How businesses can unlock the full potential of the Inflation Reduction Act with intelligent automation

As businesses and tax professionals navigate the evolving landscape of sustainability and decarbonization, one critical opportunity is often left on the table: energy & manufacturing tax incentives under the Inflation Reduction Act (IRA). Despite the significant savings these incentives represent, many companies struggle to discover, qualify for, and manage them due to the complexity of requirements and documentation.

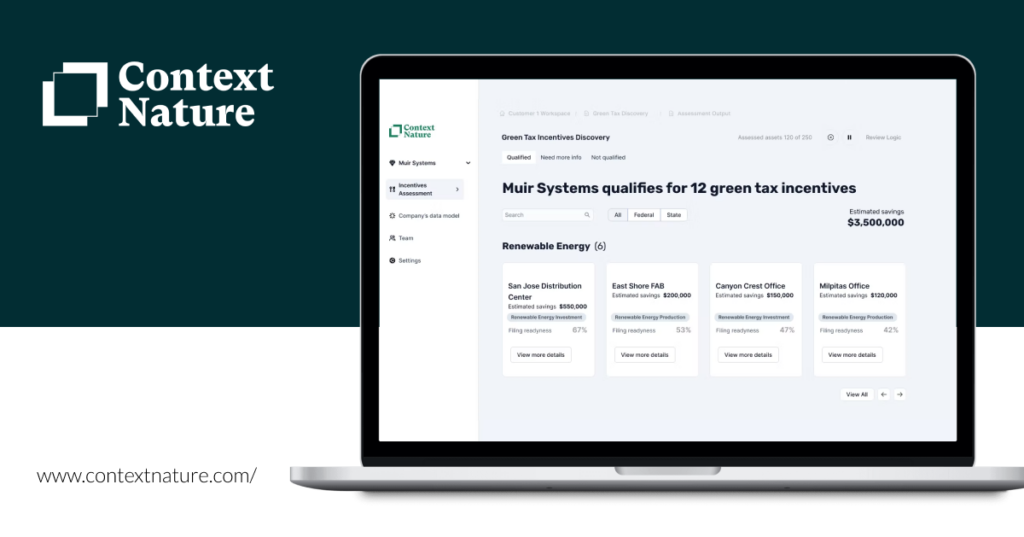

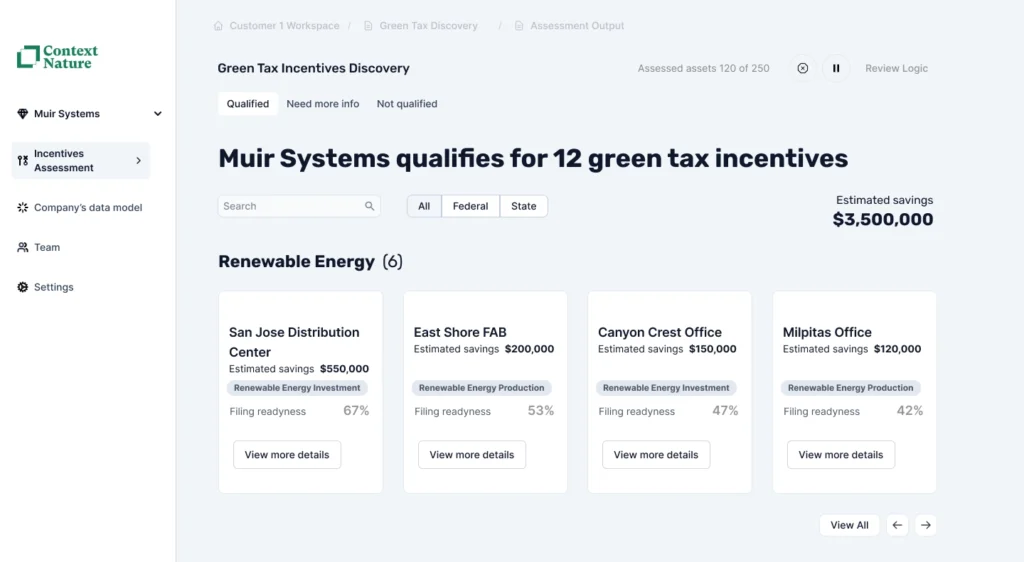

That’s where the Context Nature App comes in—a new AI-driven tool currently in its pilot phase and developed in partnership with Scrubbed. At its core, the app helps accounting teams automate the discovery, qualification, and reporting of these tax credits and incentives, turning a time-consuming challenge into a streamlined opportunity. It also complements broader ESG reporting services by helping businesses align tax strategies with their sustainability goals.

Why Context Nature App Matters

Problem: Green tax credits such as those for energy efficiency and advanced manufacturing are valuable, but notoriously difficult to manage. Tax professionals often face:

- Complex qualification criteria

- Time-intensive document collection

- Frequent changes in regulations

- Limited internal bandwidth to fully explore these opportunities

Solution: The Context Nature App eliminates these barriers with automation and intelligence. Designed for tax accountants and forward-thinking businesses, the app simplifies the end-to-end process of identifying and qualifying for credits, saving time, increasing compliance, and boosting bottom-line results.

Key Features That Set It Apart

- AI-Powered Discovery: Once tax returns and source documents are uploaded, the app identifies applicable green tax incentives automatically.

- Customizable Questionnaires: Secure, credit-specific forms make collecting client data fast and accurate.

- Smart Matching and Modeling: The app evaluates incentive opportunities based on customer data and produces reports with actionable insights.

- Streamlined Document Collection: A centralized, secure space for sensitive files reduces back-and-forths and delays.

- Form Drafting Assistance: Saves even more time by helping teams draft necessary tax forms with ease.

“The biggest impact for early users is time saved and the substantial financial value these incentives provide,” said Esfer John Pamintuan, Scrubbed Professional Consultant for the Context Nature App.

The User Journey: From Tax Return to Savings Insight

Here’s how a typical user interacts with the app:

- Create or Import Client Profiles

- Collect Information Using Custom Questionnaires

- Upload Tax Documents Securely

- AI Analyzes and Matches Data to Incentives

- Receive Tailored Reports Highlighting Potential Tax Credit Opportunities

This seamless flow ensures tax teams spend less time researching and more time delivering value to clients.

What’s Next for Context Nature?

Backed by a $150,000 seed fund from the Entrepreneurs Roundtable Accelerator, Context Nature has ambitious plans to scale:

- Expanded Incentive Coverage: Automation for R&D tax credits is on the roadmap.

- Integrations: The app will soon connect with popular accounting and financial software for a more unified workflow.

- Continuous Policy Updates: The AI models and incentive databases are designed to evolve with regulatory changes, ensuring up-to-date compliance.

“Our goal is to help businesses decarbonize and save money, without adding complexity to their tax process,” shared Sylvia Vaquer from Context Nature.

Ready to Be Part of the Future of Green Tax Planning?

The Context Nature App is currently in its pilot phase, and businesses or tax professionals interested in early access can join the waitlist here.

Scrubbed is proud to partner with Context Nature in supporting innovation at the intersection of technology, sustainability, and tax strategy.

Get Involved

Join the Waitlist– Be among the first to experience the app’s capabilities.

Contact Scrubbed – Explore how we can support your sustainability and tax planning goals.

About Scrubbed

Scrubbed is a global professional services firm providing accounting, biotech accounting services, fractional CFO services, and advisory solutions that help businesses grow with confidence. From technology partnerships to innovative tax planning, we’re committed to delivering excellence, backed by a human touch.