Mergers and acquisitions (M&A), collectively known as business combinations, are fundamental strategies for companies to grow and expand their market reach. However, while these transactions offer strategic benefits, they also involve accounting procedures that can be time-consuming and vulnerable to mistakes.

To guide companies with the complexity, Accounting Standards Codification (ASC) 805 – Business Combinations requires companies to use the acquisition method to evaluate the financial impact of a business combination. Two of the crucial steps often overlooked in the acquisition method are:

• Identifying the acquirer

• Determining the consideration transferred

Who Is In Charge during M&A? – Identifying the Accounting Acquirer

One of the combining companies in any business combination must be designated the “accounting acquirer” based on ASC 810 ─ Consolidation guidelines.

The accounting acquirer is the party with control and is usually the legal acquirer, the party named as the buyer in a contract. To establish which party has control, companies must look first at the party with the largest share of voting power in the combined entity. This process includes examining the existing and potential voting rights in acquired shares, such as options, warrants, and convertible instruments.

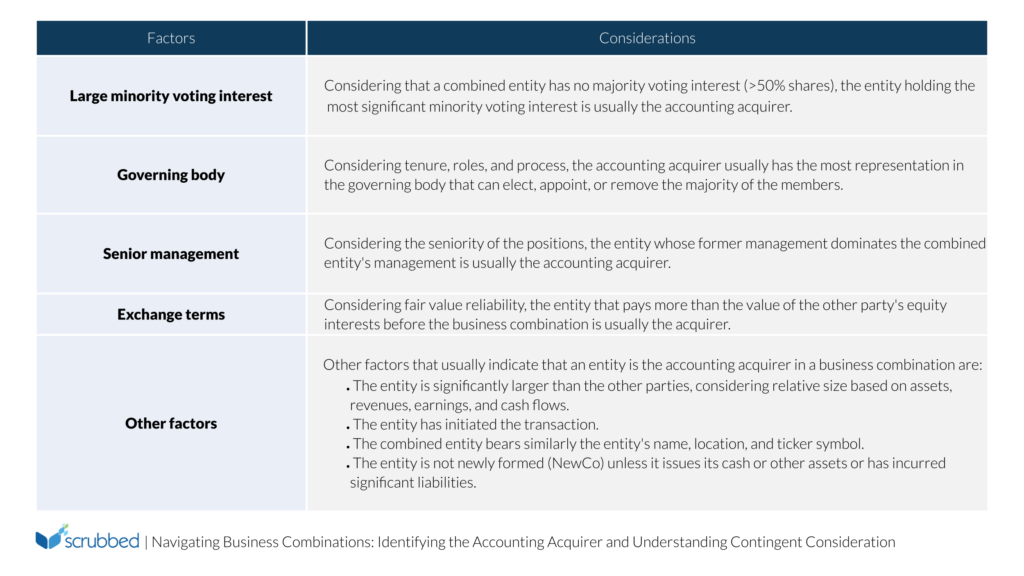

In some business combinations, particularly those involving share exchange, voting rights alone might not provide a definitive picture. Here, companies must consider other relevant details and circumstances:

When Accounting and Legal Acquirers are Different

While it’s less common, there are cases when the legal acquirer differs from the accounting acquirer, where we must consider different factors. Examples include:

• Reverse Acquisitions: Here, the entity issuing securities becomes the accounting acquiree, while the entity whose ownership stake is acquired becomes the accounting acquirer. This often happens when a larger operating entity is acquired by a smaller legal entity, which then issues shares to the original owners. In such cases, the economic substance takes precedence over the legal form.

• Acquisitions by Non-Substantive NewCos: A newly formed company (NewCo) may act as a conduit for another entity for legal or tax purposes. Key factors to understand its role include survival post-acquisition, type of consideration (cash or shares), ownership stake, and pre-combination financing activities. Indicators that an entity is a non-substantive NewCo are its sole acquisition purpose, lack of independent operations, and lack of debt financing. In these cases, the entity that formed the NewCo, not the NewCo itself, is likely the accounting acquirer. Here, the focus is on the economic substance of the transaction and identifying the true controlling entity.

• Variable Interest Entities (VIEs): Regardless of the agreement’s structure, the accounting acquirer is always the primary beneficiary of a VIE. This is because the primary beneficiary bears the economic risks and rewards associated with the VIE.

Consequences of Misidentification

Incorrectly identifying the accounting acquirer can have long-term severe financial repercussions for companies, including:

• Misstated Financial Statements: Consolidated financial statements for both acquirer and acquiree could be inaccurate, misleading investors, creditors, and other stakeholders about the combined entity’s financial health.

• Integration Challenges: Difficulties may arise when integrating the reporting systems of the involved entities.

