By now most of us are familiar with the concept of Environmental, Social, and Governance (ESG)—three key factors in measuring a company’s sustainability and its ethical and social impact. Businesses that focus on ESG are better equipped to sustain long-term value, reduce their carbon footprint, manage risks, and capitalize on opportunities.

While it might not be readily apparent, ESG has a direct impact on your accounting and financial reporting. With a greater understanding of how ESG impacts your business from an accounting perspective, you can take steps to meet emerging requirements and standards.

The Undeniable Move Toward ESG

How ESG Impacts Accounting and Financials

As a McKinsey report noted, companies that commit to ESG practices experience higher growth, lower costs, increased productivity, and fewer regulatory and legal interventions. While adopting ESG practices isn’t mandatory yet, there is a sense that it could become a requirement at some point. Even without such mandates, integrating an ESG framework into the operation will surely be essential for companies that expect to grow and thrive.

In fact, the many stakeholders that impact a business’s success increasingly expect companies to follow ESG practices. That includes investors, customers, legislators, the media, and anyone else within a business’s ecosystem. As these stakeholders “vote with their wallets” by purchasing sustainable products and services and investing in values-based companies, regulators are responding with efforts to standardize ESG reporting frameworks. This shift has a direct impact on a business’s accounting, making ESG reporting services and even highly specialized support like biotech accounting services essential for ensuring accurate, transparent, and compliant disclosures.

Companies are already beginning to account for items that arise out of ESG practices within their financial statements, even in the absence of standards or requirements, though doing so is far from straightforward. For example, if your business has ESG assets such as carbon offsets (including Renewable Energy Credits, or RECs), green bonds, or other financial instruments associated with ESG, it adds complexity to your accounting. It’s critical to understand the nature of ESG-related assets, acceptable accounting practices, and emerging standards and regulations.

Taxation is one area of accounting where ESG can have a big impact. Often, governments allow tax credits or assess tax penalties related to a company’s adoption (or failure to adopt) sustainable, environmentally sound practices. For instance, the Inflation Reduction Act in the US, passed in August 2022, provides production tax credits for solar energy companies, investment tax credits for energy storage technologies, and many other clean energy tax provisions. It’s vital to know whether your business is eligible for ESG-related tax credits and how they might affect your financials.

Financial reporting also is significantly impacted by ESG, with emerging regulatory standards and guidance that will require companies to improve their financial controls and ESG data analytics processes. And from an audit perspective, businesses will need to provide some degree of assurance and confidence in the reliability and credibility of their ESG reporting.

A Closer Look at ESG Reporting Standards

Given the complexity of ESG reporting, regulators worldwide are hard at work establishing standards or guidance to help companies report on their ESG activities in a way that is relevant and provides a faithful representation of both their commitments and their progress toward meeting them.

Several regulatory proposals would require companies to disclose information about each of the three main sources of greenhouse gas emissions: Scope 1 (a business’s direct emissions), Scope 2 (emissions a company makes indirectly, for example, through the energy a third party generates for its use), and Scope 3 (emissions from the business’s value chain).

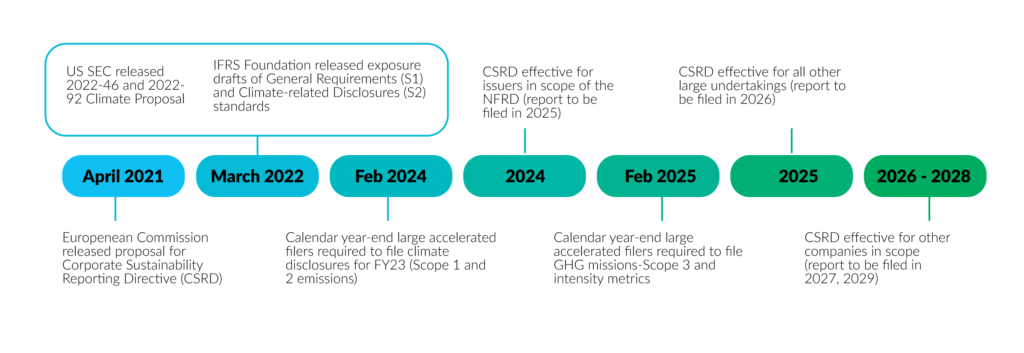

On a global level, the International Sustainability Standards Board (ISSB), established in late 2021 during the United Nations’ climate change conference, is developing a baseline of disclosure standards to ensure stakeholders can obtain information about a business’s sustainability-related risks and opportunities. Referred to as the IFRS Sustainability Disclosure Standards, they were released in March 2022 in two exposure drafts: IFRS S1 covers general requirements for disclosing sustainability-related financial information, while IFRS S2 focuses on climate-related disclosures.

In the US, the Securities and Exchange Commission (SEC), which has provided guidance on climate change-related disclosures for over a decade, is now working to further improve sustainability reporting. In March 2022, the SEC released two proposals related to climate change reporting—one for public companies, the other for ESG funds.

And in Europe, regulators have already pushed to adopt the Corporate Sustainability Reporting Directive (CSRD), which supports the European Green Deal climate change initiatives and extends previous directives to include more European and non-European companies listed and operating in the EU-regulated markets. The directive requires companies to comply with amended reporting requirements beginning in 2024 if they are already in scope of the EU’s Non-Financial Reporting Directive (NFRD), in line with mandatory EU sustainability reporting standards and alongside an external assurance of sustainability reporting. To help companies comply, the European Commission released background on corporate sustainability reporting and the CSRD proposal.