Before the year ends, take note of key regulatory updates in the US that may affect your business, particularly those effective January 1, 2024.

California’s Climate Accountability Package

In October 2023, the State of California enacted a landmark climate disclosure accountability package — the California Corporate Data Accountability Act (Senate Bill No. 253 or SB 253), Climate-Related Financial Risk Act (Senate Bill No. 261 or SB 261) and Voluntary Carbon Market Disclosures (Assembly Bill No. 1305 or AB 1305).

California Corporate Data Accountability Act and Climate-Related Financial Risk Act

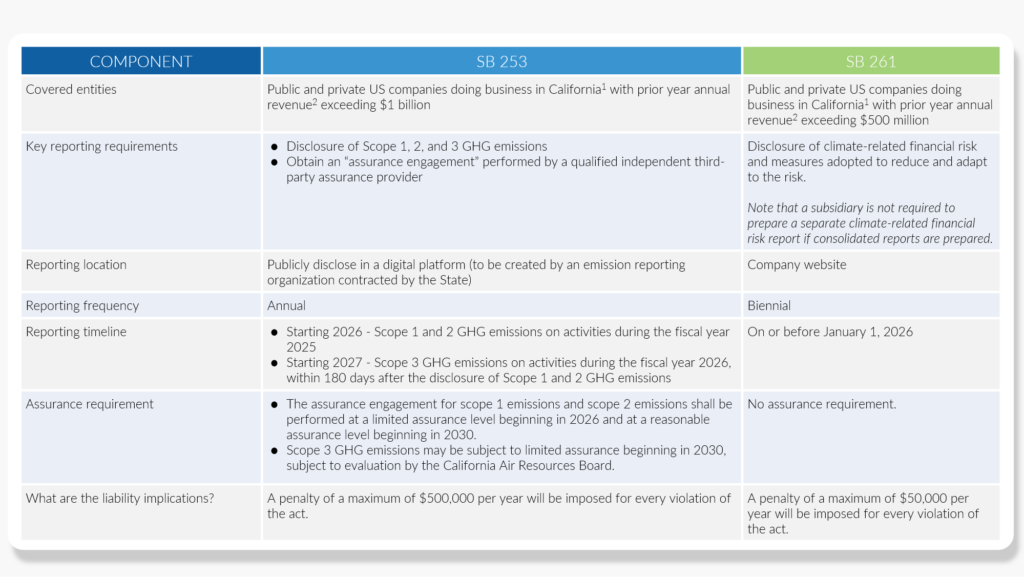

SB 253 and SB 261 are the first general US regulations that mandate the corporate reporting of GHG emissions and climate risks in the United States.

Below is an overview of the two Senate bills:

¹The term “doing business in California” is not clearly defined in either bill. Further clarification regarding the definition of the term is expected in the future. However, it is defined by the State here.

²Revenues are not required to be earned exclusively in California.

Take note of the revenue threshold required by the two laws. Some companies are not required to disclose GHG emissions under SB 253 but must report climate-related financial risks under SB 261.

Voluntary Carbon Market Disclosures

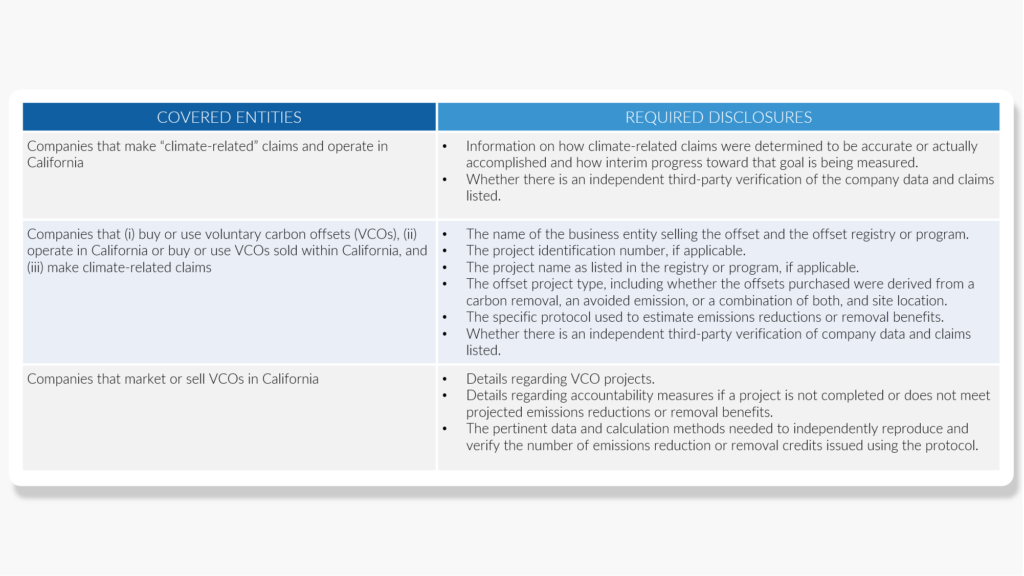

For businesses operating in California, it’s important to highlight the commencement of the Voluntary Carbon Market Disclosures mandated by Assembly Bill No. 1305. AB 1305 is intended to combat the greenwashing of climate-related emission claims.