• Regulatory Penalties: Misidentification may lead to fines or penalties from regulatory bodies.

Determining the Consideration Transferred and Understanding Contingent Consideration

The consideration transferred in a business combination is typically measured at fair market value. When the payment method is clear-cut, accounting for this transaction is simple. However, many deals involve uncertainties, which are then addressed through contingent consideration.

Contingent consideration is essentially a payment or additional stock the acquirer gives to the acquiree if certain future events happen or specific conditions are met. This approach offers flexibility in deal structuring as both parties can agree on terms even if the deal’s final value is still unknown.

Contingent consideration is classified in three ways:

• Asset: If the acquirer has the right to get some of the initial payment back.

• Liability: If the acquirer is obligated to pay more in cash.

• Equity: If the acquirer is obligated to pay more in stock.

The fair value of asset and liability contingent considerations is determined both initially and at subsequent reporting dates. Contingent consideration, classified as equity, is only valued initially and is not re-measured later.

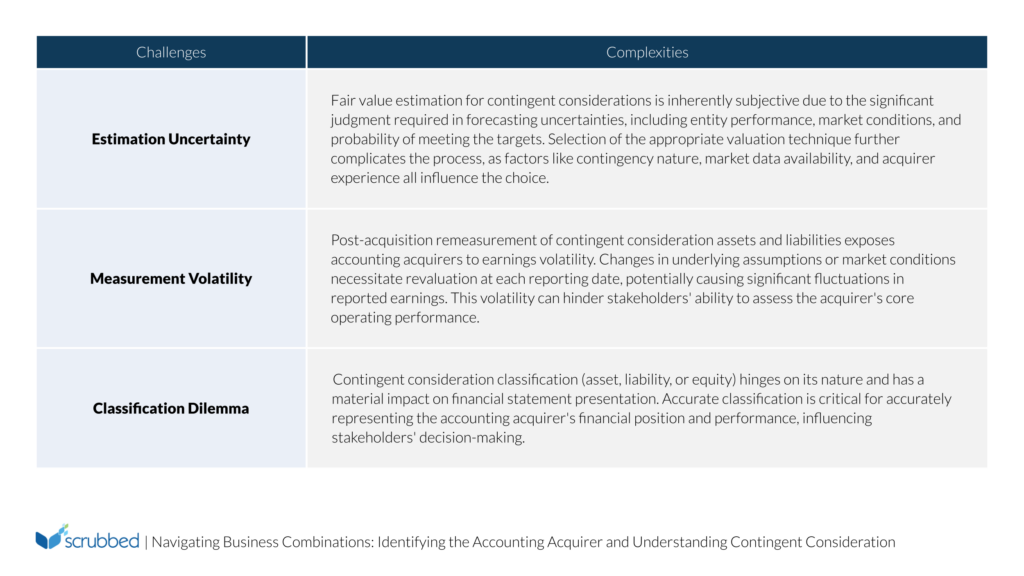

While contingent consideration can help at the deal structuring stage, it can also introduce accounting challenges further down the line:

It’s essential to address the transfer of any consideration carefully. Lack of transparency around valuations, inaccurate classifications of contingent considerations, or poorly documented fair value estimates can raise concerns about a company’s ability to operate. It can also indicate poor management judgment and even create opportunities for manipulating earnings. These issues can make it difficult for investors, creditors, and other stakeholders to trust the financial statements and make informed decisions.

Ensuring Accurate Determination

As we’ve seen, identifying the accounting acquirer and properly handling the consideration in a business combination can be challenging, especially in complex transactions or those with hidden influences. To mitigate these risks, we recommend implementing robust fair value methodologies, clearly communicating the valuation processes, and adhering to strict accounting standards. Maintaining strong risk and SOX compliance frameworks throughout the process also helps ensure accuracy, transparency, and accountability.

How Scrubbed can help

Our experienced team delivers technical accounting expertise. We handle key areas like identifying the acquirer, classifying potential additional payments, and accurately valuing uncertainties. We help you navigate compliance requirements, from tax implications to reporting regulations, so you can focus on integrating the new entity.

Beyond these core services, Scrubbed offers additional benefits:

• Robust controls: We establish robust, GAAP-compliant accounting systems to ensure a smooth transition and ongoing stability.

• Data-driven decisions: We provide market-informed insights that empower strategic decision-making to help you gain a competitive advantage.

Our Technical Accounting Group is more than just consultants; we’re your trusted advisors throughout the M&A process. We go beyond the numbers to ensure effective operations and a successful business combination tailored to your needs. This includes specialized support such as corporate finance advisory, giving you the confidence to move forward with clarity in complex transactions.

Contact us today at [email protected] for a comprehensive M&A consultancy assessment.