In our recent blog, we briefly discussed the impact of Environment, Social, and Governance (ESG) on accounting and reporting and introduced the three standard-setting bodies leading the charge in navigating the complexities of ESG — U.S. Securities and Exchange Commission (SEC), International Sustainability Standards Board (ISSB), and European Financial Reporting Advisory Group (EFRAG) through the Corporate Sustainability Reporting Directive — also known as the ‘big three’.

As the focus continues to shift toward the reporting aspect of ESG, all eyes are on the three standard-setting bodies to lay the foundation for transforming the ESG reporting landscape. With the ‘big three’ rushing to get ahead of the booming call for uniform guidance on disclosing ESG matters, stakeholders must keep up with the rapid developments that can aid in preparing ESG disclosures and sustainability reports, as well as in making sound business decisions, managing expectations, and strategic planning.

SEC’s Final Rule on Climate Change Disclosure

in March 2022, the SEC proposed a new rule to enhance and standardize climate-related disclosure. The SEC aims to finalize this rule around the second quarter of 2023 according to the Reg Flex Agenda released on January 2023.

The SEC is under constant pressure to deliver a final rule acceptable to all stakeholders and organizations as it faces political and legal challenges. A review of the public comments on the rule by the Commonwealth Climate and Law Initiative revealed that most investor coalitions, NGO/third sector organizations, asset managers, and service providers strongly supported the proposal in general. On the other hand, law firms, regulators, politicians, and trade associations were generally against the proposal. Republicans and certain corporate lobby groups were also expected to challenge the proposed rule in court once finalized. They claim that requiring companies to publish climate-related information infringes the right to free speech.

We can only speculate as to the magnitude of change the final rule will bring. For the time being, let’s recap the highlights of the proposed new rule issued last March 2022, which includes the required disclosure of:

• Climate-related risks and their actual or likely material impacts on the registrant’s business, strategy, and outlook

• Governance of climate-related risks, including risk management processes

• Scope 1 and Scope 2 greenhouse gases (GHG) emissions; Scope 3 GHG emissions if material or if the registrant set an emissions target or goal that includes Scope 3 emissions

• Climate-related financial statement metrics and related disclosures in a note to its audited financial statement

• Information on climate-related targets and goals and transition plan, if any

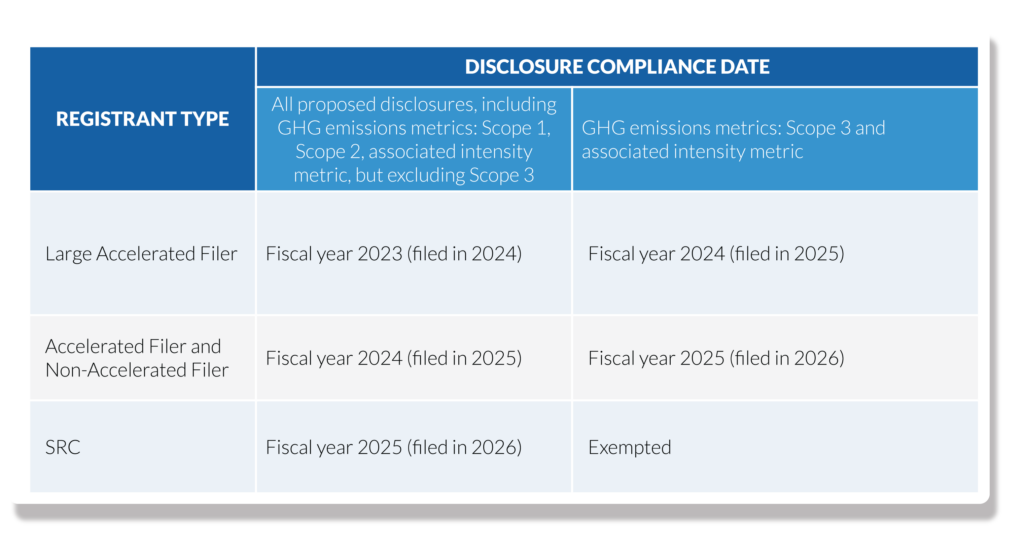

Below is the summary of the compliance date assuming the proposal will be adopted with an effective date in December 2022 and that the filer has a December 31st fiscal year-end:

Meanwhile, a proposed rule for human capital management disclosures is also expected to be released during the same timeframe.

The European Sustainability Reporting Standards (ESRS)

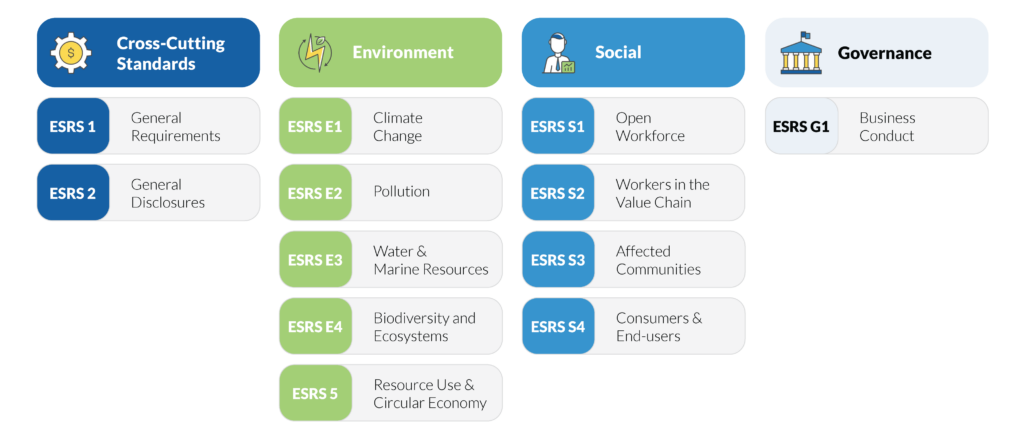

On November 22, 2022, the EFRAG submitted the first set of draft ESRS to the European Commission (EC). The first set of standards comprises two cross-cutting standards and ten topical standards.