Certain disclosures on information covering the fiscal year starting January 1, 2024 are mandatory. This information should be reflected on the company’s website on or before January 1, 2025 and must be refreshed on an annual basis.

Mr. Jesse Gabriel, the author of AB 1305 sent a letter to the Chief Clerk of the Assembly to clarify his intent related to the timing of the disclosures required under AB-1305. The letter stated that “While the bill does not specify the date on which the first set of disclosures must be posted to a company’s Internet website, it was my intent that the first annual disclosure be posted by January 1, 2025.

A summary of AB 1305 is as follows:

Unlike SB 253 and SB 261, which have revenue thresholds, AB 1305 is applicable to all private and public entities regardless of revenue.

Penalties

A company that violates AB1305 is subject to a civil penalty of $2,500 for each day that information is not available or is inaccurate on the person’s website, but the total penalty is not to exceed $500,000.

Corporate Transparency Act of 2021

The Corporate Transparency Act (CTA), which will be effective January 1, 2024, will require smaller and otherwise unregulated companies to file a report containing the company’s Beneficial Ownership Information (BOI) to the Financial Crimes Enforcement Network (FinCEN).

The CTA aims to enhance corporate transparency and combat illicit activities such as money laundering and tax evasion, such that one of Congress’s primary goals in enacting the CTA is to discourage the use of shell corporations as a tool to disguise and move illicit funds. While the primary focus of the CTA is unearthing those involved in illegal activities, most businesses fall under the broad reach of the new legislation.

Who must comply with the Corporate Transparency Act?

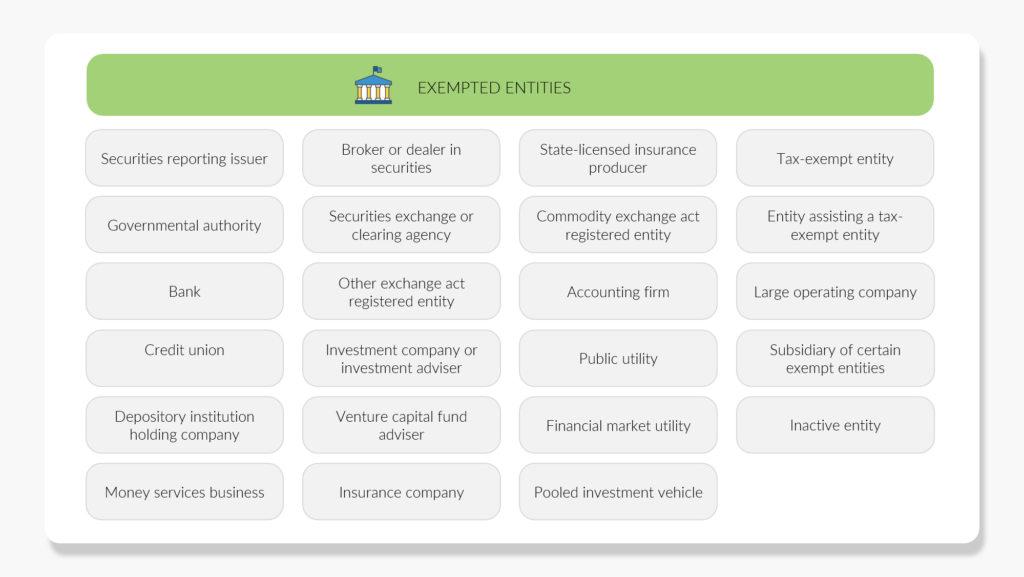

The CTA applies only to domestic companies and foreign entities registered to do business in the U.S., with 23 types of entities subject to exemption.

The term “reporting company” is defined as a corporation, limited liability company, or other similar entity that is the following:

i.) created by the filing of a document with a secretary of state or similar office under the law of a U.S. state or Indian Tribe, or

ii.) formed under the law of a foreign country and registered to do business in the U.S. by the filing of a document with a secretary of state or a similar office under the laws of a U.S. state or Indian Tribe.

The CTA requires each reporting company to submit to FinCEN a report containing specific information about its beneficial ownership.

The CTA and FinCEN provide exemptions to the definition of a reporting company. The list of exempted entities is as follows:

The CTA defines a “beneficial owner” as an individual who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise:

i.) exercises substantial control over the entity, or

ii.) owns or controls not less than 25 percent of the entity’s ownership interests.

