Accounting for SaaS Companies

Scrubbed’s expert accounting for SaaS companies optimizes financial efficiency. Navigate complexities, ensure compliance, & drive success in your SaaS ventures.

Your SaaS Business Has Unique Accounting and Finance Needs

Since you don’t sell a physical product, determining when to recognize the revenue can be difficult. Similarly, knowing when to recognize expenses—which ones to amortize and which to recognize immediately—can be tricky.

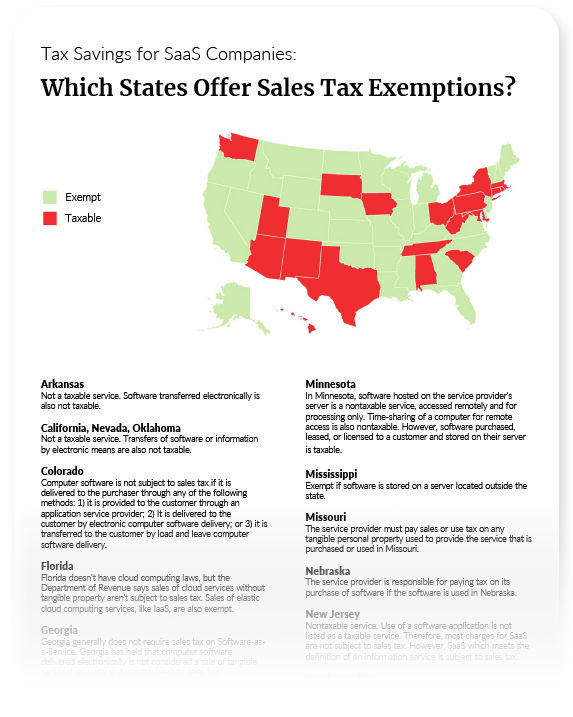

On top of that, if your business operates in multiple states, you need to follow lots of different sales tax laws. It’s a lot to keep track of, and getting it wrong can mean compliance issues or inaccurate reporting.

That’s why many US-based SaaS companies turn to Scrubbed.

We understand accounting for SaaS companies. Our SaaS accounting experts keep your finances accurate and compliant while meeting your investors’ reporting requirements.

Outsourced Accounting for SaaS Companies

SaaS companies rely on Scrubbed for high-quality accounting services. Our experienced team helps with everything from revenue and expense recognition and financial reporting to budgeting and forecasts that help you plan with confidence. We work alongside your team so you can focus on what you do best—building great software for your customers.

Depending on the stage and needs of your business, we can provide the following services:

Featured Work

Guide

Securing investment capital is essential for SaaS companies, enabling continuous product enhancement, effective marketing, and seamless scaling.

Guide

Discover how Arable Labs streamlined accounting with Scrubbed, boosting accuracy and freeing up time for strategic priorities in agricultural IoT.

Guide

Are you struggling to determine which states require you to collect and remit sales and use taxes on your SaaS product?

Download Capabilities Brochure here:

Want to learn more about our services or meet more of the Scrubbed team?

“The accounting team that I worked with Scrubbed is very persistent. They are always really aiming for accuracy and they keep me to task on making sure that I’m giving the information they need to do their jobs. One of the best things about Scrubbed is that they keep my attention on the day-to-day accounting of the company. They’re very patient and kind in trying to extract the information they need to get our books done.”

Brian Johansing

Featured Insights

Meet Our SaaS Experts

Laurence Ruelo

Director

With over a decade of professional experience in financial management and advisory services, he has demonstrated expertise in optimizing financial operations for international organizations. His work includes successful on-site implementations of streamlined finance processes across multiple locations, ensuring precise reporting of individual location performance and organization-wide consolidated results.

Joy Gallardo

Senior Manager

Joy has more than 11 years of experience that includes general accounting, assurance and advisory service lines. Her expertise are on project and finance operations management and has thorough exposure on finance transformation, business process optimization and continuous improvement projects. Prior to Scrubbed, she started her career with Ernst & Young Philippines.

FAQs

An outsourced team can help you manage cash flow and burn rate and improve compliance with ASC 606 and GAAP standards. Your outsourced accounting experts have experience preparing investor-ready financials that align with venture capital ( VC) and private equity (PE) expectations. Outsourcing also reduces your SaaS firm’s overhead costs by giving you access to highly skilled financial professionals without the expense of maintaining a full in-house finance team. Additionally, outsourced firms are great partners in ensuring business continuity when dealing with internal resource gaps and turnover.

Outsourced accounting services scale with your SaaS company as it progresses through the various funding stages. As you grow the business, your outsourced accounting partner can add people to your team and implement more sophisticated systems to support multi-entity and multi-currency accounting, and ensure audit readiness for funding rounds, acquisitions, or public offerings.

SaaS leaders’ most common concerns about outsourcing include worries about accurate revenue recognition under ASC 606, the complexities of managing different billing and subscription models, coordinating technology across different platforms and data security. Being aware of these challenges can help you screen and select the right outsourced accounting provider for your firm.

Some typical scenarios that indicate outsourcing your SaaS firm’s accounting would be a good fit include:

- Rapid Growth: When your sales are growing quickly, outsourced accounting experts can help you manage and automate increased transaction volumes, ensure accurate financial records, and manage new revenue streams without the need to hire and train additional staff.