It is now in EC’s hands to evaluate the draft standards and propose revisions by consulting the member states of the European Union and other experts before adopting the final standards as delegated acts in June 2023, followed by a scrutiny period by the European Parliament and Council.

Forty additional sector-focused standards will be released over the next few years.

First, companies will have to apply the standards in the financial year 2024 for reports published in 2025. Listed SMEs are obliged to report from 2026, with a further possibility of voluntary opt-out until 2028, and will be able to report according to separate, proportionate standards that EFRAG will develop next year.

Although ESRS is mostly applicable to EU companies, non-EU companies can still be scoped in due to, but not limited to, the following scenarios:

• If it has a secondary listing in an EU-regulated market

• If it has an annual net turnover in the EU exceeding €150 million for each of the last two consecutive financial years and has at least one large subsidiary, one subsidiary listed on an EU-regulated market, or one branch in the EU that generated over €40 million in annual net turnover the preceding financial year

Revisiting IFRS S1 and IFRS S2 Exposure Drafts

On February 16, 2023, ISSB reconvened and redeliberated the IFRS S1 and IFRS S2 exposure drafts after considering the results of public consultation.

The ISSB proposed the following tentative changes:

• To amend the requirement in draft S1 to permit, but not require, preparers to consider ‘the most recent pronouncements of other standard-setting bodies whose requirements are designed to meet the needs of users of general-purpose financial reporting’ in identifying sustainability-related risks and opportunities and in identifying disclosures about those risks and opportunities. The ISSB also tentatively permitted preparers to consider the Global Reporting Initiative Standards and the ESRS in identifying disclosures about sustainability-related risks and opportunities.

• To require both IFRS S1 and IFRS S2 to be effective for annual reporting periods beginning on or after January 1, 2024. Early application of IFRS S1 and S2 is permitted if an entity applies both standards at the same time. If the entity applies IFRS S1 and IFRS S2 early, it is required to disclose the fact.

• To permit entities applying short-term transitional relief to report their sustainability-related financial disclosures at the same time as its next second quarter or half-year interim report or within nine months of the end of its annual reporting period, depending on whether an entity provides an interim report or not. They also tentatively decided to make available in the first annual reporting period in which an entity applies IFRS S1 and IFRS S2: (a) relief from the requirement to report sustainability-related financial disclosures at the same time as the related financial statements, (b) relief from the requirement to measure Scope 1, Scope 2 and Scope 3 GHG emissions in accordance with the Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard if the entity uses a different measurement basis in the annual reporting period immediately preceding its initial application of IFRS S2, and (c) relief from the requirement to disclose Scope 3 GHG emissions.

The ISSB unanimously decided not to re-expose IFRS S1 and IFRS S2 to public consultation.

Further, on April 4, 2023, ISSB met again to discuss further the transition reliefs to be provided in IFRS S1. Reliefs agreed tentatively includes the following:

Staying Ahead of the Requirements

As of this writing, while these standards are under finalization, it gives an opportunity for companies to be a step ahead and prepare for the expected influx of accounting and disclosure requirements related to ESG by considering the following:

• Start data gathering

• Assess the impact on ESG

• Establish policies, procedures, and controls

• Training your people

• Prepare to report by referring to existing guidance like TCFD, SASB, and GRI – which will most likely be similar to the finalized rule as consultations were made from these organizations while the big three proposals were being drafted.

More ESG News

J.P. Morgan’s Carbon Offset Project

J.P. Morgan Asset Management is one step closer to its goal of becoming an active participant in carbon offset markets through its acquisition of commercial timberland spanning more than 250,000 acres in the Southeastern U.S. last February 2023. The land, valued at over $500 million, will be used for carbon offset and timber production to meet the growing demand for sustainable products.

According to Anton Pil, the Global Head of J.P. Morgan Global Alternatives, the alternative investment arm of J.P. Morgan Asset Management, this transaction is one of the largest of its type in the past decade and builds on efforts to expand their asset class offering across alternatives by offering investors access to a robust carbon sequestration and timber management platform.

Additional Disclosure Requirements for Federal Suppliers

The new proposed rule on GHG and climate reporting would affect contractors covering over 86% of annual federal spending. Major contractors, which are those receiving more than $50 million in federal contracts, are required to disclose the following:

1. Scope 1, Scope 2, and relevant Scope 3 GHG emissions determined under the GHG Protocol Corporate Accounting and Reporting Standard.

2. Annual climate disclosure aligned with the recommendations of the TCFD; and

3. Science-based targets for reducing GHG emissions are validated by the Science-Based Targets Initiative every five years.

Meanwhile, significant contractors, those receiving from $7.5 million to $50 million in federal contracts, are only required to disclose Scopes 1 and 2 GHG emissions.