FinCEN’s regulations set forth a range of activities that constitute “substantial control” of a company, including the following:

- Serving as a senior officer of the reporting company;

- Having authority over the appointment or removal of any senior officer or a majority of the board of directors (or similar body); directing, determining, or having substantial influence over important decisions made by the reporting company.

Substantial control individuals required to be reported under the rules explicitly include: (1) senior officers (for example, “president, chief financial officer, general counsel, chief executive officer, chief operating officer, or any other officer, regardless of official title, who performs a similar function”) and (2) anyone else who “directs, determines, or has substantial influence over important decisions made by the reporting company” or has “any other form of substantial control over the reporting company”

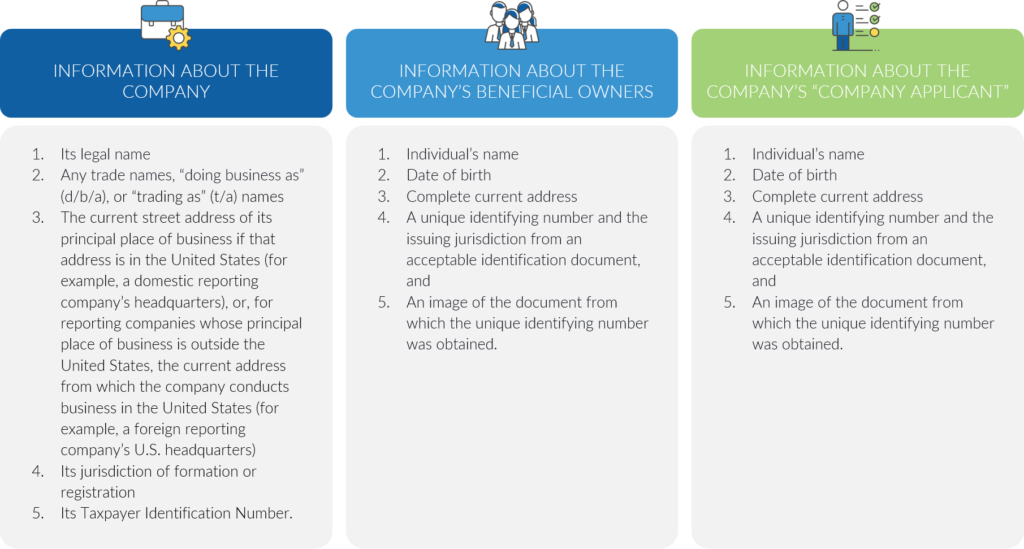

What Beneficial Ownership Information Will Reporting Companies Have to Provide?

The following table summarizes the information required for each reporting company:

Details of the information needed are as follows:

If an individual has obtained a FinCEN identifier and provided that FinCEN identifier to a reporting company, the reporting company may include the FinCEN identifier in its report in lieu of the information required for that individual.

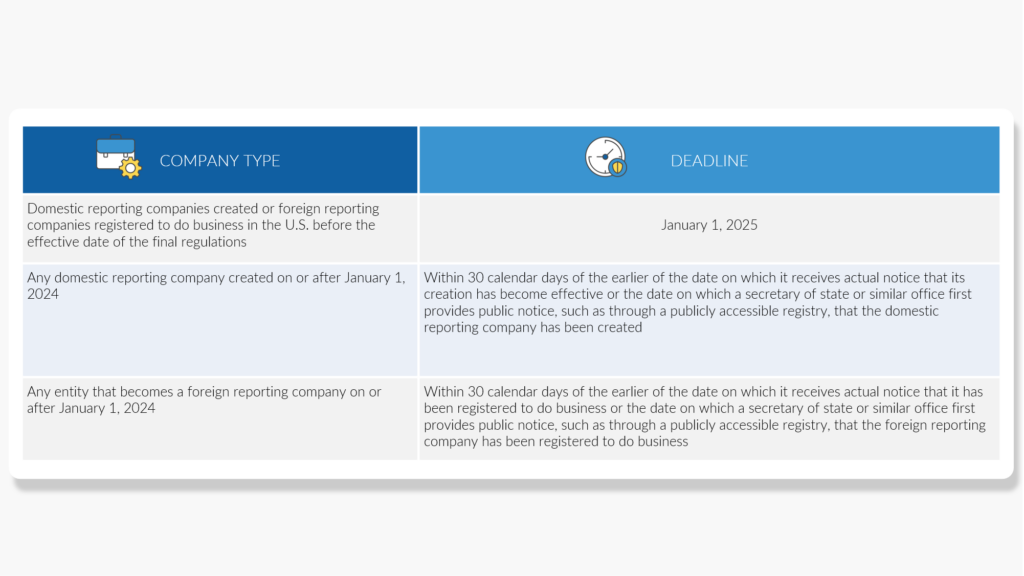

When Must Reporting Companies Start Complying with the CTA?

