The rise of digital businesses has fundamentally challenged traditional tax frameworks designed for a brick-and-mortar economy. Intangible assets, virtual presence, and borderless transactions complicate determining where profits are generated and how they should be taxed. Imagine you’re the CEO of a global powerhouse. Wouldn’t the allure of relocating profits to nations with lower tax rates be irresistible?

Recognizing these challenges, the OECD launched a comprehensive initiative to modernize international tax rules, promote transparency, and create a level playing field for businesses worldwide. In 2023, they introduced Pillar One to ensure businesses pay tax in countries where they generate profits, and Pillar Two rules setting a minimum tax floor come into effect for fiscal year 2024:

• Pillar One: Aligning Profits with Market Presence

Pillar One, which came into effect in 2023, aims to ensure that multinational enterprises (MNEs) allocate a portion of profits to the markets in which they have economic presence rather than relocating profits to other countries they operate in that have lower tax rates. This data-driven approach considers factors like sales and user engagement, ensuring MNEs contribute where they earn.

• Pillar Two: Establishing a Global Minimum Tax Floor

These rules set a global 15% minimum corporate tax rate. This means that MNEs will contribute meaningfully to public finances in the countries in which they operate, fostering fiscal stability and equity. It’s akin to establishing a baseline for corporate tax rates, similar to setting a minimum wage.

The pillars operate in tandem, addressing different yet complementary aspects of the digital tax challenge. This holistic approach creates a robust and sustainable international tax system. While Pillar One has been in operation for some time, let’s take a look at the implications of the new Pillar Two.

How do Pillar Two calculations work?

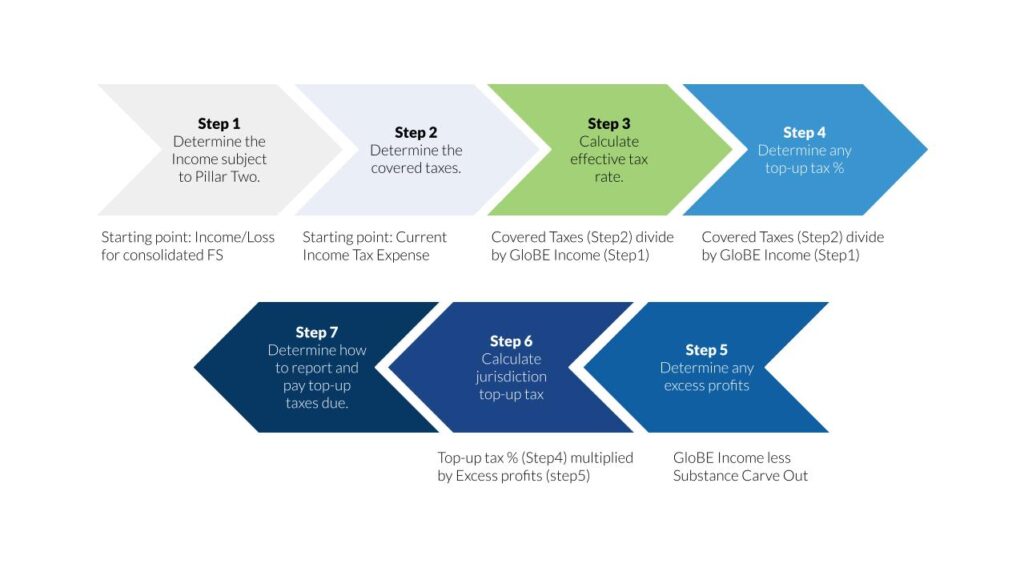

This diagram shows the process that businesses must work through to ensure that Pillar Two income tax liability is correctly calculated.

How will Pillar Two affect your business?

In terms of financial reporting and compliance, companies will need to update their accounting policies and introduce some robust internal controls to ensure that Pillar Two tax liabilities and disclosures are calculated and reported accurately. In particular, you must disclose your known or reasonably estimable exposure to Pillar Two income taxes in your annual report starting January 1, 2023.

The International Accounting Standards Board (IASB) has issued a temporary exception for recognizing and disclosing deferred tax assets and liabilities related to Pillar Two top-up taxes. This will avoid potential mismatching in the short term.

Other implications for your business might include:

• Increased taxes: Although the US income tax rate is 21%, under the Pillar Two calculation, some income can be viewed as being taxed less than 15%. This might mean that US businesses need to pay taxes in other countries via the Under Tax Profits Rule (UTPR).

• Double taxation: The “Undertaxed Profits Rule” allows other countries to tax US companies on income deemed undertaxed by the US, potentially leading to double taxation in some cases.

• Short-term relief: Transitional safe harbors offer temporary relief for companies operating in low-risk jurisdictions.

• Indirect impact on SMEs. While OECD Pillar Two offers small and midsize enterprises (SMEs) potential benefits like a level playing field and simplified reporting, challenges like data gathering and administrative burdens remain. Temporary exemptions and ongoing alignment efforts aim to ease compliance. However, as these enterprises adapt to complex regulations, understanding risk and SOX compliance becomes increasingly important. Seeking professional guidance is crucial for SMEs to navigate the evolving landscape and ensure they remain compliant on all fronts.

Ultimately, the impact will vary depending on your company’s structure and tax situation. While concerns exist, many aspects are still evolving, so staying informed is crucial.

How Scrubbed Can Help

Navigating the intricate landscape of tax obligations can be challenging for any business owner or executive. Scrubbed’s proactive planning and compliance experts are dedicated to ensuring your company’s tax affairs remain in order, allowing you to stay compliant with ever-changing tax laws and explore avenues to minimize your tax liabilities.

Our recognized professionals, highly skilled in tax matters and leveraging diverse industry experience, offer invaluable insights to optimize your tax position amidst regulatory changes. Whether you’re navigating international taxation or exploring corporate finance advisory options, our team provides the expertise you need.

If you have any questions regarding your taxes, please contact us for a free consultation.

Learn more about our Tax Compliance and Advisory Services for Businesses