and how the service provider will meet your needs.”

Experience with nonprofits:

Look for a partner with a proven track record in nonprofit accounting and a deep understanding of the regulatory requirements. They should be able to clearly explain how their approach to financial strategies aligns with your broader goals.

Services Offered

Beyond strategic CFO guidance, fractional accounting services can include:

- Bookkeeping: Accurate record-keeping and reconciliations.

- Grant Management: Tracking grant usage and ensuring compliance with donor restrictions.

- Budgeting and Forecasting: Helping nonprofits allocate resources efficiently for maximum impact.

- Audit Preparation: Supporting smooth, stress-free audits with organized documentation.

- Form 990 Filing: Managing tax-exempt compliance and ensuring timely filings.

Scalability

If you’re expecting a new grant or to expand your services, will the provider be able to grow with your business? How easy is it to downscale for less busy times of the year when you may need less support?

Technology

Advanced accounting tools can improve efficiency, accuracy, and transparency, but they may be unaffordable for smaller organizations. Choose a partner who can bring modern accounting software to your organization or help you integrate existing software to streamline processes like bookkeeping, financial reporting, and compliance tracking.

Communication and Reporting

Your outsourced accounting partner should be proactive, easily accessible, and capable of explaining complex financial concepts in an understandable way for your team.

Security and Compliance

References and Reviews

- Ask the service provider for references from previous clients.

- Check online reviews and testimonials to see what other businesses have experienced.

Cost and Pricing Structure

- Get quotes from several different service providers.

- Understand the pricing structure (hourly rate, monthly retainer, etc.).

- Be sure to ask about any hidden fees or additional costs.

Conclusion

Fractional accounting provides a practical and effective solution for nonprofits looking to strengthen their financial management while keeping costs in check. By leveraging expert financial support on a flexible basis, nonprofits can ensure financial stability, improve efficiency, and focus on what matters most—their mission.