Accounting for revenue from contracts between a seller and a customer seems complex enough, but what if it gets more complicated as another party becomes involved — a third party?

The rise of e-commerce, such as online retail, transportation and delivery services, and the sale of mobile applications and games, increases the involvement of an intermediary (typically an online platform) in delivering goods and services to the end consumers. That is why Financial Accounting Standards Board (FASB) issued accounting guidelines for arrangements where more than one party is involved in providing goods and services to a customer. ASU 2016-08, Principal Versus Agent Considerations, provides clarifications and illustrations to support ASC 606, Revenue from Contracts with Customers, in evaluating whether a party acts as a principal or an agent in a multi-party arrangement.

Why principal/agent classification is important

Deciding whether the nature of an entity’s promise is to transfer goods or services to the customer (as a principal) or to arrange for goods or services to be provided by another party to the customer (as an agent) is an important determination in accounting because the classification can significantly affect the amount of revenue to be recognized.

While a principal recognizes revenue at the gross amount it is entitled to from its customer, an agent recognizes revenue in the amount of any fees or commissions or the net amount retained in exchange for arranging the transaction. Significant judgment may be required when assessing whether an entity acts as a principal or agent in certain transactions.

Principal versus agent evaluation

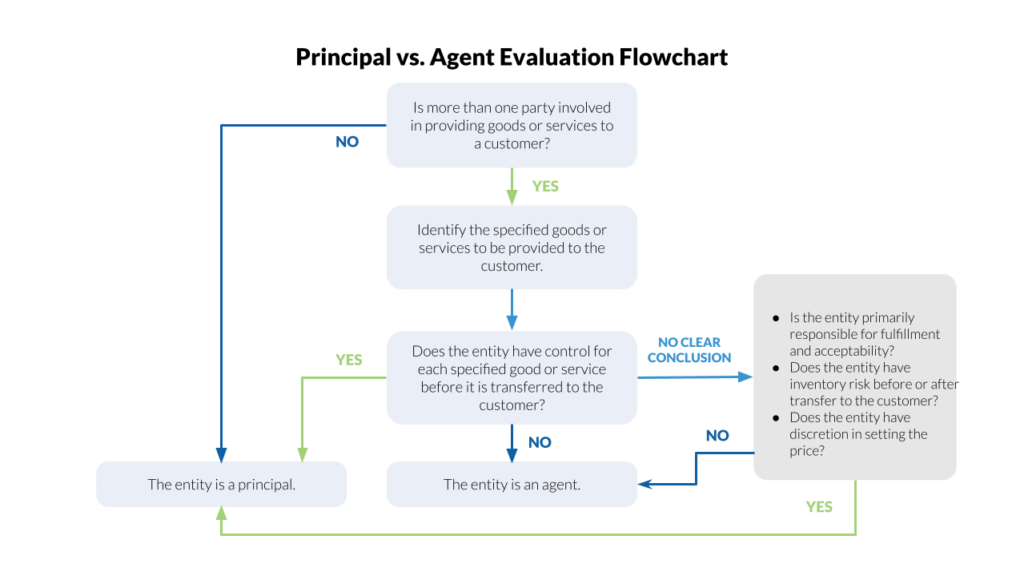

Determining whether an entity is a principal or an agent is a process that involves (1) identifying the specified good or service to be provided to the customer and (2) determining whether the entity controls the specified good or service before it is transferred to the customer.

The following flowchart is based on interpretations by EY and PwC and illustrates the Principal versus Agent evaluation process:

1. Identifying the specified goods and services

The first step in the evaluation is to identify the “specified” goods or services that will be transferred to the customer. A specified good or service is defined as a distinct good or service (or a distinct bundle of goods or services) to be provided to the customer.

A good or service is capable of being distinct if the customer can benefit (i.e., use, consume, or sell) from that good or service on its own or with other resources that are readily available. This means that the principal-versus-agent evaluation is performed for each performance obligation and not on a per-agreement basis. Accordingly, an entity could be both a principal for certain aspects of a contract and an agent for others.