- Scaling Operations: As your SaaS firm expands or you move to more advanced billing systems and different pricing models, your outsourced team can help implement effective systems and processes.

- Revenue Recognition: If your firm is managing deferred revenue, subscription billing, multi-year contracts, an outsourced team or professional can help you improve revenue recognition and compliance with accounting standards like ASC 606, reducing the risk of errors.

- Financial Forecasting and Cash Flow Management: If you’re struggling with cash flow management and budgeting as your firm grows, an outsourced team can provide financial forecasting and strategic advice to optimize cash flow and plan for growth.

- Preparing for Audit or Investment: When you’re looking for funding or preparing for an audit, outsourcing can help you get your financials in order, providing accurate and investor-ready statements that improve your chances of securing investment or positioning your business for acquisition.

Resource or Expertise Gap: When facing a resource or expertise gap in accounting that you can't efficiently fill internally or through direct hires, outsourcing can provide immediate and long-term solutions. Outsourced firms also handle ongoing training, ensuring their team remains up-to-date with relevant standards.

Your first step is to ensure that they have expertise in the SaaS industry and the ability to scale with your business. They should have a track record in delivering investor-ready reports and experience with subscription-based revenue models, key SaaS metrics (MRR, ARR, CAC, and LTV), and ASC 606 compliance. Lastly, look at case studies and client testimonials to confirm that your potential partner has successfully supported other SaaS companies like yours.

An outsourced accounting firm with SaaS expertise can help you track and analyze crucial KPIs such as:

- Monthly Recurring Revenue (MRR): The predictable revenue generated by your active subscriptions each month.

- Annual Recurring Revenue (ARR): The annualized value of your MRR.

- Customer Acquisition Cost (CAC): The cost of acquiring a new customer.

- Customer Lifetime Value (LTV): The total revenue a customer is expected to generate over their relationship with your business.

- Churn Rate (Customer & Revenue Churn): The percentage of customers or revenue lost over a specific period.

- Customer Retention Rate: The percentage of customers retained over a specific period.

- CAC Payback Period: The time it takes to recover the cost of acquiring a customer.

- LTV:CAC Ratio: A key indicator of the efficiency and sustainability of your customer acquisition efforts.

- Gross Margin: The revenue remaining after deducting the cost of goods sold (often including hosting, support, etc., for SaaS).

- SaaS Magic Number: A metric used to evaluate the efficiency of your sales and marketing spend in generating new ARR.

They can provide regular reports and insightful analysis of these metrics to help you make data-driven decisions.

Yes, managing sales tax and Value Added Tax (VAT) can be complex for SaaS businesses with customers in various locations. Outsourced accounting firms with experience in this area can help you navigate these complexities by:

- Determining your tax obligations in different jurisdictions.

- Setting up processes for collecting and remitting sales tax and VAT.

- Ensuring compliance with international tax regulations.

- Managing tax filings and reporting requirements.

- Staying updated on changes in tax laws and regulations.

This expertise can save you significant time and reduce the risk of penalties for non-compliance.

Outsourced accounting teams can play a vital role in your SaaS company's budgeting and forecasting by:

- Developing comprehensive financial models tailored to your SaaS business.

- Creating realistic budgets based on historical data, industry benchmarks, and growth projections.

- Generating regular forecasts to anticipate future financial performance.

- Analyzing variances between actual results and budgets/forecasts to identify areas for improvement.

- Providing scenario planning to assess the potential impact of different business decisions.

- Offering insights and recommendations to optimize financial performance and achieve your strategic goals.

Reputable outsourced accounting firms prioritize seamless integration with your existing SaaS tools and systems. This typically involves:

- Direct integrations: Connecting accounting software with your CRM (e.g., Salesforce, HubSpot), billing platforms (e.g., Stripe, Chargebee), and other relevant systems through APIs.

- Data automation: Setting up automated data flows to ensure accurate and timely transfer of financial information.

- Custom integrations: Developing tailored solutions for systems that may not have standard integrations.

- Collaboration tools: Utilizing shared platforms and communication channels to ensure efficient information exchange and collaboration between your internal team and the outsourced accounting team.

The goal is to create a streamlined and efficient financial management process.

Outsourced accounting teams follow a structured and timely approach to month-end and year-end closing, which typically includes:

- Reconciling all key accounts: Ensuring the accuracy of cash, accounts receivable, accounts payable, deferred revenue, and other balances.

- Preparing and posting journal entries: Recording all necessary financial transactions.

- Reviewing financial data for accuracy and completeness: Identifying and resolving any discrepancies.

- Generating financial statements: Producing the balance sheet, income statement, and cash flow statement.

- Analyzing financial performance: Providing insights into key trends and variances.

- Ensuring compliance with accounting standards: Adhering to GAAP or other relevant frameworks.

- Coordinating with auditors (for year-end): Providing the necessary documentation and support for the audit process.

Want to learn more?

Let’s discuss how we can help by managing your day-to-day accounting needs, or taking on a larger financial management role, so you can continue to deliver on your mission-critical goals.