What you need to know:

- London Interbank Offered Rate (LIBOR) ends on December 31, 2021.

- ASU 2020-04 – Reference Rate Reform (Topic 848) provides temporary optional expedients and exceptions to the US GAAP guidance on contract modifications and hedge accounting. The ASU is effective immediately and all entities would be able to apply it until December 31, 2022.

- Cessation of LIBOR would expose businesses to various risks such as liquidity risk, technology risk, operational risk, and financial reporting and compliance risk.

- The U.S. Treasury Department and Internal Revenue Service (IRS) released the Proposed Interbank Offered Rate (IBOR) Regulations in October 2019 to address the tax treatment of alterations made to instruments to replace an IBOR-based rate with an alternative rate.

LIBOR is currently produced in 7 tenors (overnight/spot next, one week, one month, two months, three months, six months, and 12 months) across 5 currencies. In the US and global markets, LIBOR is widely used as a reference interest rate in commercial agreements and a broad range of financial instruments. However, in 2017, the U.K. Financial Conduct Authority announced that all currency and term variants of LIBOR (IBORs) are expected to cease after the end of 2021. This decision was made due to the increasing absence of active underlying markets and the scarcity of term unsecured deposit transactions which led to serious questions about the future sustainability of the LIBOR benchmarks.

FASB proposed optional expedients and exceptions to the guidance in U.S. GAAP to contracts, hedging relationships, and other transactions affected by reference rate reform.

In March 2020, the Financial Accounting* Standards Board (FASB) released ASU No. 2020-04 in response to the cessation of the LIBOR. Several issues and challenges that are likely to arise due to this were raised by stakeholders:

- Voluminous contracts and other arrangements will need to be modified to replace reference rates.

- Application of existing accounting* standards to contracts and other arrangements could be costly and burdensome.

- The inability to apply hedge accounting* because of reference rate reform could result in financial reporting outcomes that do not reflect entities’ intended hedging strategies.

Key Considerations Include:

Contract Modifications |

—Consider embedded features to be clearly and closely related to the host contract without reassessment. —Any contemporaneous changes to other contract terms (i.e., those that do not directly replace or have the potential to replace a reference rate) that change, or have the potential to change, the amount and timing of contractual cash flows must be related to the replacement of the reference rate. |

|

Critical terms of hedging relationships —Provide optional expedients to enable entities to change critical terms and continue to apply hedge accounting Fair value hedges —Allows an entity to change the designated benchmark interest rate documented at hedge inception to a different eligible benchmark interest rate under Subtopic 815-20 —An entity may disregard certain qualifying conditions for the shortcut method that are not met because of reference rate reform and may continue to disregard those qualifying conditions for the remainder of the fair value hedging relationship (including for the remainder of hedging relationships that end after December 31, 2022). Cash flow hedges —Allows an entity to assert that it remains probable that the hedged forecasted transaction will occur. —Continue hedge accounting upon a change in the hedged risk as long as the hedge is still highly effective —Allows an entity may revert to hedge accounting requirements in Subtopics 815-20 and 815-30 without de-designating the hedging relationship |

—Perform some effectiveness assessments in ways that disregard certain potential sources of ineffectiveness. Fair value hedges —The hedge is expected to remain highly effective —The optional expedients for fair value hedging relationships may be elected on an individual hedging relationship basis Cash flow hedges —An entity may continue hedge accounting for a cash flow hedge for which the hedged interest rate risk changes if either the hedge is highly effective under an assessment method in Subtopics 815-20 and 815-30 or an optional expedient method in this Update is elected. —An entity should disregard the potential change in the designated hedged interest rate risk that may occur because of reference rate reform when the entity assesses whether the hedged forecasted transaction is probable in accordance with the requirements of Topic 815. |