Typically, identifying the specified good or service is relatively straightforward, especially those involving tangible goods. For example, if an entity resells computers, the specified good that will be transferred to the customer is a computer.

However, the assessment may require significant judgment in other situations, such as those involving intangible goods or services. For example, when the specified good or service is a right to a good or service that another party will provide, the entity should determine whether its obligation is a promise to provide that right (and it is, therefore, a principal) or whether it is arranging for the other party to provide that right (and it is, therefore, an agent).

For example, consider a travel website that offers flight vouchers that allow customers to book flights. In identifying the specified service, the travel website should assess if it is promising that the vouchers will be honored (principal) or if it is just acting as an intermediary between the airline company and the customers (agent).

2. Determining whether the entity controls the specified goods or services

The second step in the evaluation is to determine whether the entity controls the specified good or service before it is transferred to the customer. Control is defined as the ability to direct the use of, and obtain substantially all of the remaining benefits from, an asset. Control also includes the ability to prevent others from using and obtaining such benefits. The benefits are the potential cash flows that can be obtained by using, selling, or holding the asset.

If the entity concludes that it controls the specified good or service before it is transferred to the customer, the entity is a principal in the transaction. Otherwise, the entity is an agent for the specified good or service.

The application of the control principle is observed to be more difficult for intangible goods and services than for tangible goods because the former generally exist only at the moment they are delivered. To address this, the standard includes guidance on how the control principle applies to certain types of arrangements by identifying the nature of the specified good or service to be provided to the customer, which may include the following:

A: A good or another asset from the other party that it then transfers to the customer (e.g., an online retailer of clothes is a principal since it already controls the clothes before reselling them to its customers.)

B: A right to a service to be performed by the other party, which gives the entity the ability to direct that party to provide the service to the customer on the entity’s behalf or replace the party in case of non-performance of the obligation (e.g., if a travel website guarantees the validity of the voucher, then it is a principal.)

C: A good or service from the other party that it then combines with other goods or services in providing the specified good or service to the customer (e.g., a laptop distributor is a principal even though it does not own the operating systems installed in the devices because those are combined with its own goods and services.)

Indicators of control

FASB understands that it still may not be clear whether an entity has control over the specified goods or services after considering the above guidance. Here are three indicators of when an entity controls the specified good or service to serve as additional considerations:

A: Primary responsibility for fulfillment. If the entity is primarily responsible for fulfilling the obligation to the customer, this is an indicator that the entity controls the specified good or service.

B: Inventory risk. If the entity bears the risk of loss due to factors such as physical damage, decline in value, or obsolescence of the inventory, the entity has control over the specified good or service.

C: Pricing discretion. If the entity has discretion in establishing the price that the customer pays, it serves as an indicator that the entity obtains substantially all the benefits from the specified good or service, and therefore has control over it.

The above indicators do not override the entity’s assessment of control, and should not be considered as a checklist of criteria to be met in all scenarios. Considering one or more of the indicators is just a guide in determining whether the entity controls the specified good or service before it is transferred to the customer. Depending on the facts and circumstances, the indicators may be more or less relevant to the assessment of control.

How Scrubbed can help

Determining whether your entity is a principal or an agent in transactions with customers may require significant professional judgment, necessitating complex assessments in accordance with the requirements of the standard. The Technical Accounting Group at Scrubbed can provide hands-on assistance to your evaluation process. We provide technical consultations and support to help ensure that the accounting standards are applied appropriately. Contact Scrubbed to learn how the experts in our Technical Accounting Group can help your business apply the revenue standard in the right way.Disclaimer: The information contained herein is general and is not intended to address the circumstances of any particular individual or entity. It is not intended to be relied upon as accounting, tax, or other professional services. Please refer to your advisors for specific advice. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation.

*Special thanks to Mark Reynald Dacaymat for his invaluable contributions to this article.