The CTA’s requirements will take effect on the effective date of FinCEN’s regulations, January 1, 2024. The exact deadlines for filing initial reports will depend on when a reporting company was created or registered, and there are also deadlines for submitting updated reports with new information or reports correcting erroneous information.

Penalties for Non-Compliance

The CTA provides multiple penalties for non-compliance, providing for both criminal and civil penalties. Any person who provides false information or fails to report complete or updated information is subject to a civil penalty of not more than $500 for each day that the violation continues and may face fines of not more than $10,000, imprisonment for not more than two years, or both.

Also, take note of the following:

- There will be no fee for submitting the beneficial ownership information report to FinCEN.

- The reports are to be filed electronically through a secure filing system available via FinCEN’s website.

For more details related to the CTA, you can check on the articles by clicking on the links below:

- Corporate Transparency Act: FinCEN Issues Final Rule for Beneficial Ownership Reporting

- The US Corporate Transparency Act: who is affected and how to prepare

- The New Corporate Transparency Act – What Are the Reporting and Filing Requirements for Your Business?

- Beneficial Ownership Information Reporting

To learn more about the various ESG reporting frameworks and standards, you can check some of the suggested readings by accessing the following links:

Next Steps!

Consider the following actions in order to adhere to the requirements of the aforementioned key US Regulatory Updates.

California’s Climate Accountability Package

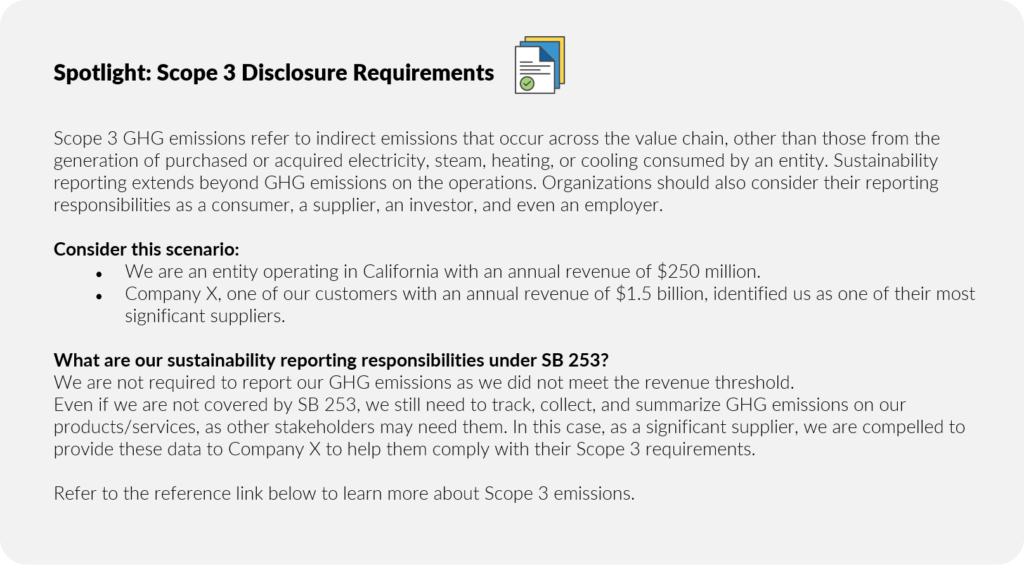

• Familiarize yourself with SB 253, SB 261, and AB 1305, check if you exceed the revenue thresholds, and start preparing for the relevant reporting requirements.

• If you meet the revenue threshold under SB 253, start defining and understanding your value chain by utilizing the existing guidelines provided by the GHG Protocol Corporate Accounting and Reporting Standard.

• Whether you have already met the revenue thresholds or not, inventory your GHG emissions and be prepared to furnish this information to regulators and key stakeholders across the value chain, especially suppliers and customers, as a consideration for Scope 3 reporting.

• Start working with your top suppliers and customers to assess and manage Scope 3 emissions, considering the Company’s entire value chain. We can assist them in defining specific metrics for accurate emission measurement.

• If subject to the requirements of SB 261, start to build an understanding of the TCFD framework as early as now.

Corporate Transparency Act

• Gain a comprehensive understanding of CTA’s implications for your organization, particularly in relation to reporting beneficial ownership.

• Identify beneficial owners, both in terms of direct control and substantive control.

• Gather the required information for each beneficial owner.

• Provide training to relevant employees, particularly to those who will be involved in record keeping and compliance.

• Consult and work with your legal counsel to ensure adherence to CTA.

If you have questions or concerns, contact Scrubbed at [email protected] or connect with your trusted Scrubbed contacts.