|

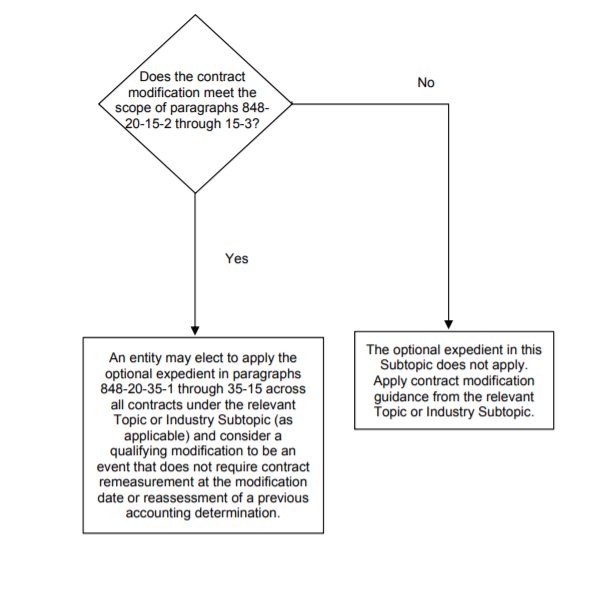

Contract modifications The following decision tree summarizes whether a contract modification is eligible to apply for the optional relief in ASC 848-20-55-1.

ASU No. 2020-04 also provides optional expedients for applying the requirements of certain topics that require analysis of contract modification:

- Modifications of contracts within the scope of Topics 310, Receivables and Topic 470, Debt should be accounted for by prospectively adjusting the effective interest rate

- Modifications of contracts within the scope of Topics 840, Leases and Topic 842, Leases should be accounted for as a continuation of the existing contracts with no reassessments of the lease classification and the discount rate (for example, the incremental borrowing rate) or remeasurements of lease payments that otherwise would be required under those Topics for modifications not accounted for as separate contracts; and

Modifications of contracts do not require an entity to reassess its original conclusion about whether that contract contains an embedded derivative that is clearly and closely related to the economic characteristics and risks of the host contract under Subtopic 815-15, Derivatives and Hedging— Embedded Derivatives.

Changes that are related to the replacement of a reference rate

To be eligible for the optional expedients in Subtopic 848-20, modifications of contractual terms that change (or have the potential to change) the amount or timing of contractual cash flows must be related to the replacement of a reference rate. Changes made to effect the transition for reference rate reform are considered related to replacement of the reference rate and, therefore, are in the scope of the ASU. Changes to terms that are the result of new business decisions separate from the transition for reference rate reform are not considered related and, therefore, are not in scope. The ASU includes examples of changes that are related and unrelated to the replacement of the reference rate.

Tax Implications of Elimination of LIBOR

A. Modification of Terms of Debt Instruments or Non-Debt Contracts.

Under IRS proposed regulations, if the terms of a debt instrument or non-debt contract are modified to replace, or to provide a fallback to, a LIBOR-referencing rate and the modification does not change the fair market value, there is no gain or loss under the recognition of gain or loss rules. These rules apply regardless of whether the modification occurs by an amendment to the terms of the instrument or agreement or by replacing the existing debt instrument or contract with a new one.

B. Qualified Rate

The proposed regulations also provide the rules for determining whether a rate is a qualified rate. The rules provide that the fair market value of a debt instrument or derivative may be determined by any reasonable valuation method, as long as that reasonable valuation method is applied consistently and takes into account any one-time payment made in lieu of a spread adjustment.

The debt instrument or non-debt contract are considered equivalent in value after the modification if:

- at the time of the modification the historic average of the LIBOR-referencing rate is within 25 basis points of the historic average of the rate that replaces it; or

- the parties to the debt instrument or non-debt contract are not related and, through bona fide, arm’s length negotiations, determine that the fair market value of modified instrument or contract is substantially equivalent to the fair market value prior to the modification.

C. Transactions and Hedges

The proposed regulations clarify that a taxpayer is permitted to alter the terms of a debt instrument or modify one or more of the other components of an integrated or hedged transaction to replace a rate referencing an IBOR with a qualified rate without affecting the tax treatment of either the underlying transaction or the hedge.

D. One-Time Payment

Under the proposed regulations, the source and character of a one-time payment that is made in connection with a modification described above will be the same as the source and character that would otherwise apply to a payment made by a payor with respect to the debt instrument or non-debt contract that is altered or modified.

E. Grandfathered Agreements

Because proposed regulations prevent debt instruments and non-debt contracts from being treated as reissued following a deemed exchange, the debt instrument or contract would not lose its grandfathered status as a result of any modifications made in connection with the elimination of LIBOR.

F. Original Issue Discount (OID) and Qualified Floating Rate

Proposed regulations stipulate three special rules for determining the amount and accrual of OID in the case of a variable rate debt instrument that provides both for interest at a LIBOR-referencing qualified floating rate and for a fallback rate that is triggered when the LIBOR becomes unavailable or unreliable.

G. Real Estate Mortgage Investment Conduit (REMIC)

Proposed regulations permit an interest in a REMIC to retain its status as a regular interest despite certain alterations and contingencies.

H. Interest in Foreign Corporations

The proposed regulations amend the election to allow a foreign corporation that is a bank to compute interest expense attributable to excess U.S.-connected liabilities using a yearly average Secured Overnight Financing Rate (SOFR) in addition to the 30-day LIBOR.

Applicability Date

This section applies to an alteration of the terms of a debt instrument or a modification of the terms of a non-debt contract that occurs on or after the date of publication of a Treasury decision adopting these rules as final regulations in the Federal Register. Taxpayers and their related parties may apply this section to an alteration of the terms of a debt instrument or a modification of the terms of a non-debt contract that occurs before the date of publication of a Treasury decision adopting these rules as final regulations in the Federal Register, provided that the taxpayers and their related parties consistently apply the rules of this section before that date.

Risks Related to the Elimination of LIBOR

Contract Risk:

- Risk that contracts which has stipulations dependent in LIBOR will be affected causing inconsistencies and disruption in the execution of it.

- To mitigate the risk, make a list of all the contracts that may be affected. However, for some it will be challenging if there is no repository of these contracts.

- Negotiate terms with counterparties for those stipulations relating to LIBOR, although some counterparties may be unknown or difficult to reach.

Liquidity Risk:

- Risk that LIBOR cessation will make it more difficult for existing products to be traded, with more costs and uncertainties.

- Because of this, companies have to reassess their investment and financing strategies as soon as possible in order to prepare for the cessation of LIBOR.

Basis Risk and Value Transfer

- Risk that differences in the timing and terms for similar contracts will result in gaps and inconsistencies in the contracts and value transfer

- Since there is a shift of basis for LIBOR-dependent contracts, the difference will cause value-transfer because of timing concerns, necessity for practical expedients, and differing term structures.

- To mitigate basis risk, the gaps may be hedged to additional derivatives.

Reputational Risks

- There is a risk that improper transition plans will result to besmirched reputation to important stakeholders.

- There should be clear communication with investors, creditors, customers, regulators and other counterparties of the extent of exposure, as well as transition plans that include controls as well as disclosures.

Operational and Technology Risk

- Risk that modification to current operating models and systems that are heavily reliant on LIBOR will result to inaccurate inconsistent outputs

- Determine all items that are affected by the cessation, including inventory, IT systems both internal and external, and other data and plan for the capabilities existing and needed for the transition, including control changes.

Financial Reporting and Tax Risk

- Risk of incomplete and inaccurate reporting to accounting* bodies and tax authorities.

- Certain financial reporting and tax reliefs are being proposed by regulators. Therefore, there is a need to study on how these reliefs can be infused in the transition plans.

- Certain financial instruments with dependence in LIBOR may need to reassess the fair value considerations due to changes in the observability of LIBOR transactions.

- Disclosures are necessary for all relevant items in the transition plan that have significant accounting* impact to policies currently in place. Refer to the discussion above for more details on the Accounting* and Tax implications of LIBOR cessation.

We’d love to help.

To ensure that all factors are considered in the pursuit of reliable financial reporting, effective and efficient operations, and compliance with law and regulations, our services can be scaled to accommodate your business needs, especially in considering the impacts of LIBOR Transition. Our Technical Accounting* Group supports the accounting* services and provides a thorough analysis of factors outside the normal course of business.

E-mail us at [email protected] for full consultancy assessment.

About the Authors

To have a thorough discussion on the matter, please contact:

Jezaniah Castro has extensive experience in preparation and filing of federal, state and local income tax returns for businesses and high net-worth individuals and other business-related filings, including sales and use tax in compliance with applicable US federal and state tax laws and regulations. She has also dealt with IRS and State tax notices, tax legislation, or audit workpapers in advocating taxpayer’s position to the taxing authorities.

JM Miclat has years of Advisory experience with EY Philippines mainly focused on leading SOX 404 compliance and top-risk audit engagements from one of the largest Fast Moving Consumer Goods (FMCG) company. He has extensive knowledge in applying Topics 606 and 842 of US GAAP to business processes. He ranked 9th in the CPA Board Examinations (PH) in 2016.

Disclaimer

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. It is not intended to be relied upon as accounting*, tax, or other professional service. Please refer to your advisors for specific advice. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation.